Market Share

Pathological Microscopes Market Share Analysis

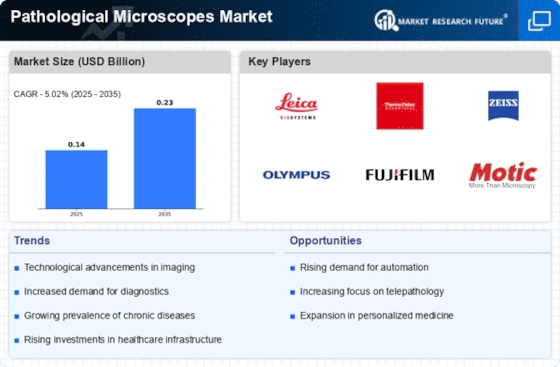

Telepathology revolutionizes diagnostic processes by leveraging advanced digital communication mediums to transmit pathological data. In contrast to the traditional diagnostic approach, which is time-consuming and necessitates a physical sample for testing, telepathology streamlines the entire process. The initial step involves collecting and preparing the sample under the microscope. However, instead of relying on physical transportation, high-resolution images of these prepared samples are shared with laboratory technicians for analysis through digital platforms. This innovative approach not only saves valuable time but also significantly reduces the costs associated with traditional diagnostic procedures. One of the key advantages of telepathology is its provision of real-time data, empowering medical professionals to make swift and informed decisions. The integration of digital platforms in the diagnostic workflow enhances the speed and efficiency of the entire process, contributing to better patient outcomes. According to a report published by the American Hospital Association in 2018, around 65% of hospitals in the United States had already established connections with patients through digital platforms. This statistic underscores the growing prevalence of telepathology and telemedicine in modern healthcare practices. The rising adoption of telepathology is concurrently driving the demand for pathology microscopes in medical centers. Pathological microscope manufacturers are presented with lucrative opportunities to tap into previously unexplored markets. The shift towards digital transmission of pathological data necessitates advanced imaging equipment, and manufacturers catering to this demand stand to benefit from the increasing integration of telepathology in healthcare institutions. The impact of telepathology extends beyond its efficiency gains. By eliminating the need for physical sample transportation, it addresses geographical barriers, enabling medical professionals to access and analyze pathological data remotely. This is particularly significant in areas with limited access to specialized healthcare services, where telepathology facilitates timely and accurate diagnoses. Additionally, telepathology contributes to the ongoing evolution of telemedicine, enabling a broader spectrum of healthcare services to be delivered remotely. The seamless integration of digital platforms not only facilitates diagnostic processes but also opens avenues for virtual consultations, further enhancing the overall healthcare experience for patients. As the healthcare landscape continues to evolve, telepathology emerges as a pivotal player in modernizing diagnostic practices. Its impact is not only evident in the enhanced efficiency of pathological processes but also in the broader transformation of healthcare delivery. The statistics from the American Hospital Association underscore the widespread adoption of digital platforms in healthcare, marking a paradigm shift in how medical professionals interact with and diagnose patients. Telepathology represents a transformative approach to diagnostic procedures, leveraging digital communication mediums to transmit pathological data. Its efficiency gains, cost reductions, and real-time data provision contribute to better patient outcomes. The increasing prevalence of telepathology and telemedicine opens doors for pathology microscope manufacturers to explore new markets. Beyond the technological advancements, telepathology addresses geographical barriers, expanding access to specialized healthcare services. As telemedicine continues to evolve, the integration of telepathology stands out as a key driver in reshaping the future of healthcare delivery.

Leave a Comment