Market Share

Palm Recognition Market Share Analysis

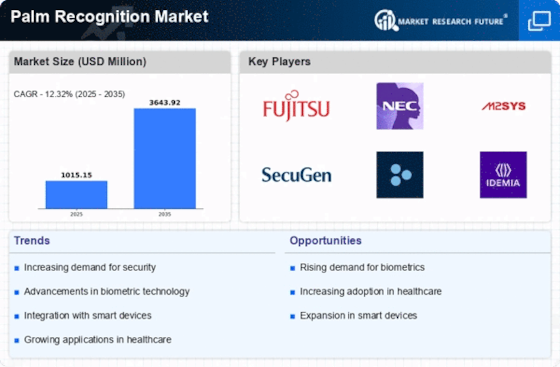

The Palm Recognition Market is an evolving business arena aimed at creating and marketing palms to be utilized for the purpose of authentication and recognition of biometrics. To achieve their competitive positioning laishing their comparative advantage and increasing market share companies in this market employ different positioning strategies.

An experimental tactic of the Palm Imprint sector is technological advancement. Organizations pump in their resources to develop palm recognition systems which are capable of performing equivalent or much better than their traditional counterparts. Innovation and improvement in technology are the very factors that distinguish companies as the market leaders in an industry and can outline their products and solutions as the best on the market and attract customers who evaluate uniqueness as an important choice feature. With this strategy, they are in a position to distinguish themselves from competition and get bigger market capturing.

Strategies such as personalization, for example, feature largely in the marketing mix. Companies working in the Palm Recognition Market are those that provide solutions for customized application which games the diverse user interface demands of different industries and applications. Whether it is related to access control, time and attendance or identity verification, companies offer their customers certain tailored options by configuring them to the specific needs of their customers. Being in search for individualized offerings, enterprises have a great chance to designate the range of their own customers and make their market share as large as possible.

On top of that, the companies in the industry of Palm Recognition Market continue improvement of their products by making them more user-friendly and convenient. They develop the user-friendly interfaces and intelligent systems that the palm recognition so the ease of the usage and the process seems so obvious. From this, a company might as well turn to the concept of helping the user experience as what the consumers actually value are speed and ease of use. This tactic allows enterprises to expand into different markets and dominate wider market share by offering the technology which, by analogy to the soup, is easy for adoption and does not need integration into existing systems.

As security positioning strategy is also used, it follows that companies exploit it t overequal. Besides the cheap cost, it also has a high level of security and accuracy. Companies extoll the safety of their systems and often talk about the benefits of palm as a biometric data compared to the others. In this way they can become authentications providers with a reputation of being reliable and secure candidates and acquire a large market share by attracting those customers who give priority to data safety.

Another factor to be taken into consideration by the firms in the Palm Recognition market is the role that they play by building collaboration and instead concentrating on partnerships in order to expand their market. They make arrangements with other IT suppliers and system integrators to supply complete solutions which have the ability to settle extensive customer demands. Through engaging already established organizations in this field the companies can penetrate into new market expansions, gain more customers, and as well as increase their competitiveness.

Leave a Comment