Market Trends

Key Emerging Trends in the Palm Recognition Market

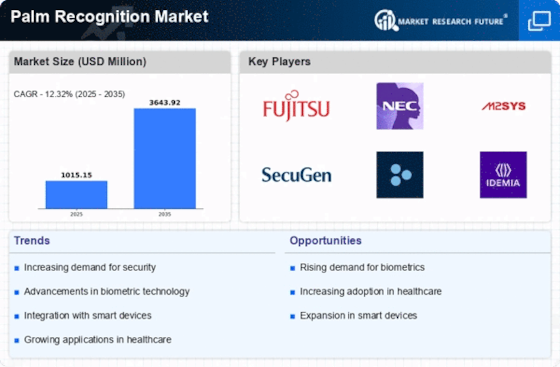

The palm recognition market has been displaying marked growth in the last few years, due to several market trends that have emerged to meet the present high demand for secure and contactless biometric identification technology.

An increasing demand for accurate biometric security systems is a market trend that is enhancing the growth of the palm recognition market. Today, the legacy methods of authentication, including password and PIN, have grown less secure, being prone to breach. As a consequence, more and more companies and organizations deploy biometric authentication technology to protect their assets and information. Biometrics is appealing, especially palm recognition, which allows a highly accurate identification of users and offers a secure and convenient substitute mode of verification. In just few years, this tendency has led to a rising demand for palm recognition technologies making the palm recognition market to grow faster and faster.

Moreover, the environment is going to see the introduction of contactless biometric technologies. The current coronavirus outbreak has made establishing physical boundaries and eliminating the chance of infection a prime concern. Palm recognition technology is a versatile technology as it depends on a contactless authentication method, users only have to put their palm close to a sensor for the identification. This all touchless experience, with improved hygiene measures but also convenience and speed, assure the security of authentication. A great number of sectors, such as health care, finance, and transportation observed significant rise in the demand for contactless biometric solutions based on palm recognition.

Besides that the share in palm recognition usage in access control and time attendance systems also increases. Palm recognition is becoming preferred biometric technology by organizations and businesses for security enhancement and attendance tracking efficiency. The feature of the invisible palm recognition system that can promptly and accurately identify people opens the possibility of using it for access control and time tracking systems. This trend is becoming increasingly popular as organizations are looking for strong and efficient systems to monitor the participation of employees and to restrict access to the physical sites.

Besides trend in palm recognition market is integration with other systems as well as technologies. Palm scanning technology is one of the currently most used biometric authentication methods, and it already can be integrated with different devices and platforms, for example, smartphones and smart locks. With this implementation, users unlock the capability to authenticate themselves via palm biometrics for various apps and devices on different platforms thus making the experience more convenient and secure. The palm recognition has been incorporated with the existing access control systems, that is automatically taking place without the significant disruption of regular workflow for the organizations.

Leave a Comment