Medical Sensors Market Trends

Medical Sensors Market Research Report By Application (Wearable Devices, Monitoring Systems, Diagnostic Imaging), By Type (Temperature Sensors, Pressure Sensors, Image Sensors, Biosensors), By End Use (Hospitals, Home Care, Diagnostic Laboratories, Research Institutions), By Sensor Technology (Electrochemical, Optical, Thermal, Micro-electromechanical Systems) and By Regional (North America, Eu...

Market Summary

As per Market Research Future Analysis, the Medical Sensors Market was valued at 23.1 USD Billion in 2023 and is projected to grow to 45.0 USD Billion by 2035, with a CAGR of 5.71% from 2025 to 2035. The market is driven by technological advancements, increasing chronic illnesses, and a growing elderly population, necessitating improved health monitoring solutions.

Key Market Trends & Highlights

Key trends shaping the Medical Sensors Market include technological innovation and rising demand for remote monitoring.

- Wearable Devices are expected to grow from 8.0 USD Billion in 2024 to 15.0 USD Billion by 2035.

- Monitoring Systems are projected to increase from 9.0 USD Billion in 2024 to 16.5 USD Billion by 2035.

- Diagnostic Imaging applications are anticipated to rise from 7.42 USD Billion in 2024 to 13.5 USD Billion by 2035.

- Telehealth usage surged by 79% during the early stages of the COVID-19 pandemic, highlighting the demand for remote patient monitoring.

Market Size & Forecast

| 2023 Market Size | USD 23.1 Billion |

| 2024 Market Size | USD 24.42 Billion |

| 2035 Market Size | USD 45.0 Billion |

| CAGR (2025-2035) | 5.71% |

| Largest Regional Market Share in 2024 | North America. |

Major Players

Key players include Abbott Laboratories, NXP Semiconductors, Bosch Sensortec, STMicroelectronics, Philips, Roche, GE Healthcare, and Medtronic.

Market Trends

Technological developments and changing healthcare requirements are driving notable trends in the Global Medical Sensors Market. Key market drivers include the rising incidence of chronic illnesses, which calls for improved monitoring strategies. This development is driving the need for medical sensors, enabling real-time health monitoring and management. The increasing elderly population worldwide also drives more need for creative healthcare solutions, hence strengthening the necessity for dependable medical sensors. The use of artificial intelligence and machine learning in medical equipment will help to maximize commercial possibilities.

These technologies seek to increase diagnosis accuracy, hence improving patient outcomes. Moreover, the growing popularity of telehealth and remote patient monitoring creates opportunities for more general usage of medical sensors. Given that healthcare systems all over are striving toward digital transformation, businesses can look into alliances to improve these devices' features. Driven by consumer desire for personal health management tools, wearable medical sensors have gained attention in recent years. These gadgets encourage active involvement in patients' wellness journeys by allowing them to monitor their health parameters easily.

The worldwide rise of telemedicine has sharpened attention to creating tiny sensors and wireless technologies, thereby offering customers quick and easy choices for health monitoring. These trends draw attention to a dynamic scene guiding the Global Medical Sensors Market toward a bright future where technological innovation meets patient-centric care.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

The Global Medical Sensors Market is poised for robust growth, driven by advancements in technology and increasing demand for remote patient monitoring solutions.

U.S. Food and Drug Administration (FDA)

Medical Sensors Market Market Drivers

Growing Aging Population

The Global Medical Sensors Market Industry is significantly impacted by the growing aging population across the globe. As individuals age, they often experience a higher incidence of health issues, necessitating regular monitoring and management. Medical sensors are crucial in providing timely health data, which can lead to proactive healthcare interventions. For instance, wearable sensors that track heart rates and other vital signs are increasingly utilized among older adults. This demographic shift is expected to drive market growth, with forecasts suggesting an increase to 24.4 USD Billion in 2024, highlighting the essential role of medical sensors in catering to the needs of an aging population.

Technological Advancements

The Global Medical Sensors Market Industry is experiencing rapid growth due to continuous technological advancements. Innovations in sensor technologies, such as miniaturization and enhanced connectivity, are enabling the development of more sophisticated medical devices. For instance, wearable sensors that monitor vital signs in real-time are becoming increasingly prevalent. These advancements not only improve patient outcomes but also enhance the efficiency of healthcare delivery. As a result, the market is projected to reach 24.4 USD Billion in 2024, with an expected CAGR of 5.71% from 2025 to 2035, indicating a robust trajectory for the industry.

Government Initiatives and Funding

Government initiatives and funding play a pivotal role in shaping the Global Medical Sensors Market Industry. Various governments are investing in healthcare infrastructure and technology to improve patient outcomes and reduce healthcare costs. For instance, funding for research and development of innovative medical sensors is increasing, which supports the growth of the industry. Additionally, regulatory bodies are establishing frameworks to ensure the safety and efficacy of these devices. Such initiatives are likely to contribute to the market's growth, with projections indicating a potential increase to 45 USD Billion by 2035, reflecting the importance of government support in advancing medical technology.

Increasing Prevalence of Chronic Diseases

The Global Medical Sensors Market Industry is driven by the increasing prevalence of chronic diseases worldwide. Conditions such as diabetes, cardiovascular diseases, and respiratory disorders necessitate continuous monitoring and management, which medical sensors provide. For example, glucose monitoring sensors are essential for diabetes management, allowing patients to track their blood sugar levels effectively. This growing need for chronic disease management is expected to propel the market, with estimates suggesting a rise to 24.4 USD Billion in 2024. The integration of medical sensors into treatment protocols is likely to enhance patient care and reduce healthcare costs.

Rising Demand for Remote Patient Monitoring

The Global Medical Sensors Market Industry is significantly influenced by the rising demand for remote patient monitoring solutions. As healthcare systems evolve, there is a growing emphasis on providing care outside traditional clinical settings. Medical sensors facilitate this transition by enabling continuous monitoring of patients' health metrics from their homes. This trend is particularly relevant in managing chronic diseases, where timely data can lead to better health outcomes. The market's expansion is evident, with projections indicating a growth to 45 USD Billion by 2035, underscoring the critical role of medical sensors in modern healthcare.

Market Segment Insights

Medical Sensors Market Application Insights

The Global Medical Sensors Market has outlined a comprehensive segmentation focused on Application, which includes critical areas such as Wearable Devices, Monitoring Systems, and Diagnostic Imaging. In 2024, the overall market valuation is expected to reach approximately 24.42 USD Billion, with significant contributions from its various applications. Wearable Devices are projected to generate a valuation of 8.0 USD Billion in the same year, and it is anticipated to grow to 15.0 USD Billion by 2035, thus indicating the increasing reliance on personal health monitoring solutions.

These devices have gained traction for their ability to provide real-time health data, thereby empowering individuals to manage their health proactively. Monitoring Systems are also seeing substantial market traction, with expected valuations of 9.0 USD Billion in 2024 and projected growth to 16.5 USD Billion by 2035. The demand for these systems is being driven by the growing emphasis on patient-centric care and the need for continuous health monitoring, particularly in chronic disease management contexts.

Moreover, Diagnostic Imaging applications, valued at 7.42 USD Billion in 2024, are expected to rise to 13.5 USD Billion by 2035.The importance of this segment cannot be overstated, as it not only enables precise diagnostic capabilities but also supports advancements in treatment planning, making it significant in the healthcare continuum. Trends such as telehealth and remote patient monitoring are acting as growth drivers across all segments, while challenges such as data privacy concerns and integration with existing healthcare systems persist.

Overall, the Global Medical Sensors Market segmentation clearly reflects the dynamic landscape of healthcare technology, presenting both challenges and opportunities for industry stakeholders as they navigate this evolving ecosystem. The market growth in these application areas signals a robust shift towards smarter, more connected healthcare systems that prioritize patient outcomes. As we look ahead to 2035, these segments will play crucial roles in shaping the future of healthcare delivery on a global scale, supported by advances in technology and increased consumer awareness regarding health management.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Medical Sensors Market Type Insights

The Global Medical Sensors Market is expected to be valued at 24.42 billion USD in 2024, showcasing significant growth potential. The market is structured around various types of sensors, including Temperature Sensors, Pressure Sensors, Image Sensors, and Biosensors, each playing a crucial role in healthcare applications. Temperature Sensors are vital for monitoring patients' body temperature, contributing significantly to clinical settings. Pressure Sensors are essential for cardiovascular monitoring and medical device functionalities, holding substantial importance in the diagnostics domain. Image Sensors facilitate advanced imaging technologies such as MRI and CT scans, enhancing diagnostic precision.

Biosensors, which measure biological responses for medical analysis, dominate the field due to their critical role in point-of-care testing and chronic disease management. The market is driven by technological advancements and rising healthcare expenditures globally. However, it also faces challenges like regulatory constraints and the need for standardized protocols. Overall, the Global Medical Sensors Market segmentation reveals diverse applications and robust potential for innovation and growth in improving patient outcomes on a global scale, with increasing adoption across various healthcare sectors.

Medical Sensors Market End Use Insights

The Global Medical Sensors Market is experiencing significant growth as it caters to various end-use applications including Hospitals, Home Care, Diagnostic Laboratories, and Research Institutions. By 2024, the overall market is projected to reach a value of 24.42 USD Billion, with a steady growth trajectory leading to an expected valuation of 45.0 USD Billion by 2035. Hospitals represent a vital segment, utilizing medical sensors for patient monitoring and diagnostics, which enhances the quality of care provided. Home Care has gained traction, driven by the increasing preference for remote health monitoring and personalized patient management.

Diagnostic Laboratories play a critical role in the accurate evaluation of health conditions, where advanced sensors are instrumental in testing and analysis. Similarly, Research Institutions leverage these sensors to facilitate innovative studies and breakthrough discoveries. The continual evolution in medical technology, coupled with an aging population and rising healthcare expenditure, propels the Global Medical Sensors Market growth, presenting opportunities for advancements in sensor capabilities and integration within healthcare systems.The demand for high-precision sensors in these segments highlights their importance, ensuring effective healthcare delivery and improved patient outcomes across the globe.

Medical Sensors Market Sensor Technology Insights

The Global Medical Sensors Market is poised for significant growth, with a valuation of 24.42 USD Billion expected in 2024. Sensor Technology plays a crucial role in this market, driving advancements in medical diagnostics and patient monitoring systems. The market encompasses various types of sensors, including Electrochemical, Optical, Thermal, and Micro-electromechanical Systems. Electrochemical sensors are vital for monitoring blood glucose levels and other analytes, showcasing their importance in diabetes management and chronic disease monitoring. Optical sensors dominate in non-invasive monitoring applications, providing real-time feedback to healthcare providers.

Thermal sensors are essential for accurate temperature measurements, making them crucial in both clinical and home healthcare settings. Micro-electromechanical Systems contribute to miniaturization and integration of sensors into wearable devices, enhancing patient mobility and comfort. The overall market growth is fueled by rising demand for personalized healthcare solutions, increasing incidence of chronic diseases, and advancements in sensor technologies, despite challenges such as high initial costs and regulatory hurdles. With opportunities for innovation, the Global Medical Sensors Market is on track to reach 45.0 USD Billion by 2035, reflecting the growing integration of sensor technology in the healthcare industry.

Get more detailed insights about Medical Sensors Market Research Report -Forecast till 2035

Regional Insights

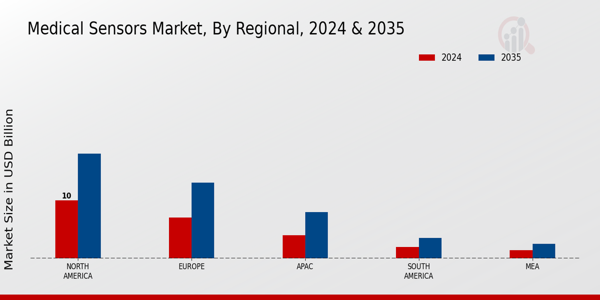

The Global Medical Sensors Market exhibits diverse regional characteristics, with North America leading with a valuation of 10.0 USD Billion in 2024, projected to rise to 18.0 USD Billion in 2035, showcasing a significant demand for advanced healthcare technologies and increased health monitoring initiatives. Europe follows as another substantial player, holding a market value of 7.0 USD Billion in 2024, expected to reach 13.0 USD Billion by 2035, driven by stringent regulatory requirements and a growing aging population.

The Asia-Pacific (APAC) region has a lower initial valuation of 4.0 USD Billion in 2024, with projections of 8.0 USD Billion in 2035, attributed to rapid urbanization and increasing healthcare expenditure. South America stands at 2.0 USD Billion in 2024, forecasted to grow to 3.5 USD Billion by 2035, reflecting a growing investment in healthcare infrastructures. Lastly, the Middle East and Africa (MEA) starts at 1.42 USD Billion in 2024, with estimates reaching 2.5 USD Billion in 2035, highlighting the regions' needs for improved healthcare systems in developing economies.

The significance of these regional dynamics underpins the Global Medical Sensors Market revenue, driven by technological advancements and demographic shifts across continents.The balance among these regions reflects varied investment priorities, yet collectively contributes to the market growth in the medical sensors landscape.

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

Key Players and Competitive Insights

The Global Medical Sensors Market has been experiencing significant growth due to the increasing demand for advanced healthcare solutions, rising prevalence of chronic diseases, and the ongoing technological advancements in sensor technologies. Various players in the market are focusing on developing innovative products that can improve patient monitoring, diagnostics, and treatment outcomes. The competition within this space is intensifying as companies strive to enhance their offerings through strategic collaborations, mergers, product launches, and geographical expansions, ensuring they capture a substantial market share.

As consumer expectations evolve, companies must adapt swiftly to the changing landscape while also addressing regulatory challenges and maintaining high standards in product reliability and safety. Abbott Laboratories has carved a notable presence in the Global Medical Sensors Market by leveraging its strong research and development capabilities to introduce innovative health technologies. The company is known for its extensive range of medical devices, particularly in glucose monitoring systems and continuous glucose sensors. Abbott's strength lies in its commitment to improving patient outcomes through continuous innovation and ensuring high-quality products.

With a robust global distribution network, the company has established itself as a trusted name among healthcare providers and patients alike. Abbott Laboratories actively seeks to enhance its product portfolio and expand its market presence worldwide, positioning itself as a leader in the medical sensors domain and making significant investments to stay ahead in a highly competitive field.NXP Semiconductors also plays a crucial role in the Global Medical Sensors Market with its advanced sensor solutions designed for healthcare applications. The company is recognized for its innovative semiconductor technologies that facilitate precise data acquisition and processing in medical devices.

By providing a wide range of products, including sensing solutions for monitoring vital signs and enabling connectivity in medical applications, NXP Semiconductors ensures that it meets the evolving needs of healthcare systems. With a strategic focus on merging and acquiring other technology leaders, NXP has enhanced its capabilities and strengthened its market presence globally. The company’s commitment to research and development enables it to deliver cutting-edge solutions that enhance the functionality and efficacy of medical devices.

Together with its partnerships and collaborations, NXP Semiconductors is positioned to be a favorable contender in the global market, contributing to the advancement of healthcare technologies.

Key Companies in the Medical Sensors Market market include

Industry Developments

The Global Medical Sensors Market is currently experiencing significant developments, particularly with advancements in technology and strategic partnerships among key players. Recently, Abbott Laboratories announced the launch of its latest continuous glucose monitoring system, enhancing diabetes management for patients globally in September 2023. In terms of acquisitions, in August 2023, Siemens Healthineers acquired Varian Medical Systems to strengthen its position in the oncology space, which is expected to enhance Siemens' diagnostic and therapeutic capabilities. Additionally, Honeywell has expanded its healthcare sensors portfolio, featuring innovations aimed at improving patient monitoring systems through smart technology.

The growing aging population and increasing prevalence of chronic diseases are driving demand for advanced medical sensors that provide accurate and real-time data. Furthermore, in June 2022, Philips invested significantly in R&D to develop wearable health technologies, reflecting the company’s commitment to enhancing healthcare delivery through innovative medical sensors. Amid these changes, the global medical sensors market is projected to experience substantial growth, fueled by technological advancements and increasing healthcare investments, thereby transforming patient care and clinical outcomes across various regions.

Future Outlook

Medical Sensors Market Future Outlook

The Global Medical Sensors Market is projected to grow at a 5.71% CAGR from 2024 to 2035, driven by technological advancements, increasing healthcare demands, and rising chronic diseases.

New opportunities lie in:

- Develop wearable sensors for remote patient monitoring to enhance healthcare accessibility.

- Invest in AI-driven analytics for real-time data interpretation and decision-making.

- Create integrated sensor solutions for personalized medicine to improve treatment outcomes.

By 2035, the market is expected to be robust, reflecting significant advancements and increased adoption of medical sensors.

Market Segmentation

Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Medical Sensors Market Type Outlook

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

Medical Sensors Market End Use Outlook

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

Medical Sensors Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Medical Sensors Market Application Outlook

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

Medical Sensors Market Sensor Technology Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Report Scope

| Report Attribute/Metric Source: | Details |

| MARKET SIZE 2023 | 23.1(USD Billion) |

| MARKET SIZE 2024 | 24.42(USD Billion) |

| MARKET SIZE 2035 | 45.0(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 5.71% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| MARKET FORECAST PERIOD | 2025 - 2035 |

| HISTORICAL DATA | 2019 - 2024 |

| MARKET FORECAST UNITS | USD Billion |

| KEY COMPANIES PROFILED | Abbott Laboratories, NXP Semiconductors, Bosch Sensortec, STMicroelectronics, Philips, Roche, GE Healthcare, Maxim Integrated, Microchip Technology, Texas Instruments, Analog Devices, Medtronic, Honeywell, Omron, Siemens Healthineers |

| SEGMENTS COVERED | Application, Type, End Use, Sensor Technology, Regional |

| KEY MARKET OPPORTUNITIES | Wearable health monitoring devices, Telemedicine integration growth, Rising demand for remote diagnostics, Advancements in sensor technology, Increased health awareness globally |

| KEY MARKET DYNAMICS | Technological advancements, Rising demand for home healthcare, Increasing prevalence of chronic diseases, Growing need for early diagnosis, Expanding healthcare infrastructure |

| COUNTRIES COVERED | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the projected market size of the Global Medical Sensors Market in 2024?

The Global Medical Sensors Market is expected to be valued at 24.42 USD Billion in 2024.

What is the expected market size of the Global Medical Sensors Market by 2035?

By 2035, the market is anticipated to reach a value of 45.0 USD Billion.

What is the expected compound annual growth rate (CAGR) for the Global Medical Sensors Market from 2025 to 2035?

The Global Medical Sensors Market is expected to grow at a CAGR of 5.71% from 2025 to 2035.

Which region is expected to dominate the Global Medical Sensors Market in 2024?

North America is projected to dominate the market with a value of 10.0 USD Billion in 2024.

What is the forecasted market size for Europe in the Global Medical Sensors Market by 2035?

The market size for Europe is expected to reach 13.0 USD Billion by 2035.

What are the expected market values for Wearable Devices in the Global Medical Sensors Market by 2024 and 2035?

Wearable Devices are expected to be valued at 8.0 USD Billion in 2024 and 15.0 USD Billion by 2035.

What is the projected market value for Monitoring Systems in 2024 and by 2035?

The market for Monitoring Systems is projected to be 9.0 USD Billion in 2024 and reach 16.5 USD Billion by 2035.

Who are some major players in the Global Medical Sensors Market?

Major players include Abbott Laboratories, GE Healthcare, Medtronic, and Philips.

What are the projected values for Diagnostic Imaging within the Global Medical Sensors Market by 2024 and 2035?

The market for Diagnostic Imaging is expected to be valued at 7.42 USD Billion in 2024 and 13.5 USD Billion by 2035.

What is the anticipated market size for the APAC region in the Global Medical Sensors Market by 2035?

The APAC region is projected to have a market size of 8.0 USD Billion by 2035.

-

EXECUTIVE SUMMARY

-

Market Overview

-

Key Findings

-

Market Segmentation

-

Competitive Landscape

-

Challenges and Opportunities

-

Future Outlook

-

MARKET INTRODUCTION

-

Definition

-

Scope of the study

-

Research Objective

-

Assumption

-

Limitations

-

RESEARCH METHODOLOGY

-

Overview

-

Data Mining

-

Secondary Research

-

Primary Research

-

Primary Interviews and Information Gathering Process

-

Breakdown of Primary Respondents

-

Forecasting Model

-

Market Size Estimation

-

Bottom-Up Approach

-

Top-Down Approach

-

Data Triangulation

-

Validation

-

MARKET DYNAMICS

-

Overview

-

Drivers

-

Restraints

-

Opportunities

-

MARKET FACTOR ANALYSIS

-

Value chain Analysis

-

Porter's Five Forces Analysis

-

Bargaining Power of Suppliers

-

Bargaining Power of Buyers

-

Threat of New Entrants

-

Threat of Substitutes

-

Intensity of Rivalry

-

COVID-19 Impact Analysis

-

Market Impact Analysis

-

Regional Impact

-

Opportunity and Threat Analysis

-

Medical Sensors Market, BY Application (USD Billion)

-

Wearable Devices

-

Monitoring Systems

-

Diagnostic Imaging

-

Medical Sensors Market, BY Type (USD Billion)

-

Temperature Sensors

-

Pressure Sensors

-

Image Sensors

-

Biosensors

-

Medical Sensors Market, BY End Use (USD Billion)

-

Hospitals

-

Home Care

-

Diagnostic Laboratories

-

Research Institutions

-

Medical Sensors Market, BY Sensor Technology (USD Billion)

-

Electrochemical

-

Optical

-

Thermal

-

Micro-electromechanical Systems

-

Medical Sensors Market, BY Regional (USD Billion)

-

North America

-

US

-

Canada

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Italy

-

Spain

-

Rest of Europe

-

APAC

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Thailand

-

Indonesia

-

Rest of APAC

-

South America

-

Brazil

-

Mexico

-

Argentina

-

Rest of South America

-

MEA

-

GCC Countries

-

South Africa

-

Rest of MEA

-

Competitive Landscape

-

Overview

-

Competitive Analysis

-

Market share Analysis

-

Major Growth Strategy in the Medical Sensors Market

-

Competitive Benchmarking

-

Leading Players in Terms of Number of Developments in the Medical Sensors Market

-

Key developments and growth strategies

-

New Product Launch/Service Deployment

-

Merger & Acquisitions

-

Joint Ventures

-

Major Players Financial Matrix

-

Sales and Operating Income

-

Major Players R&D Expenditure. 2023

-

Company Profiles

-

Abbott Laboratories

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

NXP Semiconductors

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Bosch Sensortec

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

STMicroelectronics

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Philips

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Roche

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

GE Healthcare

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Maxim Integrated

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Microchip Technology

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Texas Instruments

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Analog Devices

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Medtronic

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Honeywell

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Omron

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

Siemens Healthineers

-

Financial Overview

-

Products Offered

-

Key Developments

-

SWOT Analysis

-

Key Strategies

-

References

-

Related Reports

-

North America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

North America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

North America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

North America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

North America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

US Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

US Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

US Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

US Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

US Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Canada Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Canada Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Canada Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Canada Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Canada Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Germany Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Germany Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Germany Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Germany Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Germany Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

UK Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

UK Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

UK Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

UK Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

UK Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

France Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

France Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

France Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

France Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

France Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Russia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Russia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Russia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Russia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Russia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Italy Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Italy Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Italy Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Italy Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Italy Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Spain Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Spain Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Spain Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Spain Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Spain Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Rest of Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Rest of Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Rest of Europe Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

China Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

China Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

China Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

China Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

China Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

India Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

India Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

India Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

India Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

India Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Japan Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Japan Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Japan Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Japan Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Japan Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

South Korea Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

South Korea Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

South Korea Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

South Korea Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

South Korea Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Malaysia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Malaysia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Malaysia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Malaysia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Malaysia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Thailand Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Thailand Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Thailand Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Thailand Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Thailand Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Indonesia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Indonesia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Indonesia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Indonesia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Indonesia Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Rest of APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Rest of APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Rest of APAC Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Brazil Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Brazil Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Brazil Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Brazil Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Brazil Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Mexico Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Mexico Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Mexico Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Mexico Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Mexico Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Argentina Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Argentina Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Argentina Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Argentina Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Argentina Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Rest of South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Rest of South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Rest of South America Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

GCC Countries Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

GCC Countries Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

GCC Countries Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

GCC Countries Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

GCC Countries Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

South Africa Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

South Africa Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

South Africa Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

South Africa Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

South Africa Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

Rest of MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD Billions)

-

Rest of MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY TYPE, 2019-2035 (USD Billions)

-

Rest of MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD Billions)

-

Rest of MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY SENSOR TECHNOLOGY, 2019-2035 (USD Billions)

-

Rest of MEA Medical Sensors Market SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD Billions)

-

PRODUCT LAUNCH/PRODUCT DEVELOPMENT/APPROVAL

-

ACQUISITION/PARTNERSHIP

-

MARKET SYNOPSIS

-

NORTH AMERICA MEDICAL SENSORS MARKET ANALYSIS

-

US MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

US MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

US MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

US MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

US MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

CANADA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

CANADA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

CANADA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

CANADA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

CANADA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

EUROPE MEDICAL SENSORS MARKET ANALYSIS

-

GERMANY MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

GERMANY MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

GERMANY MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

GERMANY MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

GERMANY MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

UK MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

UK MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

UK MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

UK MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

UK MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

FRANCE MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

FRANCE MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

FRANCE MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

FRANCE MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

FRANCE MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

RUSSIA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

RUSSIA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

RUSSIA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

RUSSIA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

RUSSIA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

ITALY MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

ITALY MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

ITALY MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

ITALY MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

ITALY MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

SPAIN MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

SPAIN MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

SPAIN MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

SPAIN MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

SPAIN MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

REST OF EUROPE MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

REST OF EUROPE MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

REST OF EUROPE MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

REST OF EUROPE MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

REST OF EUROPE MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

APAC MEDICAL SENSORS MARKET ANALYSIS

-

CHINA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

CHINA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

CHINA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

CHINA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

CHINA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

INDIA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

INDIA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

INDIA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

INDIA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

INDIA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

JAPAN MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

JAPAN MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

JAPAN MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

JAPAN MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

JAPAN MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

SOUTH KOREA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

SOUTH KOREA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

SOUTH KOREA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

SOUTH KOREA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

SOUTH KOREA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

MALAYSIA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

MALAYSIA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

MALAYSIA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

MALAYSIA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

MALAYSIA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

THAILAND MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

THAILAND MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

THAILAND MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

THAILAND MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

THAILAND MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

INDONESIA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

INDONESIA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

INDONESIA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

INDONESIA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

INDONESIA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

REST OF APAC MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

REST OF APAC MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

REST OF APAC MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

REST OF APAC MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

REST OF APAC MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

SOUTH AMERICA MEDICAL SENSORS MARKET ANALYSIS

-

BRAZIL MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

BRAZIL MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

BRAZIL MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

BRAZIL MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

BRAZIL MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

MEXICO MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

MEXICO MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

MEXICO MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

MEXICO MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

MEXICO MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

ARGENTINA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

ARGENTINA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

ARGENTINA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

ARGENTINA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

ARGENTINA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

REST OF SOUTH AMERICA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

REST OF SOUTH AMERICA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

REST OF SOUTH AMERICA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

REST OF SOUTH AMERICA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

REST OF SOUTH AMERICA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

MEA MEDICAL SENSORS MARKET ANALYSIS

-

GCC COUNTRIES MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

GCC COUNTRIES MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

GCC COUNTRIES MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

GCC COUNTRIES MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

GCC COUNTRIES MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

SOUTH AFRICA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

SOUTH AFRICA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

SOUTH AFRICA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

SOUTH AFRICA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

SOUTH AFRICA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

REST OF MEA MEDICAL SENSORS MARKET ANALYSIS BY APPLICATION

-

REST OF MEA MEDICAL SENSORS MARKET ANALYSIS BY TYPE

-

REST OF MEA MEDICAL SENSORS MARKET ANALYSIS BY END USE

-

REST OF MEA MEDICAL SENSORS MARKET ANALYSIS BY SENSOR TECHNOLOGY

-

REST OF MEA MEDICAL SENSORS MARKET ANALYSIS BY REGIONAL

-

KEY BUYING CRITERIA OF MEDICAL SENSORS MARKET

-

RESEARCH PROCESS OF MRFR

-

DRO ANALYSIS OF MEDICAL SENSORS MARKET

-

DRIVERS IMPACT ANALYSIS: MEDICAL SENSORS MARKET

-

RESTRAINTS IMPACT ANALYSIS: MEDICAL SENSORS MARKET

-

SUPPLY / VALUE CHAIN: MEDICAL SENSORS MARKET

-

MEDICAL SENSORS MARKET, BY APPLICATION, 2025 (% SHARE)

-

MEDICAL SENSORS MARKET, BY APPLICATION, 2019 TO 2035 (USD Billions)

-

MEDICAL SENSORS MARKET, BY TYPE, 2025 (% SHARE)

-

MEDICAL SENSORS MARKET, BY TYPE, 2019 TO 2035 (USD Billions)

-

MEDICAL SENSORS MARKET, BY END USE, 2025 (% SHARE)

-

MEDICAL SENSORS MARKET, BY END USE, 2019 TO 2035 (USD Billions)

-

MEDICAL SENSORS MARKET, BY SENSOR TECHNOLOGY, 2025 (% SHARE)

-

MEDICAL SENSORS MARKET, BY SENSOR TECHNOLOGY, 2019 TO 2035 (USD Billions)

-

MEDICAL SENSORS MARKET, BY REGIONAL, 2025 (% SHARE)

-

MEDICAL SENSORS MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

-

BENCHMARKING OF MAJOR COMPETITORS

Medical Sensors Market Segmentation

Medical Sensors Market By Application (USD Billion, 2019-2035)

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

Medical Sensors Market By Type (USD Billion, 2019-2035)

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

Medical Sensors Market By End Use (USD Billion, 2019-2035)

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

Medical Sensors Market By Sensor Technology (USD Billion, 2019-2035)

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

Medical Sensors Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Medical Sensors Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

North America Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

North America Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

North America Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

North America Medical Sensors Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

US Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

US Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

US Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

US Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- CANADA Outlook (USD Billion, 2019-2035)

CANADA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

CANADA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

CANADA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

CANADA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

Europe Outlook (USD Billion, 2019-2035)

Europe Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

Europe Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

Europe Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

Europe Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

Europe Medical Sensors Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

GERMANY Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

GERMANY Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

GERMANY Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- UK Outlook (USD Billion, 2019-2035)

UK Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

UK Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

UK Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

UK Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

FRANCE Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

FRANCE Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

FRANCE Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

RUSSIA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

RUSSIA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

RUSSIA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- ITALY Outlook (USD Billion, 2019-2035)

ITALY Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

ITALY Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

ITALY Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

ITALY Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

SPAIN Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

SPAIN Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

SPAIN Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

REST OF EUROPE Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

REST OF EUROPE Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

REST OF EUROPE Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

APAC Outlook (USD Billion, 2019-2035)

APAC Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

APAC Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

APAC Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

APAC Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

APAC Medical Sensors Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

CHINA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

CHINA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

CHINA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

CHINA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- INDIA Outlook (USD Billion, 2019-2035)

INDIA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

INDIA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

INDIA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

INDIA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

JAPAN Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

JAPAN Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

JAPAN Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

SOUTH KOREA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

SOUTH KOREA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

SOUTH KOREA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

MALAYSIA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

MALAYSIA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

MALAYSIA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

THAILAND Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

THAILAND Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

THAILAND Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

INDONESIA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

INDONESIA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

INDONESIA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

REST OF APAC Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

REST OF APAC Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

REST OF APAC Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

South America Outlook (USD Billion, 2019-2035)

South America Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

South America Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

South America Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

South America Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

South America Medical Sensors Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

BRAZIL Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

BRAZIL Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

BRAZIL Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

MEXICO Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

MEXICO Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

MEXICO Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

ARGENTINA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

ARGENTINA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

ARGENTINA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

REST OF SOUTH AMERICA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

REST OF SOUTH AMERICA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

REST OF SOUTH AMERICA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

MEA Outlook (USD Billion, 2019-2035)

MEA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

MEA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

MEA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

MEA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

MEA Medical Sensors Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

GCC COUNTRIES Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

GCC COUNTRIES Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

GCC COUNTRIES Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

SOUTH AFRICA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

SOUTH AFRICA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

SOUTH AFRICA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

- REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Medical Sensors Market by Application Type

- Wearable Devices

- Monitoring Systems

- Diagnostic Imaging

REST OF MEA Medical Sensors Market by Type

- Temperature Sensors

- Pressure Sensors

- Image Sensors

- Biosensors

REST OF MEA Medical Sensors Market by End Use Type

- Hospitals

- Home Care

- Diagnostic Laboratories

- Research Institutions

REST OF MEA Medical Sensors Market by Sensor Technology Type

- Electrochemical

- Optical

- Thermal

- Micro-electromechanical Systems

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment