Market Share

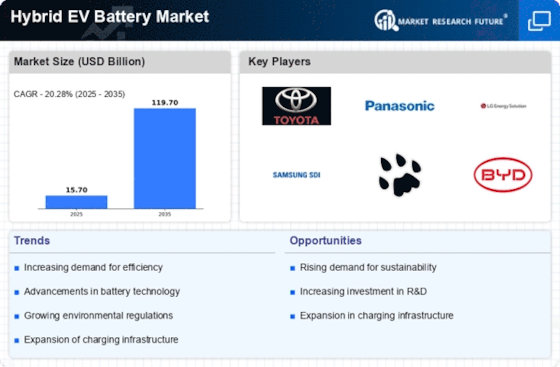

Hybrid EV Battery Market Share Analysis

In the rapidly evolving landscape of the hybrid electric vehicle (HEV) battery market, companies employ diverse market share positioning strategies to establish a competitive presence and address the growing demand for sustainable transportation solutions. One central strategy is technological differentiation, where companies focus on developing advanced and high-performance hybrid EV batteries. Innovations in battery chemistry, energy density, and charging capabilities contribute to a differentiated product portfolio. Companies strive to offer batteries that not only extend the driving range of hybrid vehicles but also enhance charging efficiency, addressing key concerns for consumers considering the switch to electric and hybrid vehicles. Another infallible strategy in the hybrid EV battery market is cost leadership. Firms are manufacturing themselves as high-efficiency producers to reduce additive costs and the prices charged for batteries. As this cost is so critical in the total price of hardware hybrid electric vehicles, even more interesting for the customer are affordable at the same time quite stable battery options. Companies using a cost leadership strategy can gain an enhanced market share as, by making the hybrid cars available to the big consumer base, companies can easily capture the larger segment of the market. Therefore, market segmentation is one of the most important factors in positioning strategies that are adopted within the hybrid EV battery market. Companies have the unique opportunity to analyze consumers’ diverse needs, which range from individual car owners to large scale commercial fleets; they then design batteries that caters for particular needs. For instance, batteries specified for smaller compact cars designed as hybrid technologies used in them may vary significantly when the same are purchased with a view of using them in larger SUVs or commercial hybrids vehicles. This first type of the approach is targeted and focused, which allows companies to bring their products according to each market’s specific needs allowing them its presence in the form they have their hybrid EV battery suited for some types of applications. One of strategic moves that is common among the hybrid EV battery market players involves geographical expansion. With disparities in individuals’ preference, incentives from the public-sector, and facility charging states among different regions firms tactically broaden their clout to achieve varied markets. This method ensures that companies can design their hybrid EV batteries around homes and industries in accordance with local preferences thus solving the problems that may arise from specific challenges to the residents and producers in different countries. Moreover, geographical growth allows organizations to manage risks caused by the real of threshold on a single market and use benefits offered in regions where sustainable transportation is severely noised. Positioning of brands is critical in shaping with consumer perceptions that translates to market share for the hybrid EV battery industry. Companies that win consumer’s trust over their business may be in the position to assure them through reliability as one of the key aspects, and by offering new innovative products and attaching responsibility for ecological issues. A strong brand reputation is especially crucial in an industry where the performance, longevity, and sustainability of batteries are paramount considerations for consumers making the transition to electric and hybrid vehicles. Companies that prioritize quality, customer support, and continuous improvement in their hybrid EV batteries can distinguish themselves and capture a larger market share.

Leave a Comment