Heat Shield Size

Market Size Snapshot

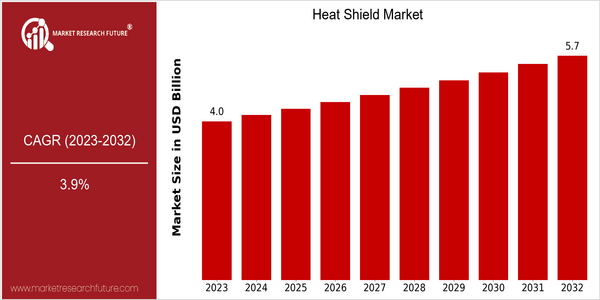

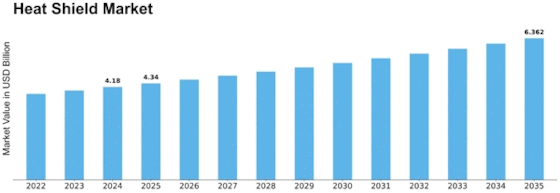

| Year | Value |

|---|---|

| 2023 | USD 4.02 Billion |

| 2032 | USD 5.67 Billion |

| CAGR (2024-2032) | 3.9 % |

Note – Market size depicts the revenue generated over the financial year

The heat-shield market is expected to be worth $ 4,024 million in 2023 and $ 5,677 million in 2032, growing at a CAGR of 4.6% from 2024 to 2032. This steady growth is due to the growing demand for heat-shield technology in various industries, especially in the fields of aerospace, automobiles and industry. The need for enhanced thermal protection and energy efficiency is increasing. Also, the development of material science has led to the development of more efficient and lightweight heat-shield materials. Ceramic-matrix composites and advanced polymers have improved performance while reducing weight, which is of particular importance for the aerospace industry. The growing demand for heat management in the automotive industry, meanwhile, is due to the increasing focus on fuel efficiency and emissions reduction. The market leaders, such as 3M, DuPont and Honeywell, are actively engaged in strategic initiatives such as collaborations and research and development to develop new products and improve their performance. Recent product launches that focus on improving heat resistance and longevity are expected to continue to drive the market growth.

Regional Market Size

Regional Deep Dive

The heat shield market is experiencing a high growth across the globe, driven by the increasing demand for heat shields in the automotive, industrial, and aeronautics applications. In North America, the heat shield market is characterized by the presence of leading aircraft manufacturers and the focus on developing new materials to enhance heat protection. In Europe, the regulatory framework is undergoing a change with a focus on energy conservation, while the Asia-Pacific region is experiencing high growth owing to the growing industrialization and the automobile industry. The Middle East and Africa are characterized by the growth in the construction and energy industries, while Latin America is slowly adopting heat shield technology in various industries. Each region is characterized by its own unique dynamics, influenced by the economic conditions, regulatory framework, and technological developments.

Europe

- The European Union's Green Deal is driving the adoption of sustainable heat shield technologies, with companies like Airbus and Rolls-Royce focusing on eco-friendly materials to meet stringent environmental regulations.

- Innovations in nanotechnology are being explored by European research institutions, enhancing the thermal resistance of heat shields, which is expected to revolutionize applications in both aerospace and automotive sectors.

Asia Pacific

- China's rapid industrialization has led to a surge in demand for heat shields in manufacturing processes, with companies like Geely and BYD investing in advanced thermal management solutions for electric vehicles.

- India's growing aerospace sector is witnessing collaborations between government and private entities, such as the Indian Space Research Organisation (ISRO) and various startups, to develop indigenous heat shield technologies.

Latin America

- Brazil's automotive industry is beginning to adopt heat shield technologies to comply with new emissions regulations, with local manufacturers exploring partnerships with global suppliers for advanced materials.

- The region's focus on renewable energy projects is leading to increased interest in heat shields for solar thermal applications, as companies seek to improve efficiency and performance.

North America

- The U.S. aerospace sector is heavily investing in advanced heat shield materials, with companies like NASA and Boeing collaborating on projects that utilize innovative thermal protection systems for next-generation spacecraft.

- Recent regulatory changes in the automotive industry, particularly in California, are pushing manufacturers to adopt heat shields that improve fuel efficiency and reduce emissions, leading to increased demand for high-performance materials.

Middle East And Africa

- The UAE's ambitious space program, including the Mars Mission, has prompted investments in advanced heat shield technologies, with local firms partnering with international aerospace companies to enhance thermal protection systems.

- Infrastructure projects in Saudi Arabia, such as NEOM, are incorporating advanced heat shield materials to improve energy efficiency in construction, reflecting a growing trend towards sustainable building practices.

Did You Know?

“The first heat shield used in space was developed for the Mercury spacecraft in the early 1960s, utilizing ablative materials that would burn away during re-entry to protect the vehicle.” — NASA Historical Archives

Segmental Market Size

The heat-shield market is currently experiencing a steady growth, driven by a rise in demand for aeronautical, automobile and industrial applications. In the aeronautical sector, the upcoming need for safety in the field of high performance is driving this market, while the automobile sector is benefiting from the growth in the demand for high performance engines. Moreover, the development of composite materials with a low density and high resistance is a further factor in this growth. The current state of heat-shield technology is that of mass production, with the likes of NASA and SpaceX leading the way in the aeronautical sector. In the automobile sector, manufacturers such as Ford and Tesla are integrating advanced heat shields to improve the performance and safety of their vehicles. The main applications are in the re-entry systems of spacecraft, automobile exhaust systems and industrial furnaces. Also, the trends in the energy-efficiency and the sustainable development of the industry are accelerating this growth, as these industries seek to reduce their heat losses. Aerogel composites and ceramic-matrix materials are the leading innovations in this market, as they improve performance and reduce weight.

Future Outlook

Heat Shields Market will see steady growth from 2023 to 2032, as the market value increases from $4.021 billion to $5.671 billion, at a CAGR of 3.9 percent. The demand for heat-resistant materials will continue to rise in the aerospace, automobile, and construction industries. In high-temperature applications, where the safety and efficiency of heat shields are important, the market is expected to see significant growth. The market will also be driven by new safety regulations and technological developments, which will enable the development of lighter and more effective heat shields. Also, new trends such as the integration of smart materials and coatings that can adapt to changing thermal conditions are expected to further increase market penetration. In the next ten years, the use of advanced heat shields will increase, especially in electric vehicles and next-generation aircraft, as industries increasingly emphasize the importance of heat shields to ensure safety and performance.

Leave a Comment