GaN powered Chargers Market Trends

GaN-powered Chargers Market Research Report Information By Power Output (25W GaN Chargers, 30W GaN Chargers, 45W GaN Chargers, 60W GaN Chargers, 65W GaN Chargers, 90W GaN Chargers, and 100W GaN Chargers), By Application (Smartphones and Tablets, Laptops and Notebooks, Autonomous Robots, Industrial Equipment, and Wireless Charging), By End User (Consumer Electronics, IT and Telecommunication, Au...

Market Summary

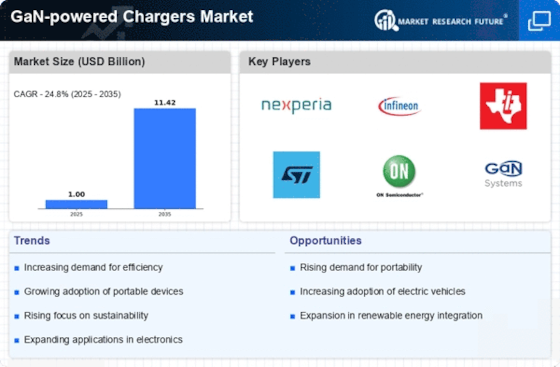

As per Market Research Future Analysis, the Global Gaming Monitors Market was valued at USD 1.0 Billion in 2024 and is projected to grow from USD 1.25 Billion in 2025 to USD 9.15 Billion by 2034, with a CAGR of 24.8% during the forecast period. Key drivers include increased internet accessibility and the adoption of advanced features by gamers and industry players. However, high investment costs for premium gaming displays may restrain growth. The market is also benefiting from the rise of online gaming tournaments and the growing number of gamers, particularly in regions like Asia-Pacific, which has around 1.5 billion video gamers.

Key Market Trends & Highlights

The gaming monitors market is experiencing significant growth driven by technological advancements and increasing gamer participation.

- Market Size in 2024: USD 1.0 Billion

- Projected Market Size by 2034: USD 9.15 Billion

- CAGR from 2025 to 2034: 24.8%

- Dominant End User Segment: Consumers in 2022

Market Size & Forecast

| 2024 Market Size | USD 1.0 Billion |

| 2025 Market Size | USD 1.25 Billion |

| 2034 Market Size | USD 9.15 Billion |

| CAGR (2025-2034) | 24.8% |

| Largest Regional Market Share in 2022 | North America |

Major Players

Key players include Samsung Electronics Co., Ltd., LG Electronics, Dell Inc., ASUSTek Computer Inc., GIGA-BYTE Technology Co., Ltd., AOC Global, Micro-Star INT'L CO., LTD., CORSAIR, and BenQ Corporation.

Market Trends

-

The extensive utilization of GaN powered chargers in various end use industries is driving the market growth

The widespread use of GaN powered chargers in numerous end use sectors is now driving the market. For instance, electric vehicles (EVs) and hybrid electric vehicles (HEVs) employ it in the lighting and brake control systems. Global sales of EVs and HEVs are increasing as a result of governments in numerous nations enacting strict regulations on greenhouse gas (GHG) emissions. Additionally, they are encouraging people to use energy-efficient technology, which is increasing the demand for GaN powered chargers in the defence and aerospace sectors.

In radars, these components are also used to improve navigation, prevent collisions, and enable real-time air traffic control. In order to improve surgical precision, they are also used in the production of medical scanning devices including sonograms, MRIs, and miniature X-ray machines. Additionally, they are employed in distributed antenna systems (DAS), tiny cells, and the densification of remote radio head networks. In addition, it is anticipated that in the upcoming years, manufacturers would benefit from the growing usage of internet of things (IoT) technology and the advent of 5G technology.

The market for GaN-powered chargers is driven by the need for quick charging options that produce less heat and lessen the possibility of overcharging. The market for GaN-powered chargers is anticipated to grow as a result of the rising use of contemporary chargers, which feature monitoring systems across numerous end-use sectors. Industry growth has been fueled by the need for fast charging for the telecommunications sectors while maintaining all power capabilities and safety norms.

Additionally, it is anticipated that throughout the forecast period, the integration of technologies such as Internet of Things (IoT), artificial intelligence (AI), machine learning, and others would hasten the total market advancement. The growing demand for these chargers across various industries is also expected to contribute to the market's rapid expansion. During the projection period, the market's growth rate will be further boosted by the spike in demand for energy-efficient and quick charging devices.

Gallium nitride (GaN) powered chargers are expected to experience continued rapid growth over the course of the projection period thanks to the development of tiny GaN-powered chargers that can be integrated with small electronics devices. Additionally, industry participants are focusing on R&D activities to expand GaN technology and introduce more potent goods. Consumer electronics device manufacturers are entering into long-term agreements with manufacturers of GaN-powered chargers in order to maintain or increase their market position in the global market. Thus, driving the GaN-powered Chargers market revenue.

The increasing demand for energy-efficient solutions in consumer electronics is driving the adoption of GaN technology in charging devices, which appears to enhance performance while reducing environmental impact.

U.S. Department of Energy

GaN powered Chargers Market Market Drivers

Consumer Electronics Market Growth

The Global GaN-powered Chargers Market Industry is closely tied to the growth of the consumer electronics market. As the demand for high-performance devices continues to rise, manufacturers are increasingly adopting GaN technology to meet consumer expectations for faster and more efficient charging solutions. The proliferation of smart devices, including wearables and IoT gadgets, further fuels this trend. The market's expansion is indicative of a broader shift towards advanced charging technologies, with projections suggesting a robust growth trajectory. The increasing integration of GaN chargers in consumer electronics is likely to play a pivotal role in shaping the industry's future.

Environmental Sustainability Initiatives

The Global GaN-powered Chargers Market Industry aligns with the growing emphasis on environmental sustainability. GaN chargers are known for their energy efficiency, which contributes to reduced carbon footprints compared to conventional chargers. As global awareness of climate change increases, consumers and businesses are increasingly prioritizing eco-friendly products. This shift is evident in the rising demand for GaN technology, which not only offers faster charging but also minimizes energy waste. The market's potential for growth is underscored by the projected CAGR of 24.78% from 2025 to 2035, reflecting a broader trend towards sustainable technology solutions in the electronics sector.

Growing Demand for Fast Charging Solutions

The Global GaN-powered Chargers Market Industry experiences a notable surge in demand for fast charging solutions, driven by the increasing reliance on portable electronic devices. As consumers seek efficient charging options for smartphones, laptops, and tablets, GaN technology offers a compelling advantage due to its ability to deliver higher power levels in a compact form. This trend is reflected in the projected market value of 1 USD Billion in 2024, highlighting the industry's rapid growth. The efficiency of GaN chargers, which can charge devices up to three times faster than traditional silicon-based chargers, positions them as a preferred choice among consumers and manufacturers alike.

Expansion of Electric Vehicle Charging Infrastructure

The Global GaN-powered Chargers Market Industry is significantly influenced by the expansion of electric vehicle (EV) charging infrastructure. As governments worldwide implement policies to promote electric mobility, the demand for efficient charging solutions rises. GaN technology, with its ability to handle high power levels and compact design, is well-suited for EV chargers. This trend is further supported by investments in charging networks, which are expected to proliferate in urban and suburban areas. The integration of GaN chargers into EV infrastructure not only enhances charging speed but also supports the transition to sustainable transportation, thereby driving market growth.

Technological Advancements in Semiconductor Materials

The Global GaN-powered Chargers Market Industry benefits from continuous advancements in semiconductor materials, particularly gallium nitride. This material exhibits superior thermal conductivity and efficiency compared to traditional silicon, enabling the development of smaller and more powerful chargers. As manufacturers invest in research and development, the performance of GaN chargers improves, leading to increased adoption across various sectors. The anticipated growth trajectory suggests that by 2035, the market could reach a valuation of 11.4 USD Billion, driven by innovations that enhance charging speed and reduce energy loss. This technological evolution is crucial for meeting the demands of modern electronics.

Market Segment Insights

GaN-powered Chargers Power Output Insights

The GaN-powered Chargers Market segmentation, based on Power Output, includes 25W GaN Chargers, 30W GaN Chargers, 45W GaN Chargers, 60W GaN Chargers, 65W GaN Chargers, 90W GaN Chargers, and 100W GaN Chargers. 30W GaN chargers segment dominated the global market in 2022. Due to their great efficiency and high energy density, 30W GaN chargers are being used more frequently to recharge laptops, cellphones, and tablets.

GaN-powered Chargers Application Insights

The GaN-powered Chargers Market segmentation, based on Application, includes Smartphones and Tablets, Laptops and Notebooks, Autonomous Robots, Industrial Equipment, and Wireless Charging. Smartphones and tablets segment dominated the GaN-powered Chargers Market in 2022. Compared to silicon, GaN-powered chargers are more compact and lightweight but also more durable and effective. Additionally, these chargers guarantee fast charging capabilities, which will increase their sales over the anticipated time frame.

GaN-powered Chargers End User Insights

The GaN-powered Chargers Market segmentation, based on End User, includes Consumer Electronics, IT and Telecommunication, Automotive, Aerospace and Defense, and Others. Automotive segment dominated the global market in 2022. This is explained by the rising need for GaN-powered chargers in the EV automobile industry.

Figure 1: GaN-powered Chargers Market, by End User, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Get more detailed insights about GaN-powered Chargers Market Research Report—Global Forecast till 2034

Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America GaN-powered Chargers Market dominated this market in 2022 (45.80%). This is because some of the top suppliers and manufacturers are well-represented in the area. This can be attributed to the rise in demand for GaN-powered chargers for a variety of applications, including wireless charging, autonomous robotics, computers, notebooks, smartphones, and tablets. Further, the U.S. GaN-powered Chargers market held the largest market share, and the Canada GaN-powered Chargers market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The US, Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: GAN-POWERED CHARGERS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe GaN-powered Chargers market accounted for the healthy market share in 2022. Application in many end-use areas is accelerating due to technological advancements in GaN semiconductor devices. A growing emphasis on various radio frequency (RF) and wireless applications will also help the market grow. One of the key developments in Europe is the rising demand for GaN in wireless devices. Further, the German GaN-powered Chargers market held the largest market share, and the U.K GaN-powered Chargers market was the fastest growing market in the European region

The Asia Pacific GaN-powered Chargers market is expected to register significant growth from 2023 to 2032. In developing nations like China, there is a growing market for high-tech GaN-powered charger items like the Dual USB-C PD GaN Wall Charger, controllers, and chargers, which is opening up profitable expansion prospects. Due to the large number of Tier II and Tier III manufacturers in East Asia, the automotive and telecom industries are expanding quickly. As a result, there will likely be a rise in the demand for GaN-powered chargers in the area.

Moreover, China’s GaN-powered Chargers market held the largest market share, and the Indian GaN-powered Chargers market was the fastest growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the GaN-powered Chargers market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, GaN-powered Chargers Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global GaN-powered Chargers Industry to benefit clients and increase the market sector. In recent years, the GaN-powered Chargers Industry has offered some of the most significant advantages to medicine.

Major players in the GaN-powered Chargers market, including Fujitsu, Toshiba Corporation, Texas Instruments Incorporated, Cree LED, Aixtron, Mitsubishi Chemical Corporation, Eaton, Siemens, Belkin International, Inc., Aukey, Gizmochina, VisIC Technologies, Koninklijke Philips N.V., VINA International Holdings LTD., GaN Systems Inc., Epigan NV, and Navitas Semiconductor Ltd., are attempting to increase market demand by investing in research and development operations.

Baseus is a manufacturer and owner of a consumer electronics brand that aims to offer consumers straightforward, cost-effective, and useful gadgets. The company's brand is focused on giving consumers with affordable and useful electronics solutions by delivering them high-quality items with premium feel and application cases for various lifestyles. Baseus introduced new Gallium Nitride (GaN) Series 120W charging heads in November 2020, with outputs of 45W, 65W, and 120W. Additionally, the business led the charging sector by introducing the first 65W triple-port quick charging plug. The 120W new Gallium Nitride (GaN) Series is primarily made for 100W 20V/5A laptop charging.

Additionally, it supports rapid charging on two laptops at once, including MacBook, Dell, HP, Lenovo, and others.

A multifaceted company with interests in electronics, electrical equipment, and information technology is Toshiba Corp (Toshiba). Storage devices, point-of-sale (POS) systems, energy-saving goods and services, semiconductors, microwave semiconductors and components, tablets, home appliance products, power systems, transmission and distribution systems, and water treatment systems are among the products it designs, develops, manufactures, and sells.

It provides building and facility technologies, digital solutions, building solutions for power systems, and other solutions for social infrastructure, including steam turbines for thermal power plants, wind and nuclear power generation systems, hydroelectric, secondary batteries, and energy supply systems, as well as lighting, air conditioning, and lift systems. The corporation conducts business throughout the Americas, Europe, the Middle East, Asia-Pacific, and Africa. The headquarters of Toshiba are in Minato-ku, Tokyo, Japan.

Key Companies in the GaN powered Chargers Market market include

Industry Developments

September 2020: In order to expand indoor coverage, Samsung Electronics struck a contract with Verizon as its first client in the United States. The current standard for rapid charging is GaN-based wall chargers, which Verizon offers. GaN-based wall chargers are considerably more compact than other types of conventional chargers.

Future Outlook

GaN powered Chargers Market Future Outlook

The GaN-powered Chargers Market is projected to grow at a 24.78% CAGR from 2024 to 2035, driven by increasing demand for efficient charging solutions and advancements in semiconductor technology.

New opportunities lie in:

- Develop compact GaN chargers for electric vehicles to capture emerging market segments.

- Innovate wireless charging solutions utilizing GaN technology for consumer electronics.

- Expand partnerships with tech companies to integrate GaN chargers into new devices.

By 2035, the GaN-powered Chargers Market is poised to achieve substantial growth, reflecting a robust demand for advanced charging technologies.

Market Segmentation

GaN-powered Chargers End User Outlook

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

GaN-powered Chargers Regional Outlook

- US

- Canada

GaN-powered Chargers Application Outlook

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

GaN-powered Chargers Power Output Outlook

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 1.0 Billion |

| Market Size 2025 | USD 1.25 Billion |

| Market Size 2034 | USD 9.15 Billion |

| Compound Annual Growth Rate (CAGR) | 24.8% (2025-2034) |

| Base Year | 2024 |

| Market Forecast Period | 2025-2034 |

| Historical Data | 2020-2023 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Power Output, Application, End User, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, U.K, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Fujitsu, Toshiba Corporation, Texas Instruments Incorporated, Cree LED, Aixtron, Mitsubishi Chemical Corporation, Eaton, Siemens, Belkin International, Inc., Aukey, Gizmochina, VisIC Technologies, Koninklijke Philips N.V., VINA International Holdings LTD., GaN Systems Inc., Epigan NV, and Navitas Semiconductor Ltd. |

| Key Market Opportunities | Requirement of GaN powered chargers in electric and hybrid vehicle |

| Key Market Dynamics | The extensive utilization of GaN power devices in various end use industries and burgeoning demand for GaN powered chargers |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the GaN-powered Chargers market?

The GaN-powered Chargers Market size was valued at USD 1.0 Billion in 2024.

What is the growth rate of the GaN-powered Chargers market?

The global market is projected to grow at a CAGR of 24.8% during the forecast period, 2025-2034.

Which region held the largest market share in the GaN-powered Chargers market?

North America had the largest share in the global market

Who are the key players in the GaN-powered Chargers market?

The key players in the market are Fujitsu, Toshiba Corporation, Texas Instruments Incorporated, Cree LED, Aixtron, Mitsubishi Chemical Corporation, Eaton, Siemens, Belkin International, Inc., Aukey, Gizmochina, VisIC Technologies, Koninklijke Philips N.V., VINA International Holdings LTD., GaN Systems Inc., Epigan NV, and Navitas Semiconductor Ltd.

Which Power Output led the GaN-powered Chargers market?

The 30W GaN Chargers Power Output dominated the market in 2022.

Which Application had the largest market share in the GaN-powered Chargers market?

The Smartphones and Tablets Application had the largest share in the global market.

-

EXECUTIVE SUMMARY

-

MARKET INTRODUCTION

- Definition

-

Scope of the Study

- Research Objective

- Assumptions

- Limitations

-

RESEARCH METHODOLOGY

-

Overview

- Data Mining

- Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

- Breakdown

-

of Primary Respondents

- Forecasting Modality

-

Market Size Estimation

- Bottom-Up Approach

- Top-Down Approach

- Data Triangulation

- Validation

-

MARKET DYNAMICS

- Overview

- Drivers

- Restraints

- Opportunities

-

MARKET FACTOR ANALYSIS

-

Value Chain Analysis

-

Porter’s Five Forces Analysis

- Bargaining

-

Porter’s Five Forces Analysis

-

Power of Suppliers

-

Bargaining Power of Buyers

- Threat of

-

Bargaining Power of Buyers

-

New Entrants

-

Threat of Substitutes

- Intensity of Rivalry

-

COVID-19 Impact Analysis

- Market Impact Analysis

- Regional

-

Threat of Substitutes

-

Impact

- Opportunity and Threat Analysis

-

GLOBAL GAN-POWERED CHARGERS

-

MARKET, BY POWER OUTPUT

- Overview

- 25W GaN Chargers

-

W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

-

W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

-

GLOBAL GAN-POWERED CHARGERS MARKET, BY APPLICATION

- Overview

-

Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

-

GLOBAL GAN-POWERED

-

CHARGERS MARKET, BY END USER

- Overview

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

-

GLOBAL GAN-POWERED CHARGERS MARKET, BY REGION

- Overview

-

North America

- U.S.

- Canada

- Europe

-

Germany

-

France

- U.K

- Italy

- Spain

- Rest of Europe

-

Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of

-

France

-

Asia-Pacific

-

Rest of the World

- Middle East

- Africa

- Latin America

-

Rest of the World

-

COMPETITIVE LANDSCAPE

- Overview

-

Competitive Analysis

- Market Share Analysis

- Major Growth Strategy

-

in the Global GaN-powered Chargers Market,

- Competitive Benchmarking

- Leading Players in Terms of Number of Developments in the Global GaN-powered

-

Chargers Market,

- Key developments and Growth Strategies

-

New Power Output Launch/Application Deployment

-

Merger & Acquisitions

- Joint Ventures

- Major Players Financial Matrix

-

Merger & Acquisitions

-

Sales & Operating Income, 2024

- Major Players R&D Expenditure.

-

COMPANY PROFILES

-

Fujitsu (Japan).

- Company

-

Fujitsu (Japan).

-

Overview

-

Financial Overview

- Power Outputs Offered

-

Financial Overview

-

Key Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

Toshiba Corporation (Japan)

-

Company Overview

- Financial

-

Company Overview

-

Overview

-

Power Outputs Offered

- Key Developments

-

Power Outputs Offered

-

SWOT Analysis

- Key Strategies

- Texas Instruments Incorporated

-

(U.S.)

-

Company Overview

- Financial Overview

-

Company Overview

-

Power Outputs Offered

-

Key Developments

- SWOT Analysis

- Key Strategies

-

Cree LED (U.S.)

- Company Overview

- Financial Overview

- Power Outputs Offered

- Key

-

Key Developments

-

Developments

-

SWOT Analysis

- Key Strategies

- Aixtron

-

SWOT Analysis

-

(Germany)

-

Company Overview

- Financial Overview

-

Company Overview

-

Power Outputs Offered

-

Key Developments

- SWOT Analysis

- Key Strategies

- MITSUBISHI CHEMICAL CORPORATION (JAPAN)

-

Key Developments

-

Company Overview

-

Financial Overview

- Power Outputs Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Eaton (Ireland)

- Company Overview

- Financial Overview

- Power Outputs Offered

- Key Developments

- SWOT

-

Financial Overview

-

Analysis

- Key Strategies

-

Siemens (Germany)

- Company

-

Overview

-

Financial Overview

- Power Outputs Offered

-

Financial Overview

-

Key Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

Belkin International, Inc (U.S.)

-

Company Overview

- Financial

-

Company Overview

-

Overview

-

Power Outputs Offered

- Key Developments

-

Power Outputs Offered

-

SWOT Analysis

- Key Strategies

- Aukey (China)

-

Company Overview

-

Financial Overview

- Power Outputs Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Gizmochina (China)

- Company Overview

- Financial

-

Financial Overview

-

Overview

-

Power Outputs Offered

- Key Developments

-

Power Outputs Offered

-

SWOT Analysis

- Key Strategies

-

VisIC Technologies (Israel)

- Company Overview

- Financial Overview

- Power

-

Outputs Offered

-

Key Developments

- SWOT Analysis

-

Key Developments

-

Key Strategies

- Koninklijke Philips N.V. (Netherlands)

-

Company Overview

-

Financial Overview

- Power Outputs Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

VINA International Holdings LTD. (U.S.)

- Company Overview

- Financial Overview

- Power Outputs Offered

-

Financial Overview

-

Key Developments

-

SWOT Analysis

- Key Strategies

-

SWOT Analysis

-

GaN Systems Inc. (Canada)

-

Company Overview

- Financial

-

Company Overview

-

Overview

-

Power Outputs Offered

- Key Developments

-

Power Outputs Offered

-

SWOT Analysis

- Key Strategies

- Epigan NV (Belgium)

-

Company Overview

-

Financial Overview

- Power Outputs Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Navitas Semiconductor Ltd. (U.S.)

- Company Overview

-

Financial Overview

-

Financial Overview

-

Power Outputs Offered

- Key Developments

- SWOT Analysis

- Key Strategies

-

Power Outputs Offered

-

APPENDIX

-

References

- Related Reports

-

GLOBAL GAN-POWERED CHARGERS MARKET, SYNOPSIS, 2018-2032

-

CHARGERS MARKET, ESTIMATES & FORECAST, 2020-2034(USD BILLION)

-

GAN-POWERED CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

GLOBAL GAN-POWERED CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

BILLION)

-

2034(USD BILLION)

-

END USER, 2020-2034(USD BILLION)

-

MARKET, BY COUNTRY, 2020-2034(USD BILLION)

-

MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

MARKET, BY END USER, 2020-2034(USD BILLION)

-

MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY COUNTRY, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

GAN-POWERED CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

REST OF EUROPE GAN-POWERED CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

BILLION)

-

2034(USD BILLION)

-

APPLICATION, 2020-2034(USD BILLION)

-

MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY COUNTRY, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

GAN-POWERED CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

AUSTRALIA GAN-POWERED CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

SOUTH KOREA GAN-POWERED CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

BILLION)

-

BILLION)

-

OUTPUT, 2020-2034(USD BILLION)

-

MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

GAN-POWERED CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

OF WORLD GAN-POWERED CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

BILLION)

-

BILLION)

-

BILLION)

-

2034(USD BILLION)

-

APPLICATION, 2020-2034(USD BILLION)

-

MARKET, BY END USER, 2020-2034(USD BILLION)

-

MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

CHARGERS MARKET, BY END USER, 2020-2034(USD BILLION)

-

GAN-POWERED CHARGERS MARKET, BY POWER OUTPUT, 2020-2034(USD BILLION)

-

LATIN AMERICA GAN-POWERED CHARGERS MARKET, BY APPLICATION, 2020-2034(USD BILLION)

-

BILLION)

-

MARKET STRUCTURE FOR THE GLOBAL GAN-POWERED CHARGERS MARKET

-

DYNAMICS FOR THE GLOBAL GAN-POWERED CHARGERS MARKET

-

CHARGERS MARKET, SHARE (%), BY POWER OUTPUT, 2024

-

CHARGERS MARKET, SHARE (%), BY APPLICATION, 2024

-

CHARGERS MARKET, SHARE (%), BY END USER, 2024

-

MARKET, SHARE (%), BY REGION, 2024

-

MARKET, SHARE (%), BY REGION, 2024

-

SHARE (%), BY REGION, 2024

-

SHARE (%), BY REGION, 2024

-

MARKET, SHARE (%), BY REGION, 2024

-

COMPANY SHARE ANALYSIS, 2024 (%)

-

SNAPSHOT

-

(JAPAN): FINANCIAL OVERVIEW SNAPSHOT

-

SWOT ANALYSIS

-

SNAPSHOT

-

(U.S.): SWOT ANALYSIS

-

CORPORATION (JAPAN): FINANCIAL OVERVIEW SNAPSHOT

-

CORPORATION (JAPAN): SWOT ANALYSIS

-

SNAPSHOT

-

FINANCIAL OVERVIEW SNAPSHOT

-

BELKIN INTERNATIONAL, INC (U.S.): FINANCIAL OVERVIEW SNAPSHOT

-

BELKIN INTERNATIONAL, INC (U.S.): SWOT ANALYSIS

-

OVERVIEW SNAPSHOT

-

(CHINA): FINANCIAL OVERVIEW SNAPSHOT

-

VISIC TECHNOLOGIES (ISRAEL): SWOT ANALYSIS

-

N.V. (NETHERLANDS): FINANCIAL OVERVIEW SNAPSHOT

-

N.V. (NETHERLANDS): SWOT ANALYSIS

-

(U.S.): FINANCIAL OVERVIEW SNAPSHOT

-

(U.S.): SWOT ANALYSIS

-

SNAPSHOT

-

EPIGAN NV (BELGIUM) : FINANCIAL OVERVIEW SNAPSHOT

-

: SWOT ANALYSIS

-

SNAPSHOT

GaN-powered Chargers Market Segmentation

GaN-powered Chargers Market Power Output Outlook (USD Billion, 2020-2034)

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

GaN-powered Chargers Market Application Outlook (USD Billion, 2020-2034)

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

GaN-powered Chargers Market End User Outlook (USD Billion, 2020-2034)

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

GaN-powered Chargers Market Regional Outlook (USD Billion, 2020-2034)

- North America Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- US Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Canada Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Europe Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Germany Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- France Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- UK Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Italy Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Spain Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Rest Of Europe Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Asia-Pacific Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- China Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Japan Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- India Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Australia Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Rest of Asia-Pacific Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Rest of the World Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Middle East Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Africa Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

- Latin America Outlook (USD Billion, 2020-2034)

- GaN-powered Chargers Market by Power Output

- 25W GaN Chargers

- 30W GaN Chargers

- 45W GaN Chargers

- 60W GaN Chargers

- 65W GaN Chargers

- 90W GaN Chargers

- 100W GaN Chargers

- GaN-powered Chargers Market by Application

- Smartphones and Tablets

- Laptops and Notebooks

- Autonomous Robots

- Industrial Equipment

- Wireless Charging

- GaN-powered Chargers Market by End User

- Consumer Electronics

- IT and Telecommunication

- Automotive

- Aerospace and Defense

- Others

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment