Market Analysis

In-depth Analysis of Fracking Chemicals Market Industry Landscape

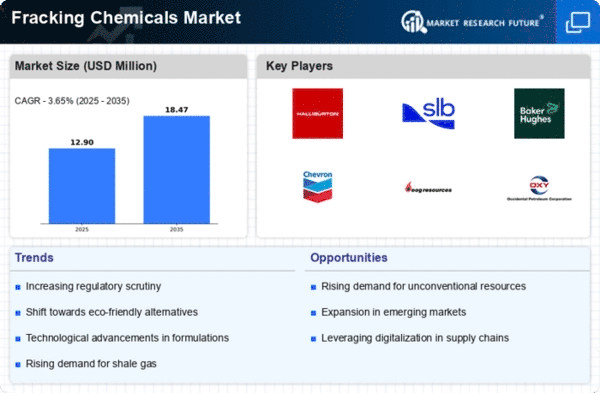

The market dynamics of the fracking chemicals industry are characterized by a complex interplay of various factors that influence supply, demand, and overall market trends. Fracking, short for hydraulic fracturing, has become a widely used method for extracting oil and natural gas from unconventional reservoirs. As a result, the demand for fracking chemicals has surged, creating a dynamic market environment. One of the key drivers of this market is the global energy demand, which continues to rise, compelling the oil and gas industry to explore and exploit unconventional resources. The increasing adoption of fracking as a viable extraction method has significantly contributed to the growth of the fracking chemicals market.

Moreover, regulatory frameworks play a crucial role in shaping the market dynamics. Governments around the world are grappling with the environmental concerns associated with fracking, leading to the implementation of stringent regulations. This has a direct impact on the type and quantity of chemicals used in the process. Market players in the fracking chemicals industry need to stay abreast of evolving regulations to ensure compliance and adapt their product offerings accordingly. The continuous evolution of environmental policies and the public's increasing awareness of environmental issues further contribute to the volatility of the market.

In addition to regulatory factors, the economic landscape plays a pivotal role in shaping market dynamics. The oil and gas industry is inherently cyclical, influenced by factors such as geopolitical events, global economic conditions, and oil price fluctuations. These variables directly impact investment decisions and exploration activities, consequently affecting the demand for fracking chemicals. Economic downturns can lead to a reduction in exploration budgets, impacting the overall market for fracking chemicals.

Technological advancements also significantly influence the fracking chemicals market. Ongoing research and development efforts aim to enhance the efficiency and environmental sustainability of fracking operations. Innovations in chemical formulations that reduce environmental impact, water usage, and overall operational costs gain traction in the market. Market participants need to invest in research and development to stay competitive and meet the evolving needs of the industry.

Furthermore, the market dynamics are shaped by the competitive landscape. The fracking chemicals market is characterized by the presence of several key players, each vying for market share. Mergers, acquisitions, and strategic partnerships are common strategies employed by companies to strengthen their position in the market. Additionally, the emergence of new entrants and the potential for disruptive technologies further intensify competition.

Geographical factors also contribute to the market dynamics, as the demand for fracking chemicals varies across regions. Regions with abundant shale resources and favorable economic conditions witness higher demand for fracking chemicals. The availability and cost of raw materials also play a role in determining the market dynamics in different regions.

Leave a Comment