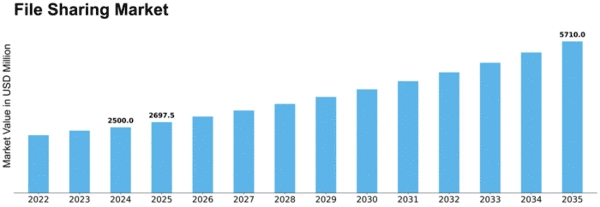

File Sharing Size

File Sharing Market Growth Projections and Opportunities

The media and entertainment (M&E) business is undergoing a change, with old and new coexisting. Over the previous decade, the media and entertainment vertical has been renovated by interactivity, digitization, various platforms, various devices, and globalization of services-based landscape. The entertainment and media industry are widely diversified and has witnessed a transformation in terms of technology and applications in recent years. This transformation has led to global entertainment and media enterprises to offer innovative content and effective distribution models to stay ahead in the highly competitive market. Movies/Cinema, Television, Music, Publishing, Radio, Internet, Advertising, and Gaming are just a few of the categories that make up the Media and Entertainment (M&E) industry. Furthermore, trends and drivers differ across sub-categories, countries, and consumer segments for each of the segments.

This distinguishes the vertical since numerous sub-verticals compete, complement, and unite to meet the worldwide demand for entertainment and information. The key players in the market are constantly developing strategies to combine high-quality content and distribute it to offer enhanced user experience in terms of content discovery and attractive prices. The industry is significantly benefitted by digital tools and platforms, facilitating efficient production, distribution, and content consumption, which is revolutionizing market growth. Key factors contributing to the market growth are increasing penetration of smartphones, growing eSports sector, rising demand for on-demand and live streaming of music and videos and growing investments by key players to develop augmented reality and virtual reality platforms. Other factors influencing the market growth are an increasing number of television subscriptions, a growing number of radio listeners, a rapidly growing video game market, outdoor advertising, and rising social media penetration among the consumers. The entertainment and media industry is expected to grow due to the rapid digital technological advancements and the emergence of 5G network connectivity services in the coming years.

Emerging small and medium enterprises offering regional and local content to international audiences also promote the industry’s growth. Artificial Intelligence is expected to impact the gaming sector with consumers demanding enhanced gaming experience will present an opportunity for key players to invest. However, controlling piracy and proper enforcement of copyright laws remains a restraint for the market players. The entertainment and media market witnesses billions of dollars of loss due to piracy and illegal file-sharing practices. Growing cyber-attacks on online platforms also pose a challenge to address for the market players. The global entertainment and media market generated a revenue of USD 2,244.8 billion in 2020 and is expected to reach a market value of USD 5,099.2 billion by 2030, growing at an 8.9% CAGR. North America accounted for 40.7% market share in the entertainment and media market due to the increasing adoption of smartphones. Growing adoption of video streaming services and video games among the individual users in North America are expected to drive the entertainment and media market throughout the forecast period. The European entertainment and media market held a 26.6% market share in 2020.

The market dynamics of the file sharing industry reflect a landscape shaped by technological advancements, changing user needs, and a growing emphasis on collaboration and remote work. File sharing, once a simple process of transferring documents between devices, has evolved into a multifaceted market driven by various factors.

One of the key drivers of market dynamics is the rapid adoption of cloud-based file sharing solutions. Cloud technology has revolutionized the way individuals and businesses store and share files, providing a secure and accessible platform for data management. The convenience and flexibility offered by cloud-based file sharing services have fueled their widespread adoption, enabling users to access their files from any device with an internet connection. This shift towards cloud solutions has not only simplified file sharing but has also contributed to the market's overall growth.

Additionally, the increasing emphasis on collaboration in both professional and personal settings has propelled the demand for advanced file sharing features. Collaboration tools, integrated into file sharing platforms, allow users to work on documents simultaneously, track changes, and provide real-time feedback. This collaborative aspect is particularly significant in the current era of remote work, where teams are geographically dispersed but still need to work seamlessly together. As a result, file sharing solutions that prioritize collaboration features are gaining traction in the market.

Security concerns play a pivotal role in shaping the market dynamics of file sharing. With the rising frequency and sophistication of cyber threats, users and organizations are prioritizing solutions that ensure the confidentiality and integrity of shared files. End-to-end encryption, secure access controls, and compliance with data protection regulations have become critical features for file sharing platforms. As security concerns continue to evolve, the market is witnessing an increased demand for robust and comprehensive security features in file sharing solutions.

The competitive landscape also significantly influences the market dynamics. Numerous vendors, ranging from established tech giants to emerging startups, offer file sharing solutions with varying features and pricing models. This competition has led to constant innovation and the introduction of new functionalities to differentiate products. Price competitiveness, user experience, and integration capabilities with other software applications are key factors that determine the success of file sharing solutions in a crowded market.

Moreover, the regulatory environment and compliance requirements impact the file sharing market dynamics. Data privacy regulations, such as the GDPR in Europe and the CCPA in California, have necessitated file sharing platforms to implement measures to protect user data and adhere to stringent privacy standards. Companies operating in this space need to navigate a complex regulatory landscape, ensuring that their solutions meet legal requirements and industry standards.

Leave a Comment