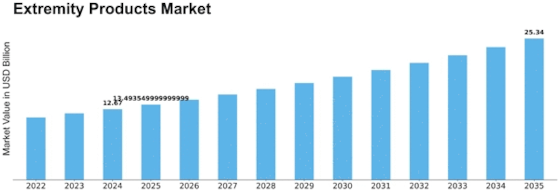

Extremity Products Size

Extremity Products Market Growth Projections and Opportunities

Many societal factors impact extreme products sales. The rising number of seniors drives demand. As the global population ages, arthritis and damaged bones become increasingly common. Joint grafts and limb braces are needed for this reason. Medical technology's rapid advancement has impacted the limb and hand industry. As materials, surgery, and implant designs advance, prosthetic limbs become more functional and durable. This makes them more enticing to doctors and patients seeking sophisticated therapy. General healthcare spending patterns affect the limb market. Countries that spend more on healthcare invest more on modern orthopedic treatments. This boosts extreme products sales. Insurance benefits and payment regulations may prevent patients from getting them. The rise of orthopedic issues such osteoarthritis and breakage drives the need for limb products. In areas where these problems are frequent, joint replacements, trauma implants, and other limb therapies are popular. The unique products market is affected by tight restrictions and regulatory processes. Manufacturers must follow regulators' guidelines to guarantee product safety and efficacy. Rules changes might influence new items and make it tougher for new enterprises to enter the market. Wild products market leaders compete fiercely. Market share is affected by product differentiation, pricing, and positioning. Research and development that creates new products gives companies an edge over competition. How well patients and healthcare personnel know about limb treatments and products affects market growth. Educational campaigns, patient workshops, and maker-healthcare professional alliances increase extreme solution adoption. This helps individuals make good choices. Foreign and regional economies affect extreme products sales. People may spend less on healthcare in a terrible economy. This will impact patient and healthcare provider purchasing power. However, economic growth may drive medical innovation purchases. Changing behaviors and culture might alter orthopedic problem frequency. Poor nutrition and lack of exercise cause joint problems. This has increased demand for limb-aid items. How various cultures see medical care and surgery influences the market. Good distribution networks and supply chain management are crucial for pricey products. Making items available fast is crucial, especially in an emergency. Strong distribution lines and partnerships may help manufacturers gain market share. Because healthcare infrastructure is improving and individuals have more money, extreme items are selling in emerging nations. These areas fulfill orthopedic healthcare demands, thus limb-related products may flourish. Pandemics might impact extreme products sales in the short and long term. Supply chain issues, healthcare goals, and patient behavior can all affect the market.

Leave a Comment