Market Share

Expanded Beam Cable Market Share Analysis

In today's landscape, the potential for new applications utilizing expanded beam optical (EBO) technology is steadily gaining traction. This innovation has found focus in various areas, with complex backplane cabling and the rise of IoT applications, particularly within building cabling, serving as key application areas for expanded beam solutions. The standout feature of EBO technology lies in its effectiveness in challenging environments, where it exhibits reduced sensitivity to factors like vibrations and dust, setting the stage for emerging applications.

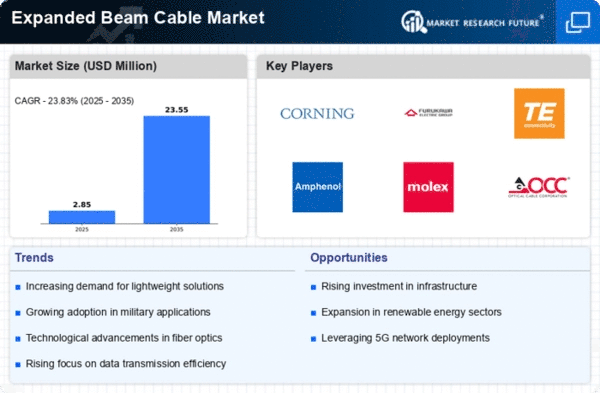

This technology's resilience makes it well-suited for edge computing and the integration of 5G into commercial production settings, addressing crucial needs in the Industry 4.0 framework. Only fiber optics can offer the sustained high bandwidths and low latencies required in the backbone infrastructure for Industry 4.0 initiatives. Consequently, the expanded beam market is anticipated to witness substantial growth owing to these critical functionalities.

Moreover, the demand for robust networks has surged, especially with the advent of 5G networks that necessitate Fibre to the Antenna (FTTA) solutions. Robust networks with expanding bandwidth capacities are essential for mobile applications, notably those used in transportation settings like trains and airplanes. These environments often experience significant vibrations during operation, highlighting the necessity for durable and reliable connectivity solutions.

To meet the diverse needs of customers across these varied applications, stakeholders in the expanded beam market are actively engaged in developing tailored connector systems. Collaborating closely with clients, these players strive to create connector solutions that align precisely with the specific requirements of each application. This collaborative approach ensures the development of highly functional, application-specific connector systems tailored to address the unique demands of challenging environments, further fueling the growth and adoption of expanded beam optical technology in diverse industrial settings.

Expanded beam connectors are engineered to thrive in challenging conditions, offering high reliability even in environments prone to dirt, dust, and other contaminants that often disrupt transmission in conventional butt-joint connectors. These connectors, unlike their butt-joint counterparts, operate without physical contact between fiber connectors. Instead, they employ a precision lens that significantly increases the beam diameter, rendering expanded beam connectors highly preferable for applications in harsh conditions across various industries.

One primary advantage lies in the expanded beam's ability to significantly reduce sensitivity to environmental factors that commonly interfere with transmission in standard connectors. This resilience proves especially crucial in sectors such as military communication, where fiber optic connections contend with high pressure, extreme temperatures, and abrasive particles like grit and dust. In such demanding operations, the use of expandable beam fiber optic cables and connectors becomes indispensable, ensuring consistent performance and reliability.

Moreover, expanded beam connectors are instrumental in mitigating interference from dust and dirt—a recurring issue in industries like mining, oil exploration, and submersible operations. Their effectiveness and efficiency in these rugged environments have been well-documented, sustaining reliable connectivity despite challenging conditions.

Leave a Comment