Market Share

Introduction: Navigating the Competitive Landscape of Europe's Renewable Electricity Market

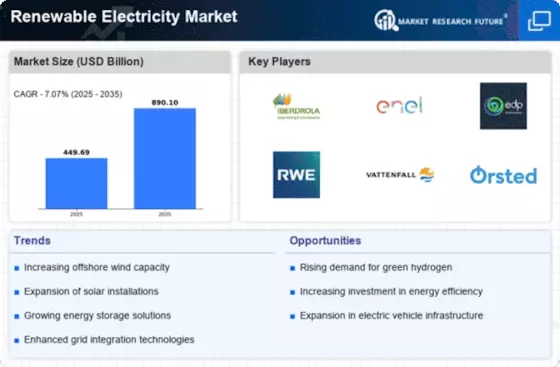

The momentum of the European market for green electricity is reshaped by the quickening of technology, by the tightening of the regulatory framework and by the growing expectations of consumers in terms of social responsibility. In this context, leading players such as original equipment manufacturers (OEMs), IT service companies and operators of the energy grids are developing new solutions based on artificial intelligence, automation and the Internet of Things. The manufacturers of electrical appliances focus on increasing the efficiency of the production and reducing costs. The IT service companies develop smart grids, which optimize the distribution of energy. The operators of the energy grids are investing in green electricity in order to meet the regulatory requirements and the consumers' demand for more sustainable energy. By 2024/25, opportunities for growth will be found in the regions, especially in the offshore wind and solar power sectors, driven by strategic trends that focus on the priorities of sustainability and resilience. Companies that use these technology-driven advantages will be able to seize market shares and drive future growth.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions across the renewable electricity spectrum, integrating various technologies and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Enel Green Power S.P.A. | Strong global presence and diverse portfolio | Renewable energy generation | Europe, Latin America, North America |

| Acciona S.A. | Expertise in sustainable infrastructure | Wind and solar energy projects | Europe, Americas, Asia |

Infrastructure & Equipment Providers

These vendors focus on the development and provision of essential infrastructure and equipment for renewable energy generation.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Contour Global P.L.C. | Focus on emerging markets and diverse energy sources | Power generation from renewable sources | Europe, Africa, Latin America |

| Abengoa S.A. | Innovative technology in solar energy | Solar power and bioenergy solutions | Europe, Americas, Middle East |

| E.D.F. S.A. | Strong backing from a major utility | Nuclear and renewable energy integration | Europe, North America, Asia |

Emerging Players & Regional Champions

- Northvolt (Sweden): specializes in the manufacture of sustainable batteries for energy storage. Recently a large-scale contract was signed with Vattenfall for a battery project, thereby complementing established suppliers and enabling energy storage to be used in projects with a high proportion of renewable energy.

- Solarpack (Spain): Focuses on solar photovoltaic (PV) projects and has recently implemented a 200 MW solar farm in Portugal, challenging established players by offering competitive pricing and innovative financing models.

- Energiekontor (Germany): Engaged in wind and solar project development, recently completed a 150 MW wind farm in the UK, complements established vendors by providing localized expertise and faster project delivery.

- Octopus Energy (UK): Offers renewable energy supply and innovative energy management solutions, recently partnered with several local councils to provide green energy, challenging traditional energy suppliers with its customer-centric approach.

- Green Eagle Solutions (France): Provides software solutions for renewable energy asset management, recently implemented its platform for a major utility in Italy, complements established vendors by enhancing operational efficiency and data analytics.

Regional Trends: In 2023, Europe is witnessing a rapid increase in the use of electricity from renewable sources, due to the incentives offered by the governments and a strong impetus towards decarbonization. Local energy solutions are in vogue, with a special focus on community-owned solar and wind projects. In the field of technology, specialization is shifting towards energy storage, smart grids and digital platforms for asset management. All of this enables a better integration of the electricity grid with the renewable sources.

Collaborations & M&A Movements

- Siemens Gamesa and Ørsted entered a partnership to develop offshore wind projects in the North Sea, aiming to enhance renewable energy capacity and strengthen their market positions amidst increasing EU climate targets.

- TotalEnergies acquired a 50% stake in the floating wind farm project from Simply Blue Group, positioning itself as a leader in innovative offshore renewable technologies and expanding its portfolio in line with EU renewable energy directives.

- Enel Green Power and EDP Renováveis have reached an agreement to jointly invest in solar energy projects in Spain and Portugal. The agreement strengthens both companies' positions in the Iberian market, which is aiming to meet the national target for the development of renewable energy.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Sustainability | Siemens Gamesa, Vestas, Nordex | Siemens Gamesa has implemented advanced recycling processes for turbine blades, enhancing sustainability. Vestas leads in wind energy solutions with a focus on reducing carbon footprints, while Nordex emphasizes eco-friendly manufacturing practices. |

| Energy Storage Solutions | Tesla, LG Chem, Sonnen | Tesla's Powerwall has gained significant adoption in residential markets, showcasing effective energy storage. LG Chem provides scalable battery solutions for commercial applications, and Sonnen focuses on community energy storage systems. |

| Grid Integration | ABB, GE Renewable Energy, Schneider Electric | ABB's microgrid solutions have been successfully deployed in various European cities, enhancing grid resilience. GE Renewable Energy offers digital solutions for grid management, while Schneider Electric focuses on smart grid technologies. |

| Renewable Energy Generation | Enel Green Power, EDP Renewables, Iberdrola | Enel Green Power has a diverse portfolio across solar and wind, with significant projects in Italy and Spain. EDP Renewables is expanding its footprint in offshore wind, while Iberdrola is a leader in onshore wind generation. |

| Digitalization and Smart Technologies | Siemens, Accenture, IBM | Siemens is leveraging IoT for predictive maintenance in renewable assets. Accenture provides consulting for digital transformation in energy, while IBM's AI solutions enhance operational efficiency in renewable energy management. |

Conclusion: Navigating Europe's Renewable Energy Landscape

Competition in the European market for green electricity is highly fragmented, with both the established and the newcomers vying for market share. Local trends indicate a move towards more local energy solutions, which will require suppliers to adjust their strategies accordingly. The established players are deploying their existing expertise and investing in new technology, while the newcomers are focusing on agility and sustainable solutions to gain a foothold in the local niches. This means that the ability to use capabilities such as artificial intelligence, automation and agility will be key to gaining a leading position in the evolving landscape. The decision-makers must be aware of the strategic implications of these developments in order to position their companies for success in the green electricity sector.

Leave a Comment