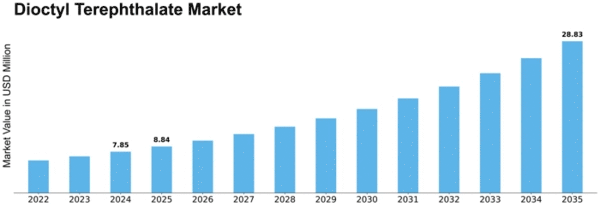

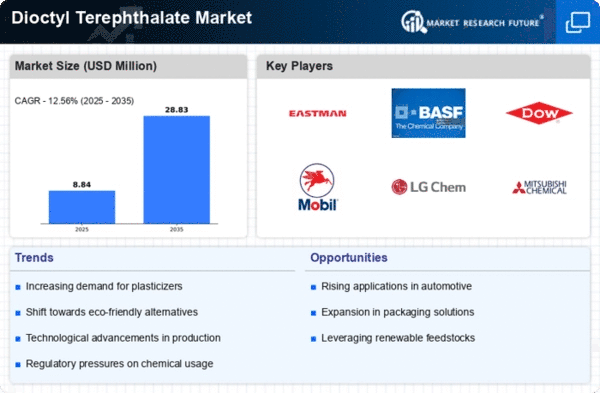

Dioctyl Terephthalate Size

Dioctyl Terephthalate Market Growth Projections and Opportunities

The Dioctyl Terephthalate (DOTP) Market is influenced by several factors that collectively shape its trends and growth dynamics. One of the primary drivers is the increasing demand for eco-friendly plasticizers in various industries, particularly in the production of flexible polyvinyl chloride (PVC) products. DOTP, known for its excellent plasticizing properties and low environmental impact, has gained prominence as a viable alternative to traditional phthalate-based plasticizers. As environmental awareness grows and regulations become more stringent, the demand for DOTP continues to rise, driven by its compatibility with sustainable and green manufacturing practices.

Global economic conditions play a crucial role in the Dioctyl Terephthalate Market. Economic growth and industrialization contribute to increased demand for plasticizers in construction, automotive, and consumer goods industries. Developing economies, in particular, witness a surge in construction and manufacturing activities, propelling the demand for DOTP as a key component in the production of flexible PVC products.

Technological advancements in plasticizer formulation impact the market dynamics. Ongoing research and development efforts lead to innovations that enhance the performance, stability, and compatibility of DOTP in various applications. Companies that invest in these technological advancements gain a competitive edge by offering high-quality and versatile DOTP solutions that meet the evolving needs of diverse industries.

Environmental considerations and regulatory measures are pivotal factors in the Dioctyl Terephthalate Market. As the industry faces increasing pressure to adopt sustainable and environmentally friendly practices, the use of DOTP, which is free from ortho-phthalates and considered non-toxic, aligns with regulatory requirements and consumer preferences. Companies in the market must comply with stringent environmental standards and communicate the eco-friendly attributes of their DOTP products to maintain a positive market position.

Geopolitical factors and trade dynamics also play a role in shaping the Dioctyl Terephthalate Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of DOTP. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Furthermore, the packaging industry significantly contributes to the demand for Dioctyl Terephthalate. As the demand for flexible and durable packaging materials increases, especially in the food and beverage sector, DOTP is utilized as a plasticizer in the production of flexible films, sheets, and containers. The versatility and performance of DOTP make it a preferred choice for packaging applications, driving its adoption in the industry.

The construction sector is another key driver of the Dioctyl Terephthalate Market. As construction activities expand globally, the demand for flexible PVC materials, such as cables, flooring, and roofing membranes, rises. DOTP, with its ability to impart flexibility and durability to PVC products, becomes instrumental in meeting the performance requirements of construction applications.

Raw material prices, particularly those of terephthalic acid and 2-ethylhexanol, play a role in shaping the Dioctyl Terephthalate Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of DOTP. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment