Market Share

Digital Identity in BFSI Market Share Analysis

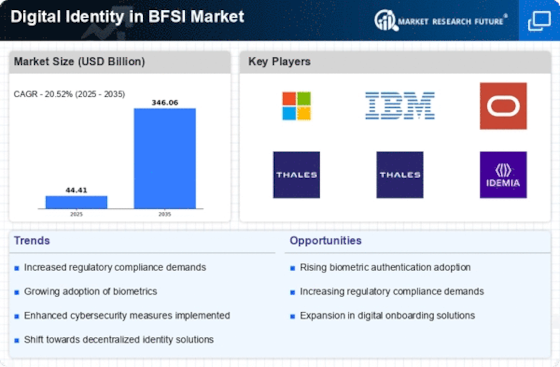

Technology-advancing world creates its own rules and gives importance for digital identity in the BFSI industries. Digital identity as a concept has been uprising in the market with more threats plunged into the world of internet privacy, digital identity solutions are the new factor in improving security, user experience and compliance with law. Among many trends in this regard, implementation of biomaterial authentication methods has played the most important role. It comes in the shape of fingerprint, facial recognition, and iris scanning for ensuring safe financial transactions and protecting customers’ sensitive information. Furthermore, there is a trend of identity management configuration decentralized many blockchain networks, protected purposes to individualized data, which in turn reduces possibility of identity theft and fraud.

Likewise, we notice that AI and ML are finding a wide range of applicability in BFSI industry in various activities including identity verification and fraud detection. These technologies provide institutions ability to extract intelligence from massive sets of data in the present time, find patterns that could refer to some fraudulent activity and confirm customer identities rapidly and exactly. Additionally, the market is experiencing the increased demand for omnichannel identity verification solutions that can integrate with different channels, regardless of each customer's preference, being a mobile app, online portal or even an in-person interaction in a physical branch.

The next important market trend is the serious implementation of regulatory compliance in the light of data wealth safeguarding like GDPR and CCPA. Digital identity solution is a key tool for BFSI institutions that are looking for ways to make sure that adherence to these regulations is in place in the interest of preserving their customers' privacy and gaining their trust. Meanwhile, with the advent of open banking initiatives and interoperable financial structures, providing safe and standard digital identity procedures is one necessary condition for hassle-free data exchange and interoperability between different financial-service providers.

In response to this development, technology vendors are introducing cutting edge digital identity products and services that are product-focused and tailor made for this sector. It includes an extensive range of services such as ID proofing, identity document authentication, risk-based authentication and continuous monitoring of customers’ identities to detect any doubtful activities. Further, the user experience more and more becomes the core of the identity concepts. It has to run smoothly and be secure enough to support the financial interactions in a daily life easily and effortlessly.

Leave a Comment