Market Trends

Key Emerging Trends in the Decentralized Finance Market

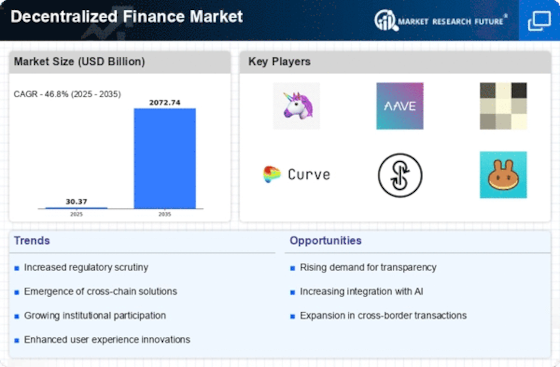

DeFi, or Decentralized Finance, is a game changer for money stuff. It stands for fairness and easy to see actions with everyone included. The independent finance market, which uses new blockchain techs, is seeing big changes. This will shape its future path. A major change in the Unattached DeFi Market is how decentralized exchanges (DEXs) are becoming more common. These websites make it easy for people to trade things without needing anyone else. They let users swap items right from their wallets. This pattern shows that more and more people want to keep their own digital money safe instead of using big central banks. So, DEXs have seen an increase in money and trading. This shows that people are moving to a more decentralized way of finance where users come first. Another important change is the growth of borrowing and lending rules that don't have a central boss. On their own, DeFi platforms are giving people the power to lend or borrow things without needing regular money places. Lending rules based on smart contracts let people get interest from their crypto money or borrow cash by using something valuable for security. This way is helping people get money services when they might not be able to with normal banks. In addition, the free DeFi Market is seeing changes in decentralized options trading platforms. These services allow people to buy and sell lots of money things, like futures and choices in a way that does not have any central authority. These trading rules use smart contracts to automatically do and finish derivative deals. This reduces risk with other traders and makes it easier for these trades in derivatives. This pattern shows that DeFi markets are growing up, to meet the different needs of traders and investors. The Independent DeFi Market is starting to pay more attention on interoperability. As more and more blockchain networks grow, there is a bigger need for easy talking and working together between different systems that don't have a central control. Things that help different blockchain networks work together are becoming more important. They let people use stuff and services from many of these networks.

Leave a Comment