Market Analysis

In-depth Analysis of Construction Lubricants Market Industry Landscape

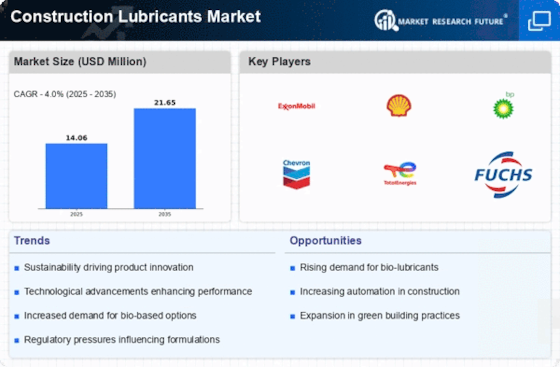

The construction lubricants market is active and essential to the proper operation of large construction gear and equipment. Supply, demand, and industry expansion drive market dynamics in this area. Market dynamics are driven by construction sector performance. Construction lubricants demand rises with worldwide construction. Lubricants are needed to keep machinery running smoothly and long-lasting as infrastructure, residential, and commercial projects rise. Lubricant formulation technology also affects market dynamics.

Construction lubricant market dynamics are also affected by base oil and additive price fluctuations. These materials account for a large amount of lubricant production expenses, therefore price changes can affect them. Manufacturers must manage these cost dynamics to retain market competitiveness. Geopolitical events and global economic conditions can affect raw material availability and pricing, complicating market dynamics.

Construction lubricants market consolidation is prominent. Mergers and acquisitions help larger organizations increase their product ranges, market positions, and distribution networks. Due to consolidation, a few major businesses dominate the market. Smaller companies focus on specific markets or specialty lubricants to stand out.

Construction lubricant industry dynamics are also shaped by regulations. Environment, worker safety, and product quality are being addressed by strict global standards. Compliance with these laws assures product market acceptance and boosts producer repute. Market favors companies who anticipate and surpass regulatory obligations.

Customer preferences and external variables affect the construction lubricants market. Users want lubricants with improved performance, longer equipment life, and more fuel efficiency. Manufacturers spend in R&D to produce new lubricant compositions to meet or surpass customer expectations.

In conclusion, industry performance, technical improvements, raw material pricing, market consolidation, regulatory compliance, and changing customer preferences affect the construction lubricants market. Market actors must be strategic and adaptable to suit current demands and position themselves for future chances in this ever-changing sector.

Leave a Comment