Market Trends

Key Emerging Trends in the Colposcopy Market

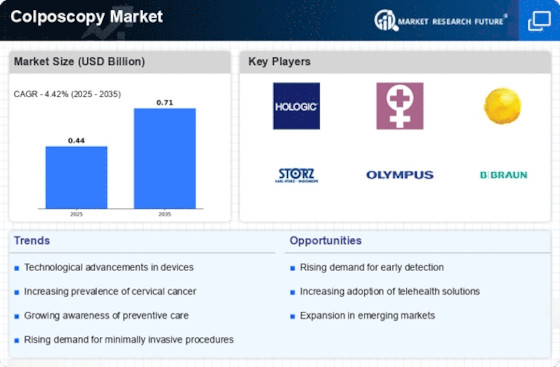

The market for colposcopy has seen notable patterns and changes recently, reflecting a dynamic environment that is driven by technological advancement and changing health practices. Colposcopy, which is a diagnostic method used to examine the cervix, vagina, and vulva closely for signs of diseases like cervical cancer, has become an integral part of women’s healthcare.

One key trend in this market is increasing use of digital colposcopes. These were previously optical lens and eyepiece-based devices. Digital incorporation has transformed the way clinicians approach diagnosis. The benefit of digital colposcopes can be depicted through high-resolution imaging which allows healthcare experts to capture and store images digitally thereby enhancing diagnosis accuracy as well as facilitating easier contact with other providers for second opinions or consultations.

In addition, AI integration in colposcopy is another trend worth mentioning about. To analyze colposcopic images AI algorithms are being developed that can help detect abnormal patterns objectively leading to more standardized results. It also enhances diagnostic accuracy but it will also streamline workflow in healthcare settings leading to better outcomes for patients and clinicians.

Similarly, there is a sharp rise in demand for portable and handheld colposcopes on the market. Moreover these small-sized convenient tools are ideal for resource-limited areas or point-of care applications. In various environments portable colposcopes enable health workers have an access to a wider variety of locations where examinations may be conducted.

Additionally preventive healthcare focus has resulted in growth in awareness levels concerning cervical conditions as well as screenings. Early detection of cervical abnormalities through awareness campaigns implemented by governments as well as non-profit organizations; screening programs put into place so that individuals get tested at early stages stage; resulting into increased demand for Colposcopy as an essential diagnostic tool aimed at preventing cervical cancer.

Geographically speaking emerging economies are showing increased adoption rates of colposcopy due to improved healthcare infrastructure development coupled with rising awareness among the population. These regions usually have higher prevalences of cervical cancer thus making colposcopy an essential element of women’s health.

Besides, in the market for Colposcopy, there are collaborative efforts and partnerships among healthcare providers and medical device manufacturers. For example, through joint ventures and partnerships with healthcare institutions, research and development capacities may be enhanced leading to introduction of innovative colposcope technologies. At the same time such collaborations contribute to global standardization of colposcopy practices as well as knowledge sharing between countries.

In spite of these positive trends, a number of challenges remain including cost constraints and access issues in some areas. In fact, this is being addressed via developing low-cost colposcopes while at the same time implementing telemedicine initiatives. It overcomes geographical barriers through enabling remote consultation and diagnosis which improves accessibility to colposcopic services via telecolposcopy.”

Leave a Comment