Coagulant Size

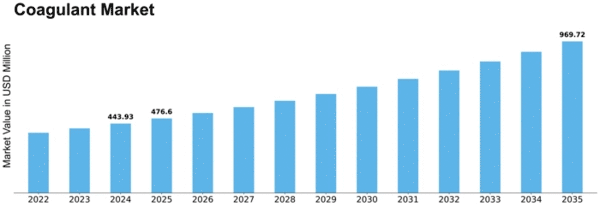

Coagulant Market Growth Projections and Opportunities

The coagulant market is influenced by several key factors that contribute to its growth and dynamics. These factors encompass various aspects such as technological advancements, regulatory policies, industry trends, and economic conditions, shaping the demand, supply, and competitive landscape of the market. One significant factor driving the coagulant market is the increasing demand from water treatment and wastewater management sectors. Coagulants are essential chemicals used in the purification of water and wastewater, aiding in the removal of suspended solids, organic matter, and other contaminants. As population growth, urbanization, and industrialization place greater pressure on water resources, the need for effective coagulant solutions to ensure clean and safe water supplies becomes more pronounced. Coagulants are used to separate the suspended solids from water. Coagulants are primarily used in the water treatment industry for moving the suspended solids, and removal of color, odors, and taste from the water. The different types of coagulants, i.e., inorganic coagulants, organic coagulants, or a combination of both, are usually used to treat water.

Technological advancements play a crucial role in driving innovation and expanding the capabilities of coagulants. Manufacturers are continuously developing new formulations and treatment processes to improve the efficiency and performance of coagulation in water treatment applications. Advanced coagulant products with enhanced properties such as higher coagulation rates, improved floc formation, and reduced chemical consumption are in high demand. Moreover, innovations in coagulant production technologies, such as membrane-based separation processes and nanotechnology, further drive market growth by offering more sustainable and cost-effective solutions.

Market trends within key industries such as municipal water treatment, industrial manufacturing, and mining also impact the coagulant market. Growing urbanization and industrialization lead to increased wastewater generation from municipal, industrial, and agricultural sources, creating opportunities for coagulant suppliers to provide effective treatment solutions. Moreover, the expansion of infrastructure projects, particularly in emerging economies, drives demand for coagulants used in construction dewatering and soil stabilization applications. Additionally, the mining industry relies on coagulants for tailings treatment and water recycling to mitigate environmental impacts and comply with regulatory requirements.

Consumer behavior and public health concerns also influence the coagulant market. As consumers become more health-conscious and environmentally aware, they demand safe and clean drinking water supplies free from harmful contaminants. Municipalities and water utilities invest in advanced coagulant technologies to ensure the quality and safety of drinking water, thereby driving market demand. Additionally, public awareness campaigns and media coverage of water-related issues, such as contamination outbreaks and pollution incidents, raise awareness about the importance of water treatment and stimulate demand for coagulant products and services.

Competitive dynamics within the coagulant market are shaped by factors such as product differentiation, pricing strategies, and industry consolidation. The presence of established players, regional suppliers, and new entrants creates a competitive landscape where companies vie for market share and customer loyalty. Manufacturers differentiate their coagulant products based on performance, reliability, and cost-effectiveness to meet the diverse needs of customers across various industries. Mergers, acquisitions, and strategic partnerships among industry players further influence market consolidation and competitive positioning. Additionally, factors such as distribution networks, technical support, and brand reputation play a crucial role in determining market success.

Leave a Comment