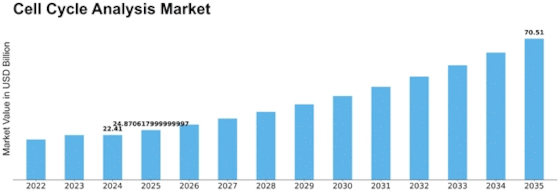

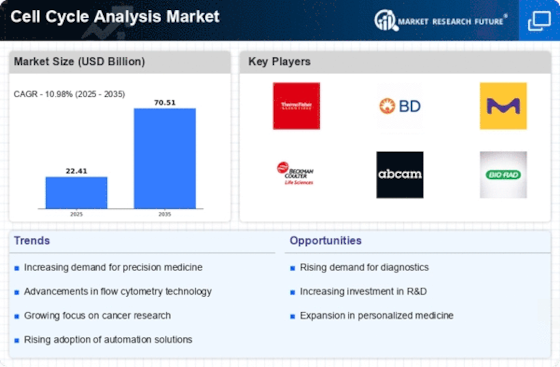

Cell Cycle Analysis Size

Cell Cycle Analysis Market Growth Projections and Opportunities

The Cell Cycle Analysis Market is essentially determined by its urgent job in cancer examination and discovery. Cell cycle analysis empowers the investigation of cell expansion, identifying indiscretions and potential markers related with different cancer types. The interest for exact and productive cell cycle analysis devices is consequently moved by the continuous endeavors to comprehend and battle cancer. The drug industry's emphasis on drug revelation and improvement assumes a critical part in the interest for cell cycle analysis devices. Understanding the cell cycle is essential in identifying potential medication targets, evaluating drug viability, and ensuring the security of drug compounds, driving market extension. The increasing pervasiveness of persistent diseases, for example, cardiovascular issues and neurodegenerative circumstances adds to the growth of the Cell Cycle Analysis Market. Cell cycle analysis is fundamental in studying the cellular components underlying these diseases, aiding in the improvement of designated treatments and treatment techniques. Progressions in single-cell analysis advancements are influencing the Cell Cycle Analysis Market. Single-cell analysis considers a more itemized and exact understanding of individual cell conduct in the cell cycle, contributing to the unraveling of complicated organic cycles and illness systems. The growth of the biotechnology and biopharmaceutical areas decidedly influences the Cell Cycle Analysis Market. Cell cycle analysis is integral in bioprocess monitoring, quality control of biopharmaceutical items, and optimizing cell culture conditions, driving the reception of cutting-edge analysis devices. The increasing reception of high-content screening in drug revelation and cell science research influences the Cell Cycle Analysis Market. High-content screening techniques empower the synchronous analysis of numerous cellular boundaries during the cell cycle, providing complete insights and accelerating research processes. The growing interest for customized medicine drives the requirement for exact cell cycle analysis. Understanding the individual varieties in cell cycle guideline is essential for tailoring medicines to the attributes of patients, influencing the reception of cutting-edge analysis procedures.

Leave a Comment