Cast Iron Cookware Size

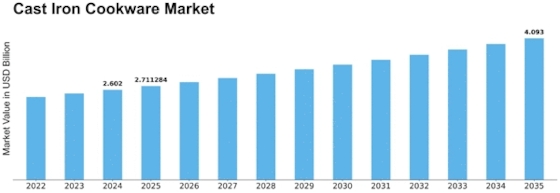

Cast Iron Cookware Market Growth Projections and Opportunities

The world's bakeware market is on the rise, and it's expected to keep growing at a rate of 5.60% every year until 2027. By then, it's predicted to reach a whopping USD 6,140.05 million. Here's why: SURGE IN THE BAKERY WORLD Bakeries all around the globe are growing fast, especially the commercial ones. Why? Well, it's because people like you and me are looking for more variety in bakery products. We want different tastes, flavors, and, of course, freshness. This growing love for bakery goodies is fueling the bakeware market. NUCLEAR FAMILIES PLAY A BIG ROLE As more families become nuclear (just a couple and their kids), the demand for bakeware is going up. Unlike joint families where one bakeware set can be shared, nuclear families tend to buy their own set. So, as more families split into smaller ones, the need for bakeware increases. MONEY MATTERS Money matters, and as households in developing countries see an increase in their average income, they're more likely to splurge on modern bakeware. Countries like India, China, and Brazil are seeing their economies grow, and families that couldn't afford fancy bakeware before can now get their hands on it. The rise in disposable income is boosting the demand for bakeware in developing countries. THE BAKEWARE SCENE Types of Bakeware: There are different types of bakeware like cups, pans, dishes, rolling pins, and more, making sure you have what you need for your baking adventures. Who's Using Bakeware: Bakeware is not just for home bakers; it's a hit in the commercial world too. Whether you're baking at home or running a bakery business, bakeware is in demand. Where to Get Bakeware: You can find bakeware in regular stores or even online. Whether you prefer to shop in a physical store or click your way to bakeware, there are options for everyone. Where in the World: The bakeware market covers different parts of the world, including North America, Europe, Asia Pacific, and more. It's a global affair! THE PLAYERS IN THE BAKEWARE GAME Many companies, big and small, are in the bakeware business. Some of the major players include Motiba Silicone Private Limited, Indigo Metalware, Reynolds Consumer Products LLC, The Oneida Group Inc., Primma G.R.A., Calphalon, LLC, USA PAN, Wonderchef Home Appliances Pvt. Ltd, Nordic Ware, and more. So, with bakeware gaining more popularity and people craving a variety of baked treats, the bakeware market is set for a deliciously successful journey ahead!

Leave a Comment