Butadiene Market Trends

Butadiene Market Research Report By Application (Synthetic Rubber, Acrylonitrile Butadiene Styrene, Butadiene Rubber, Latex), By End Use (Automotive, Footwear, Textiles, Consumer Goods), By Production Method (Steam Cracking, Dehydrogenation, Extraction, Catalytic Cracking), By Purity Level (Standard Butadiene, High Purity Butadiene, Technical Grade Butadiene) and By Regional (North America, Eur...

Market Summary

The global butadiene market is projected to grow from 24.9 USD billion in 2024 to 35 USD billion by 2035, reflecting a steady increase in demand.

Key Market Trends & Highlights

Butadiene Key Trends and Highlights

- The market is expected to experience a compound annual growth rate (CAGR) of 3.15 percent from 2025 to 2035.

- By 2035, the global butadiene market is anticipated to reach a valuation of 35 USD billion, indicating robust growth potential.

- In 2024, the market valuation stands at 24.9 USD billion, highlighting a solid foundation for future expansion.

- Growing adoption of synthetic rubber due to increasing automotive production is a major market driver.

Market Size & Forecast

| 2024 Market Size | 24.9 (USD Billion) |

| 2035 Market Size | 35 (USD Billion) |

| CAGR (2025-2035) | 3.15% |

| Largest Regional Market Share in 2024 | latin_america) |

Major Players

BP, China National Petroleum Corporation, Kraton Corporation, Braskem, LyondellBasell, Mitsubishi Chemical Corporation, Shell, ENEOS Corporation, LG Chem, Nexen Inc., Reliance Industries, TotalEnergies, Tosoh Corporation, INEOS, SABIC

Market Trends

The Butadiene Market is driven by the growing demand for synthetic rubber, particularly in the automotive sector, where it is a key ingredient in the production of tires and various rubber products. As countries focus on strengthening their automotive industries, the need for butadiene has expanded. Additionally, the shift towards environmentally friendly and sustainable practices is prompting manufacturers to explore bio-based alternatives, creating new usage opportunities.

This is part of a larger trend in manufacturing toward using more sustainable materials. There are also chances in new markets where industrialization is happening, which could mean more butadiene use. More money spent on research and development will lead to more progress in butadiene production technologies, making them more efficient and environmentally friendly.

This evolving landscape underscores the critical importance of adaptability in strategies for stakeholders in the Butadiene Market.

The Global Butadiene Market appears to be experiencing a shift towards increased demand driven by the automotive and synthetic rubber industries, suggesting a potential for growth in production capacities.

U.S. Energy Information Administration

Butadiene Market Market Drivers

Market Trends and Projections

The Global Butadiene Market Industry is characterized by various trends and projections that highlight its potential for growth. Current estimates suggest that the market will reach 24.9 USD Billion in 2024, with a steady increase anticipated through 2035, where it is projected to attain a value of 35 USD Billion. The compound annual growth rate (CAGR) of 3.15% from 2025 to 2035 indicates a stable growth trajectory, reflecting the industry's resilience and adaptability. These trends provide valuable insights for stakeholders looking to understand the future landscape of the Global Butadiene Market Industry.

Expansion of Plastics Production

The Global Butadiene Market Industry is poised for growth due to the expansion of plastics production, particularly in developing economies. Butadiene serves as a crucial feedstock for the production of various plastics, including polystyrene and acrylonitrile butadiene styrene. As countries invest in infrastructure and consumer goods, the demand for these plastics is likely to rise. This trend is expected to contribute to the market's growth, with projections indicating a market value of 35 USD Billion by 2035. The increasing reliance on butadiene in the plastics sector underscores its importance within the Global Butadiene Market Industry.

Growing Demand for Synthetic Rubber

The Global Butadiene Market Industry is experiencing a surge in demand for synthetic rubber, primarily driven by its extensive application in the automotive sector. As the automotive industry continues to expand, the need for high-performance tires and other rubber products increases. In 2024, the market is projected to reach 24.9 USD Billion, with synthetic rubber accounting for a substantial portion of this value. This trend is likely to persist, as the automotive sector is expected to grow, further propelling the demand for butadiene-derived products. The Global Butadiene Market Industry thus stands to benefit significantly from this ongoing demand.

Rising Demand for Bio-based Products

The Global Butadiene Market Industry is witnessing a shift towards bio-based products, driven by increasing environmental awareness and regulatory pressures. As consumers and manufacturers seek sustainable alternatives, bio-based butadiene is gaining traction. This trend is likely to influence traditional butadiene production methods, pushing companies to innovate and adapt. The growing interest in sustainable materials could reshape the market landscape, potentially leading to new applications and opportunities within the Global Butadiene Market Industry. This evolution may also attract investment aimed at developing greener production processes.

Market Volatility and Price Fluctuations

The Global Butadiene Market Industry is currently facing challenges related to market volatility and price fluctuations, which can significantly impact profitability. Factors such as geopolitical tensions, supply chain disruptions, and changes in crude oil prices contribute to this instability. As a result, companies operating within the industry must adopt strategies to mitigate risks associated with these fluctuations. This volatility may lead to increased operational costs and affect long-term planning. Understanding these dynamics is crucial for stakeholders in the Global Butadiene Market Industry to navigate the complexities of the market.

Technological Advancements in Production

Technological advancements in the production of butadiene are enhancing efficiency and reducing costs, thereby benefiting the Global Butadiene Market Industry. Innovations in extraction and processing techniques, such as the development of more efficient catalytic processes, are likely to improve yield and lower environmental impact. These advancements may lead to increased production capacity, aligning with the projected CAGR of 3.15% for the period from 2025 to 2035. As production becomes more efficient, the Global Butadiene Market Industry could see a rise in competitiveness and profitability, attracting further investment.

Market Segment Insights

Butadiene Market Segment Insights

Butadiene Market Segment Insights

Butadiene Market Application Insights

Butadiene Market Application Insights

The Butadiene Market exhibits a diverse range of applications that are crucial for various industries and contribute significantly to the overall market dynamics. Within this sphere, the total valuation for 2024 stands at 24.87 USD billion, expected to grow robustly by 2035, reaching 35.0 USD billion. Major applications include Synthetic Rubber, which dominates with a substantial valuation of 10.0 USD Billion in 2024, projected to increase to 14.5 USD Billion by 2035.

This specific application is critical due to its widespread use in tire manufacturing, automotive components, and various rubber goods.Following it, Acrylonitrile Butadiene Styrene holds a significant position with a valuation of 5.5 USD Billion in 2024, anticipated to rise to 8.0 USD Billion in 2035. This material is noted for its strength and versatility, making it vital in producing consumer goods, automotive interior parts, and electronic housings.

Butadiene Rubber, valued at 6.0 USD billion in 2024 and expected to grow to 8.5 USD billion by 2035, is another key application, primarily utilized in the production of high-performance tires and industrial applications due to its excellent resilience and elasticity.Lastly, Latex is projected to have a value of 3.37 USD Billion in 2024, expected to reach 4.0 USD Billion by 2035, serving a wide range of applications in gloves, paints, and adhesives.

The continued demand for these applications is driven by advancements in the automotive and consumer goods sectors, which rely heavily on the properties that these butadiene-based materials offer. The Butadiene Market segmentation showcases a clear trend toward increased utilization and innovation across these applications, reflecting their importance in driving market growth and adapting to evolving consumer and industrial needs.As markets evolve, sustainability practices and innovations will play a critical role in shaping the demand and applications of butadiene, thus offering new opportunities within the industry.

Butadiene Market End Use Insights

Butadiene Market End Use Insights

The Butadiene Market is diverse and segmented by various end uses, showcasing its vital role in multiple industries. As of 2024, the overall market is valued at approximately 24.87 USD billion, highlighting the significance of increasing utilization in manufacturing processes. Notably, the automotive sector is a major consumer, utilizing butadiene to produce synthetic rubber for tires, providing durability and performance.

Footwear also contributes substantially to the market, with the material's flexibility and resilience making it ideal for various types of footwear.In the textile industry, butadiene plays a crucial role in creating synthetic fibers, thus enhancing fabric properties and offering better durability. Consumer goods represent another prominent avenue where butadiene-derived materials are used to manufacture various everyday products, ensuring quality and longevity. The growth in these end-use applications is driven by increasing demand for durable products, innovations in synthetic material production, and an emphasis on sustainability.

Challenges such as fluctuating raw material prices and environmental regulations could impact the market; however, ongoing Research and Development efforts present numerous opportunities for future growth within the Butadiene Market.

Butadiene Market Production Method Insights

Butadiene Market Production Method Insights

The Butadiene Market is expected to showcase significant growth in the coming years, with a projected valuation of 24.87 billion USD by 2024 and a rise to 35.0 billion USD by 2035. The market segmentation around Production Method highlights various techniques, each playing a critical role in butadiene production. Steam Cracking is one of the most commonly employed methods, recognized for its efficiency in producing high yields of butadiene from hydrocarbons.

Dehydrogenation also holds importance, particularly in converting hydrocarbons into higher-value butadiene; this method is gaining traction due to advancements in catalyst technology.Extraction methods contribute to the market by isolating butadiene from other hydrocarbons, while Catalytic Cracking is notable for its ability to maximize output from crude oil and natural gas derivatives. The combination of these production techniques helps meet the rising demand for butadiene, which is key in the manufacturing of synthetic rubber, plastics, and various chemicals.

As environmental regulations tighten, there is a trend towards adopting more efficient and sustainable production conventions in the Butadiene Market, fueling continued growth and innovation in these production methods.

Butadiene Market Purity Level Insights

Butadiene Market Purity Level Insights

The Butadiene Market, particularly in the context of Purity Level, is poised for growth as it focuses on various grades of butadiene, each catering to unique industrial applications. By 2024, the market is expected to reach a value of approximately 24.87 USD billion, driven by strong demand across sectors such as automotive, synthetic rubber, and plastics.

Within this segment, Standard Butadiene serves as the backbone for numerous manufacturing processes, offering a cost-effective solution for producing synthetic rubbers used in tires and other automotive components.High Purity Butadiene is significantly crucial for the production of specialty chemicals and polymers, ensuring optimal performance in high-tech applications, which will see increased adoption in various industries. Technical Grade Butadiene is widely used in the petrochemical industry and is essential for producing a range of products, including resins and polymers. This segment's importance is underscored by evolving trends toward eco-friendly products, fostering innovation in butadiene production and applications.

As the market dynamics shift, driven by changing consumer preferences and technological advancements, the segmentation around purity levels will continue to significantly influence the overall Butadiene Market statistics and growth trajectories in the coming years.

Get more detailed insights about Butadiene Market Research Report—Global Forecast 2035

Regional Insights

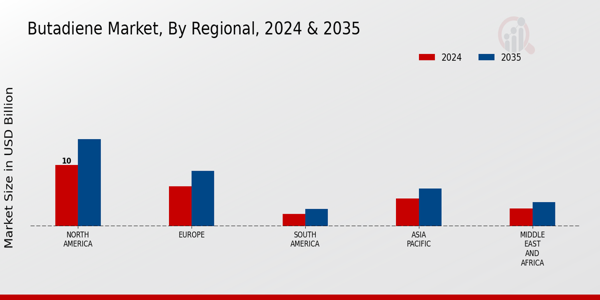

The Butadiene Market is poised for growth across various regions, with significant valuations expected by 2024. Notably, the North America region holds a valuation of 6.0 USD billion, reflecting its robust production capacity and demand for synthetic rubber and plastics. Europe follows closely with a market value of 5.5 USD Billion, driven by its strong automotive sector, which relies heavily on butadiene derivatives.

The Asia Pacific region dominates the Butadiene Market with a substantial valuation of 10.5 USD Billion in 2024, supported by rapid industrialization and increasing demand for plastics across countries like China and India.South America, although smaller, shows promise with a market value of 2.0 USD billion, bolstered by emerging economies investing in production capabilities. The Middle East and Africa region represents a smaller portion of the market at 1.87 USD billion, yet it benefits from abundant oil resources that facilitate butadiene production.

This diverse regional segmentation illustrates the Butadiene Market's expansion potential, influenced by varying growth drivers, manufacturing capacities, and regional demands for butadiene applications in sectors such as automotive, construction, and consumer goods.Furthermore, understanding these regional dynamics is essential for stakeholders as they navigate opportunities and challenges in this evolving market landscape.

Source: Primary Research, Secondary Research, Market Research Future Database, and Analyst Review

Key Players and Competitive Insights

The Butadiene Market is characterized by a diverse range of players who engage in strategic maneuvers to enhance their market positions and competitiveness. This sector plays a vital role in the petrochemical industry, with butadiene being a crucial feedstock for producing synthetic rubber and various chemicals. Competitive insights reveal that various factors such as production capabilities, technological advancements, raw material sourcing, and regional market dynamics significantly influence the competitive landscape. Companies are continuously striving to optimize their operational efficiencies and adopt innovative production methods.

Moreover, the push towards sustainability has led to an increasing emphasis on eco-friendly production techniques, which has become a determining factor in assessing competitiveness among market players.BP is one of the prominent players in the Butadiene Market, highlighted by its robust production facilities and commitment to maintaining high operational standards. The company has established a significant footprint with its advanced technology and expertise in petrochemical production, allowing it to cater to diverse consumer needs effectively. BP's strengths include its focus on sustainable practices, investments in innovation, and strategic partnerships that enhance its production capabilities.

The company's extensive network and established relationships with customers and suppliers further enable it to maintain a strong competitive edge in the market. Furthermore, BP's proactive approach to adapting to changing market trends solidifies its status as a key contender in the butadiene sector, enabling it to respond adeptly to the evolving demands of the industry.China National Petroleum Corporation is a major entity in the Butadiene Market, having developed an extensive portfolio of products and services that encompass a wide array of petrochemical applications.

The company excels in butadiene production, leveraging its significant operational scale and integrated supply chain to optimize efficiency and reduce costs. Key strengths of China National Petroleum Corporation include its advanced technological capabilities and a strategic focus on research and development, which has led to innovative production processes. Additionally, the company actively engages in mergers and acquisitions to expand its operations and enhance market share, thereby strengthening its competitive position in the market.

With its vast infrastructure and commitment to sustainability, China National Petroleum Corporation continues to be a formidable player in the Butadiene Market, addressing the growing demand for butadiene while ensuring compliance with regulatory standards and consumer expectations.

Key Companies in the Butadiene Market market include

Industry Developments

- Q2 2025: PT Lotte Chemical Indonesia started its new naphtha-fed steam cracker in late May. The steam cracker supports a 140,000 mt/year butadiene plant, and the company started supplying butadiene in July. PT Lotte Chemical Indonesia launched a new naphtha-fed steam cracker in late May 2025, enabling the start of butadiene supply from its 140,000 mt/year plant beginning in July 2025.

- Q3 2025: China's Zhejiang Petrochemical plans to restart its No. 3 naphtha-fed steam cracker in Zhejiang in early August after completing planned maintenance. The cracker, shut in late June, supports a 250,000 mt/year butadiene unit. Zhejiang Petrochemical announced the planned restart of its No. 3 naphtha-fed steam cracker in Zhejiang in early August 2025, following maintenance; the facility supports a 250,000 mt/year butadiene unit.

- Q3 2025: ExxonMobil announced the startup of its ethylene project in Huizhou, southern China in July. ExxonMobil commenced operations at its new ethylene project in Huizhou, southern China in July 2025, which is expected to impact regional butadiene supply dynamics.

- Q2 2025: TotalEnergies' Gonfreville butadiene unit restarts after outage. TotalEnergies restarted its Gonfreville butadiene unit in France in the first half of 2025, following a period of outage, contributing to increased European butadiene supply.

- Q2 2025: Dow's Bohlen site ends outage, resumes butadiene production. Dow completed maintenance and resumed butadiene production at its Bohlen site in Germany in the first half of 2025, increasing available supply for export.

Recent developments in the Butadiene Market have shown fluctuations in prices due to changes in supply and demand dynamics. As of October 2023, LyondellBasell reported an increase in production capacity to meet rising demands for synthetic rubber, highlighting an optimistic outlook for the market. Mitsubishi Chemical Corporation is also expanding its operations in Asia to leverage the growing automotive sector, leading to an increased butadiene output.

In terms of mergers and acquisitions, in September 2023, Kraton Corporation announced its acquisition of a specialty chemical producer to strengthen its position in the value chain of butadiene derivatives, aiming to enhance product offerings and market share.

Shell and TotalEnergies have been collaborating on sustainability initiatives that align with butadiene production, focusing on reducing carbon emissions. The valuation of companies such as BP and ENEOS Corporation has also seen positive growth, driven by the increasing demand for butadiene in various applications, particularly in tires and automotive components. Over the past two to three years, major developments included the acquisition of Reliance Industries’ stake in a joint venture with INEOS, reflecting strategic consolidation within the industry.

Future Outlook

Butadiene Market Future Outlook

The Global Butadiene Market is projected to grow at a 3.15% CAGR from 2024 to 2035, driven by increasing demand in automotive and synthetic rubber industries.

New opportunities lie in:

- Invest in bio-based butadiene production technologies to meet sustainability goals.

- Expand into emerging markets with rising automotive manufacturing.

- Develop innovative applications in high-performance polymers for diverse industries.

By 2035, the Butadiene Market is expected to achieve robust growth, reflecting evolving industry dynamics and increased demand.

Market Segmentation

Butadiene Market End Use Outlook

- Automotive

- Footwear

- Textiles

- Consumer Goods

Butadiene Market Regional Outlook

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Butadiene Market Application Outlook

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

Butadiene Market Purity Level Outlook

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

Butadiene Market Production Method Outlook

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2023 | 24.11 (USD Billion) |

| Market Size 2024 | 24.87 (USD Billion) |

| Market Size 2035 | 35.0 (USD Billion) |

| Compound Annual Growth Rate (CAGR) | 3.16% (2025 - 2035) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | BP, China National Petroleum Corporation, Kraton Corporation, Braskem, LyondellBasell, Mitsubishi Chemical Corporation, Shell, ENEOS Corporation, LG Chem, Nexen Inc., Reliance Industries, TotalEnergies, Tosoh Corporation, INEOS, SABIC |

| Segments Covered | Application, End Use, Production Method, Purity Level, Regional |

| Key Market Opportunities | Rising demand for synthetic rubber, Growth in automotive production, Expansion of renewable energy sector, Increasing demand for butadiene derivatives, Technological advancements in extraction processes |

| Key Market Dynamics | Supply and demand fluctuations, Price volatility, Environmental regulations impact, Technological advancements, Growing automotive industry |

| Countries Covered | North America, Europe, APAC, South America, MEA |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

What is the expected market value of the Butadiene Market in 2024?

The Butadiene Market is expected to be valued at 24.87 USD billion in 2024.

What is the expected market size of the Butadiene Market by 2035?

By 2035, the Butadiene Market is projected to reach a value of 35.0 USD billion.

What is the expected CAGR for the Butadiene Market from 2025 to 2035?

The expected CAGR for the Butadiene Market from 2025 to 2035 is 3.16%.

Which region is expected to dominate the Butadiene Market in 2024?

The Asia Pacific region is anticipated to have the largest share, valued at 10.5 USD billion in 2024.

What market size is anticipated for North America in the Butadiene Market by 2035?

North America is projected to reach a market size of 8.5 USD billion by 2035.

What is the anticipated growth rate for the Synthetic Rubber segment in the Butadiene Market by 2035?

The Synthetic Rubber segment is expected to grow to 14.5 USD billion by 2035.

Who are the key players in the Butadiene Market?

Major players include BP, China National Petroleum Corporation, and LyondellBasell, among others.

What will be the market value for Acrylonitrile Butadiene Styrene in 2024?

The market value for Acrylonitrile Butadiene Styrene is expected to be 5.5 USD Billion in 2024.

What is the expected size of the Butadiene Rubber segment in 2035?

The Butadiene Rubber segment is anticipated to reach a size of 8.5 USD billion by 2035.

How much is the market for the Middle East and Africa region projected to grow by 2035?

The Middle East and Africa region is projected to grow to 2.0 USD billion by 2035.

-

- Market Overview

-

Key Findings

- Market Segmentation

- Competitive Landscape

-

Challenges and Opportunities

- Future Outlook

- Definition

- Scope of the study

-

Research Objective

- Assumption

-

- Limitations

-

- Overview

- Data Mining

-

Secondary Research

-

Primary Research

- Primary Interviews and Information Gathering Process

-

Primary Research

-

- Breakdown of Primary Respondents

-

- Forecasting Model

- Market Size Estimation

-

Bottom-Up Approach

- Top-Down

-

Approach

- Data Triangulation

- Validation

- Overview

- Drivers

- Restraints

- Opportunities

-

Value chain Analysis

-

Porter's Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of New Entrants

- Threat of Substitutes

- Intensity of Rivalry

- COVID-19 Impact Analysis

-

Porter's Five Forces Analysis

-

Market Impact Analysis

- Regional

-

Impact

- Opportunity and Threat

-

Analysis

- Synthetic Rubber

-

Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

-

BUTADIENE MARKET, BY END USE (USD BILLION)

- Automotive

- Footwear

- Textiles

- Consumer Goods

- Steam Cracking

- Dehydrogenation

- Extraction

-

Catalytic Cracking

-

BY PURITY LEVEL (USD BILLION)

- Standard Butadiene

- High Purity Butadiene

-

Technical Grade Butadiene

-

MARKET, BY REGIONAL (USD BILLION)

-

North America

- US

-

North America

-

Canada

-

Europe

- Germany

-

Europe

-

UK

-

France

- Russia

-

France

-

Italy

-

Spain

- Rest of Europe

-

APAC

- China

-

Spain

-

-

India

- Japan

-

India

-

South Korea

- Malaysia

-

-

Thailand

- Indonesia

-

Thailand

-

Rest of APAC

-

South America

- Brazil

-

South America

-

Mexico

-

Argentina

- Rest of South America

- MEA

-

Argentina

-

GCC Countries

- South Africa

-

- Rest of MEA

-

- Overview

- Competitive Analysis

- Market share Analysis

-

Major Growth Strategy in the Butadiene Market

-

Competitive Benchmarking

- Leading Players

-

in Terms of Number of Developments in the Butadiene Market

-

Key developments and growth strategies

- New Product

-

Launch/Service Deployment

-

Merger & Acquisitions

-

Joint Ventures

- Major

-

Players Financial Matrix

- Sales and Operating

-

Income

- Major Players R&D

-

Expenditure. 2023

- INEOS

-

Financial Overview

- Products

-

Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

-

SABIC

- Financial Overview

-

SWOT Analysis

-

-

Products Offered

- Key Developments

- SWOT Analysis

-

Products Offered

-

Key Strategies

-

ExxonMobil

- Financial Overview

-

ExxonMobil

-

Products Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

- Mitsubishi Chemical

-

SWOT Analysis

-

Financial Overview

- Products

-

Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

-

Shell

- Financial Overview

-

SWOT Analysis

-

-

Products Offered

- Key Developments

- SWOT Analysis

-

Products Offered

-

Key Strategies

-

Bridgestone

- Financial Overview

-

Bridgestone

-

Products Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

-

TPC Group

- Financial

-

SWOT Analysis

-

Overview

- Products Offered

-

-

Key Developments

- SWOT Analysis

- Key Strategies

-

TotalEnergies

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

-

Key Developments

-

Key Strategies

-

Kraton

- Financial Overview

-

Kraton

-

Products Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

-

LyondellBasell

- Financial

-

SWOT Analysis

-

Overview

- Products Offered

-

-

Key Developments

- SWOT Analysis

- Key Strategies

-

JSR Corporation

- Financial Overview

- Products Offered

- Key Developments

- SWOT Analysis

-

Key Developments

-

Key Strategies

-

Repsol

- Financial Overview

-

Repsol

-

Products Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

- China National Petroleum Corporation

-

SWOT Analysis

-

Financial Overview

- Products

-

Offered

- Key Developments

-

-

SWOT Analysis

- Key Strategies

-

PetroChina

- Financial

-

SWOT Analysis

-

Overview

- Products Offered

-

-

Key Developments

- SWOT Analysis

- Key Strategies

-

LG Chem

- Financial Overview

- Products Offered

- Key Developments

-

Key Developments

-

SWOT Analysis

- Key Strategies

-

- References

- Related

-

Reports

-

MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS) FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS) FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS) BY REGIONAL, 2019-2035 (USD BILLIONS) BUTADIENE MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) BUTADIENE MARKET SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS) BY END USE, 2019-2035 (USD BILLIONS) BUTADIENE MARKET SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS) FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

BUTADIENE MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

LEVEL, 2019-2035 (USD BILLIONS) AMERICA BUTADIENE MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

& FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY END USE, 2019-2035 (USD BILLIONS) FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS)

-

2019-2035 (USD BILLIONS)

-

MARKET SIZE ESTIMATES & FORECAST, BY REGIONAL, 2019-2035 (USD BILLIONS) FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY APPLICATION, 2019-2035 (USD BILLIONS)

-

SIZE ESTIMATES & FORECAST, BY PRODUCTION METHOD, 2019-2035 (USD BILLIONS) FORECAST, BY PURITY LEVEL, 2019-2035 (USD BILLIONS)

-

MARKET ANALYSIS BY APPLICATION ANALYSIS BY END USE PRODUCTION METHOD PURITY LEVEL

-

CANADA BUTADIENE MARKET ANALYSIS BY END USE BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL BUTADIENE MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY APPLICATION BY END USE METHOD LEVEL

-

BUTADIENE MARKET ANALYSIS BY END USE MARKET ANALYSIS BY PRODUCTION METHOD MARKET ANALYSIS BY PURITY LEVEL ANALYSIS BY REGIONAL BY APPLICATION END USE METHOD LEVEL

-

RUSSIA BUTADIENE MARKET ANALYSIS BY END USE BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL BUTADIENE MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY APPLICATION ANALYSIS BY END USE BY PRODUCTION METHOD BY PURITY LEVEL REGIONAL

-

BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY APPLICATION MARKET ANALYSIS BY END USE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL EUROPE BUTADIENE MARKET ANALYSIS BY REGIONAL BUTADIENE MARKET ANALYSIS ANALYSIS BY APPLICATION BY END USE METHOD LEVEL

-

INDIA BUTADIENE MARKET ANALYSIS BY END USE BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL MARKET ANALYSIS BY REGIONAL ANALYSIS BY APPLICATION BY END USE METHOD LEVEL

-

MALAYSIA BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD

-

THAILAND BUTADIENE MARKET ANALYSIS BY APPLICATION THAILAND BUTADIENE MARKET ANALYSIS BY END USE BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL BUTADIENE MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY APPLICATION MARKET ANALYSIS BY END USE ANALYSIS BY PRODUCTION METHOD MARKET ANALYSIS BY PURITY LEVEL MARKET ANALYSIS BY REGIONAL MARKET ANALYSIS BY APPLICATION MARKET ANALYSIS BY END USE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL APAC BUTADIENE MARKET ANALYSIS BY REGIONAL AMERICA BUTADIENE MARKET ANALYSIS MARKET ANALYSIS BY APPLICATION ANALYSIS BY END USE BY PRODUCTION METHOD BY PURITY LEVEL BY REGIONAL

-

BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD BUTADIENE MARKET ANALYSIS BY PURITY LEVEL BUTADIENE MARKET ANALYSIS BY REGIONAL BUTADIENE MARKET ANALYSIS BY APPLICATION BUTADIENE MARKET ANALYSIS BY END USE MARKET ANALYSIS BY PRODUCTION METHOD MARKET ANALYSIS BY PURITY LEVEL MARKET ANALYSIS BY REGIONAL BUTADIENE MARKET ANALYSIS BY APPLICATION SOUTH AMERICA BUTADIENE MARKET ANALYSIS BY END USE REST OF SOUTH AMERICA BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD

-

BUTADIENE MARKET ANALYSIS BY APPLICATION BUTADIENE MARKET ANALYSIS BY END USE BUTADIENE MARKET ANALYSIS BY PRODUCTION METHOD COUNTRIES BUTADIENE MARKET ANALYSIS BY PURITY LEVEL GCC COUNTRIES BUTADIENE MARKET ANALYSIS BY REGIONAL SOUTH AFRICA BUTADIENE MARKET ANALYSIS BY APPLICATION

-

IMPACT ANALYSIS: BUTADIENE MARKET CHAIN: BUTADIENE MARKET

-

2025 (% SHARE)

-

2019 TO 2035 (USD Billions)

-

END USE, 2025 (% SHARE)

-

USE, 2019 TO 2035 (USD Billions)

-

BY PRODUCTION METHOD, 2025 (% SHARE) BY PRODUCTION METHOD, 2019 TO 2035 (USD Billions) BUTADIENE MARKET, BY PURITY LEVEL, 2025 (% SHARE) BUTADIENE MARKET, BY PURITY LEVEL, 2019 TO 2035 (USD Billions)

-

BUTADIENE MARKET, BY REGIONAL, 2019 TO 2035 (USD Billions)

Butadiene Market Segmentation

Butadiene Market By Application (USD Billion, 2019-2035)

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

Butadiene Market By End Use (USD Billion, 2019-2035)

- Automotive

- Footwear

- Textiles

- Consumer Goods

Butadiene Market By Production Method (USD Billion, 2019-2035)

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

Butadiene Market By Purity Level (USD Billion, 2019-2035)

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

Butadiene Market By Regional (USD Billion, 2019-2035)

- North America

- Europe

- South America

- Asia Pacific

- Middle East and Africa

Butadiene Market Regional Outlook (USD Billion, 2019-2035)

North America Outlook (USD Billion, 2019-2035)

North America Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

North America Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

North America Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

North America Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

North America Butadiene Market by Regional Type

- US

- Canada

- US Outlook (USD Billion, 2019-2035)

US Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

US Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

US Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

US Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- CANADA Outlook (USD Billion, 2019-2035)

CANADA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

CANADA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

CANADA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

CANADA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

Europe Outlook (USD Billion, 2019-2035)

Europe Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

Europe Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

Europe Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

Europe Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

Europe Butadiene Market by Regional Type

- Germany

- UK

- France

- Russia

- Italy

- Spain

- Rest of Europe

- GERMANY Outlook (USD Billion, 2019-2035)

GERMANY Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

GERMANY Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

GERMANY Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

GERMANY Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- UK Outlook (USD Billion, 2019-2035)

UK Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

UK Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

UK Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

UK Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- FRANCE Outlook (USD Billion, 2019-2035)

FRANCE Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

FRANCE Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

FRANCE Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

FRANCE Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- RUSSIA Outlook (USD Billion, 2019-2035)

RUSSIA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

RUSSIA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

RUSSIA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

RUSSIA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- ITALY Outlook (USD Billion, 2019-2035)

ITALY Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

ITALY Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

ITALY Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

ITALY Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- SPAIN Outlook (USD Billion, 2019-2035)

SPAIN Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

SPAIN Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

SPAIN Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

SPAIN Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- REST OF EUROPE Outlook (USD Billion, 2019-2035)

REST OF EUROPE Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

REST OF EUROPE Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

REST OF EUROPE Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

REST OF EUROPE Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

APAC Outlook (USD Billion, 2019-2035)

APAC Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

APAC Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

APAC Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

APAC Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

APAC Butadiene Market by Regional Type

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Indonesia

- Rest of APAC

- CHINA Outlook (USD Billion, 2019-2035)

CHINA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

CHINA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

CHINA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

CHINA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- INDIA Outlook (USD Billion, 2019-2035)

INDIA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

INDIA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

INDIA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

INDIA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- JAPAN Outlook (USD Billion, 2019-2035)

JAPAN Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

JAPAN Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

JAPAN Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

JAPAN Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- SOUTH KOREA Outlook (USD Billion, 2019-2035)

SOUTH KOREA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

SOUTH KOREA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

SOUTH KOREA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

SOUTH KOREA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- MALAYSIA Outlook (USD Billion, 2019-2035)

MALAYSIA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

MALAYSIA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

MALAYSIA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

MALAYSIA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- THAILAND Outlook (USD Billion, 2019-2035)

THAILAND Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

THAILAND Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

THAILAND Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

THAILAND Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- INDONESIA Outlook (USD Billion, 2019-2035)

INDONESIA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

INDONESIA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

INDONESIA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

INDONESIA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- REST OF APAC Outlook (USD Billion, 2019-2035)

REST OF APAC Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

REST OF APAC Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

REST OF APAC Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

REST OF APAC Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

South America Outlook (USD Billion, 2019-2035)

South America Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

South America Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

South America Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

South America Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

South America Butadiene Market by Regional Type

- Brazil

- Mexico

- Argentina

- Rest of South America

- BRAZIL Outlook (USD Billion, 2019-2035)

BRAZIL Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

BRAZIL Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

BRAZIL Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

BRAZIL Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- MEXICO Outlook (USD Billion, 2019-2035)

MEXICO Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

MEXICO Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

MEXICO Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

MEXICO Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- ARGENTINA Outlook (USD Billion, 2019-2035)

ARGENTINA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

ARGENTINA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

ARGENTINA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

ARGENTINA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- REST OF SOUTH AMERICA Outlook (USD Billion, 2019-2035)

REST OF SOUTH AMERICA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

REST OF SOUTH AMERICA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

REST OF SOUTH AMERICA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

REST OF SOUTH AMERICA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

MEA Outlook (USD Billion, 2019-2035)

MEA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

MEA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

MEA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

MEA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

MEA Butadiene Market by Regional Type

- GCC Countries

- South Africa

- Rest of MEA

- GCC COUNTRIES Outlook (USD Billion, 2019-2035)

GCC COUNTRIES Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

GCC COUNTRIES Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

GCC COUNTRIES Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

GCC COUNTRIES Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- SOUTH AFRICA Outlook (USD Billion, 2019-2035)

SOUTH AFRICA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

SOUTH AFRICA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

SOUTH AFRICA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

SOUTH AFRICA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

- REST OF MEA Outlook (USD Billion, 2019-2035)

REST OF MEA Butadiene Market by Application Type

- Synthetic Rubber

- Acrylonitrile Butadiene Styrene

- Butadiene Rubber

- Latex

REST OF MEA Butadiene Market by End Use Type

- Automotive

- Footwear

- Textiles

- Consumer Goods

REST OF MEA Butadiene Market by Production Method Type

- Steam Cracking

- Dehydrogenation

- Extraction

- Catalytic Cracking

REST OF MEA Butadiene Market by Purity Level Type

- Standard Butadiene

- High Purity Butadiene

- Technical Grade Butadiene

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment