Market Analysis

In-depth Analysis of Blood Grouping Reagents Market Industry Landscape

The surging demand for blood grouping diagnostics, coupled with population growth, has spurred the need for automated blood grouping devices. These fully automated systems boast the capacity to conduct numerous tests in a single operation, significantly enhancing productivity and efficiency within prescribed timelines. Operating on programmed protocols, these devices consistently execute test procedures with remarkable accuracy while effectively preventing sample contamination. Market players have introduced fully automated blood typing devices equipped with remote access features for heightened monitoring and result validation. These cutting-edge systems boast tailored features such as tube size and diameter recognition, integrated quality control programs, random sample positioning, real-time updates on reagent and sample status, and high-definition color result displays, among other advanced functionalities.

Key industry players like Grifols, S.A., and Informa Plc offer a diverse range of fully automated blood grouping devices renowned for their accuracy and efficiency in blood testing. Grifols, S.A., for instance, offers products like the Erytra Automated System for Blood Typing, Erytra Eflexis Automated System for Blood Typing, and Wadiana Automated System for Blood Typing. Additionally, these blood typing devices are available in various sizes—small, medium, and large—to cater to a spectrum of commercial applications.

The integration of sophisticated features and diverse size offerings in these automated blood grouping devices is anticipated to drive growth within the blood grouping reagents market in the foreseeable future. The convergence of precision, efficiency, and versatility in these systems aligns with the evolving demands of the healthcare landscape, catering to the diverse needs of medical facilities and laboratories. As the need for accurate and high-throughput blood typing continues to rise, the adoption of fully automated devices is poised to play a pivotal role in meeting these burgeoning demands, facilitating streamlined and accurate blood testing procedures.

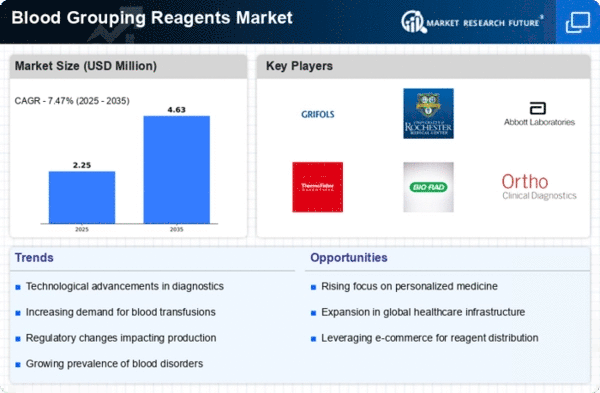

The global blood grouping reagents market is experiencing notable growth, attributed to rising instances of hereditary disorders and heightened exposure to chemical toxins and radioactive materials. The market's value chain analysis delineates four pivotal components: research and development coupled with product designing, manufacturing, distribution and sales, and post-sales review.

The first link in this value chain is research and development alongside product designing, serving as the foundational phase for innovation and creation within the market. This phase involves extensive research endeavors aimed at designing advanced blood grouping reagents tailored to meet evolving healthcare needs.

Subsequently, the manufacturing phase is pivotal in translating the designed products into tangible solutions. This stage encompasses the actual production of blood grouping reagents, ensuring they adhere to quality standards and specifications established during the design phase.

Following manufacturing, the distribution and sales segment come into play, facilitating the dissemination of these reagents to healthcare facilities, laboratories, and other end-users. This phase involves logistics, marketing, and sales efforts to make these products accessible across diverse geographical regions.

Leave a Comment