Summary Overview

MRO Mining Market Overview

The global MRO (Maintenance, Repair, and Overhaul) Mining market is currently experiencing robust growth, driven by increasing demand from various industrial sectors such as construction, mining operations, green building materials, and sustainable packaging. This market encompasses a wide range of products crucial for the operational efficiency and longevity of mining and extraction activities, including engineered mining products, specialized timber, and MRO Mining materials designed for structural integrity, operational safety, and environmental sustainability in industrial applications.

Our report provides a detailed analysis of procurement trends within the MRO Mining sector, focusing on cost control, supplier diversification, and the adoption of digital technologies to enhance efficiency across maintenance operations, equipment servicing, storage facilities, and transportation networks. Emerging challenges in MRO Mining procurement include volatile raw material prices (especially for key components like steel, machinery parts, and critical consumables), ensuring supply chain resilience in the face of global disruptions, and adhering to increasingly stringent environmental regulations, safety standards, and industry certifications.

To stay competitive, companies are employing strategic sourcing methods, leveraging blockchain technology to improve supply chain transparency, utilizing AI-driven predictive maintenance and demand forecasting tools, and adopting real-time market intelligence platforms to optimize procurement decisions. As global demand for mining services and related equipment rises, businesses are prioritizing risk management, end-to-end supply chain visibility, and securing reliable, high-quality MRO Mining materials to meet the evolving technical, safety, and regulatory demands of the industry.

Market Size: The global MRO Mining market is projected to reach USD 601.9 billion by 2035, growing at a CAGR of approximately 3.7% from 2025 to 2035.

Growth Rate: 3.7%

-

Sector Contributions: Growth in the market is driven by: -

Rising Demand for Mining Equipment and Services: The increasing demand for MRO services in the mining sector is driven by the need to sustain operations in both residential and commercial mining projects.

-

Industrial Expansion: Expanded mining operations and the adoption of advanced machinery, automation, and technologies, driving the need for specialized services to equipment failure.

-

Technological Transformation: Advancements in MRO Mining processing technologies, including digitalization, are enhancing operational efficiency, minimizing operational costs in mining facilities.

-

Product Innovation: Development of durable mining tools, high-performance materials, and specialized consumables. Advances in smart mining equipment, wear-resistant materials.

-

Investment Initiatives: Leading companies are investing in advanced research, investing in research and development (R&D) to create more efficient mining tools and solutions.

-

Regional Insights: North America & Asia-Pacific remain key regions for MRO Mining, construction growth, increased adoption of advanced technology in mining services.

Key Trends and Sustainability Outlook:

-

Digital Integration: The industry is rapidly adopting technologies like IoT, and AI to track equipment conditions, improve maintenance schedule.

-

Sustainability Focus: A Efforts to minimize energy consumption during repairs, recycling parts, and promoting eco-friendly lubricants and materials.

-

Customer-Centric MRO Solution: Service providers are adopting tailored maintenance plans, responsive delivery schedules, and remote monitoring services to align with customer needs.

-

Smart Inventory Management: Accurate demand forecasting and predictive analytics ensure better planning and resource allocation, minimizing operational disruptions.

Growth Drivers:

-

Sector Expansion: The growing demand for mining resources, global infrastructure projects, is driving the need for more efficient MRO services in the mining industry.

-

Customer Experience Expectations: Increasing demand for faster, more reliable, and more transparent options with new advance technology.

-

Sustainability Goals: The pressure to adopt environmentally friendly practices is shaping the services landscape, with many providers focusing on sustainable methods.

-

Technological Advancements: Adoption of new technologies, such as automation, AI, and IoT, is improving MRO Mining efficiency and helping companies stay competitive.

Overview of Market Intelligence Services for the MRO Mining Market:

Recent analyses have identified key challenges such as rising shipping costs, changing consumer expectations, and fluctuating demand. Market intelligence services provide actionable insights that help companies optimize their logistics procurement strategies, identify cost-saving opportunities, and enhance supply chain resilience. These insights also support companies in complying with regulations and maintaining high standards of service while managing costs effectively.

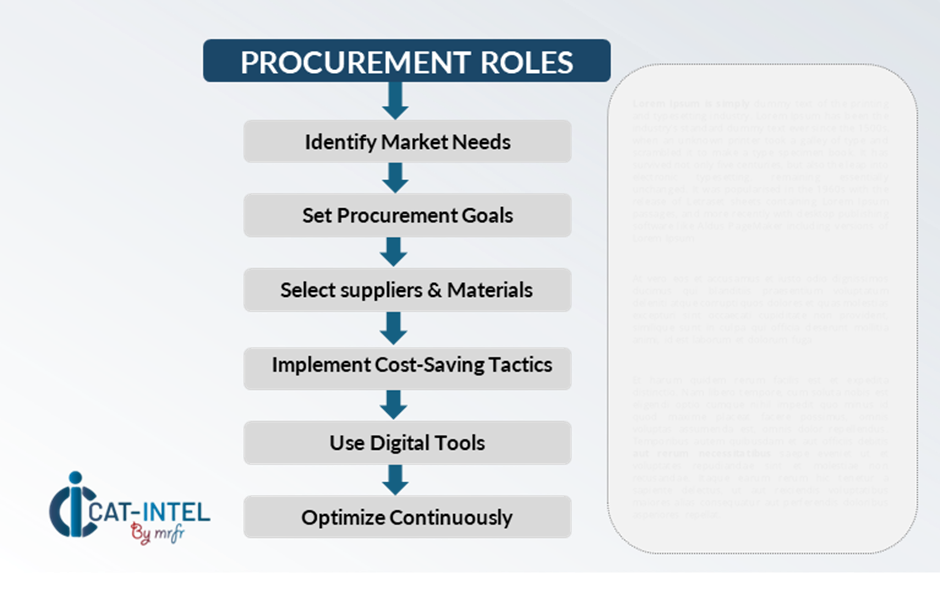

Procurement Intelligence for MRO Mining: Category Management and Strategic Sourcing

To stay competitive in the MRO Mining market, companies are streamlining their procurement processes using spend analysis and supplier performance tracking. Effective category management and strategic sourcing are essential for reducing procurement costs and ensuring consistent, high-quality service delivery. By leveraging market intelligence, businesses can refine their procurement strategies and negotiate favourable terms for logistics services, ensuring timely delivery and customer satisfaction while optimizing costs.

Pricing Outlook for MRO Mining: Spend Analysis

The pricing outlook for MRO Mining is expected to remain dynamic, influenced by various factors that affect both operational and service delivery costs. Key drivers of pricing trends include fluctuations in fuel and transportation expenses, labor costs, technological advancements in automation, and increasing demands for faster delivery times. Additionally, the rising need for sustainable packaging solutions and carbon-neutral delivery services is contributing to cost pressures.

Efforts to optimize procurement processes, improve supplier relationships, and adopt advanced technology solutions are crucial for managing costs effectively. Leveraging digital tools for real-time monitoring, route optimization, and inventory management can further enhance cost efficiency.

Partnering with reliable logistics service providers, negotiating long-term contracts, and streamlining operational workflows are essential strategies to maintain cost control in the e-commerce logistics sector. Despite these challenges, maintaining high service standards, reducing delivery times, and investing in automation will be key to sustaining profitability.

Cost Breakdown for MRO Mining: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

-

Equipment Maintenance (45%)

-

Description: The largest cost in MRO Mining comes from Equipment Maintenance. -

Trends: The adoption of new technology and autonomous systems is helping companies reduce labour costs and enhance efficiency.

- Spare Parts (XX%)

- Productivity Losses (XX%)

-

Operational Costs (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the MRO Mining industry, optimizing procurement processes and utilizing effective negotiation tactics can drive significant cost savings while enhancing service efficiency. Key strategies for achieving cost reductions include establishing long-term partnerships with logistics service providers, particularly in strategic regions, to secure better pricing, volume discounts, and more favorable terms for shipping and delivery.

Negotiation levers such as bulk purchasing, consolidating shipments, and securing forward contracts can help mitigate the effects of fluctuating transportation costs and supply chain disruptions. Companies can also negotiate for flexible delivery schedules or volume-based pricing that supports both operational needs and cost control.

Working with logistics providers that emphasize sustainability, and operational innovation can offer additional benefits, including access to eco-friendly delivery options and cost savings driven by improved efficiency in routing and warehouse management.

Supply and Demand Overview for MRO Mining: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The MRO Mining market is experiencing accelerated growth, driven by increasing demand from sectors such as construction, energy, transportation, and industrial mining applications. Balancing supply and demand in this sector require close attention to efficient resource management, effective logistics, evolving regulatory landscapes, and the integration of advanced technologies like automation, predictive maintenance, and digital tracking systems. These advancements help improve equipment uptime, streamline maintenance operations, and enhance the overall efficiency of mining processes, while also meeting sustainability goals and reducing environmental impact.

Demand Factors:

-

Mining and Infrastructure Growth: The global expansion of mining operations, increasing infrastructure development, is driving demand for MRO services in the mining sector. -

Advanced Mining Technology: Use of advanced mining technologies, such as precision drilling, and extraction equipment, the demand for high-quality MRO services is rising. -

Sustainability Initiatives: Buyers are increasingly prioritizing MRO Mining sourced from prioritizing environmentally sustainable practices, MRO services that support sustainability. -

Customization Requirements: Different industries require equipment needs, such as tailored maintenance schedules, specialized parts, and unique repair techniques for heavy machinery and equipment.

Supply Factors:

-

Transportation Infrastructure: The availability and efficiency of transportation networks, including road, rail, and air freight, significantly influence the supply of logistics services. -

Technological Advancements: Integration of AI, IoT, and automation in warehouse management, route optimization, and fleet management is improving the reliability and cost-effectiveness of services. -

Global Trade and Regulatory Challenges: Global trade policies, mining equipment regulations, and environmental restrictions on mining activities can influence the availability of raw materials and spare parts necessary for MRO services. -

Labor Availability: The availability of skilled labor is a key factor influencing the MRO mining market. The industry relies on specialized workers for equipment maintenance, repair, and quality control.

Regional Demand-Supply Outlook: MRO Mining

North America: Dominance in MRO Mining

Region is expected to dominate the MRO Mining market, driven by strong demand from the mining, construction, and infrastructure sectors. The United States plays a critical role in global MRO Mining dynamics, with its increasing investment in mining operations, including the extraction of critical minerals and resources. The growing demand for mining equipment maintenance, repair, and overhaul services, coupled with substantial infrastructure development, significantly influences global supply chains and MRO service providers.

-

High Production Capacity and Infrastructure: Strong industrial zones and port infrastructure enable enable the efficient supply and distribution of MRO services and parts to global mining operations..

-

Technological Integration: The adoption of automation in milling, combined with AI-powered inventory and logistics systems, is enhancing operational efficiency and enabling real-time visibility.

-

Industry Growth: The expansion of mining activities, driven by rising demand for minerals and resources, is increasing the need for MRO services.

-

Sustainability Focus: Industry leaders in MRO mining are increasingly adopting sustainable practices, including eco-friendly repair materials, energy-efficient maintenance solutions

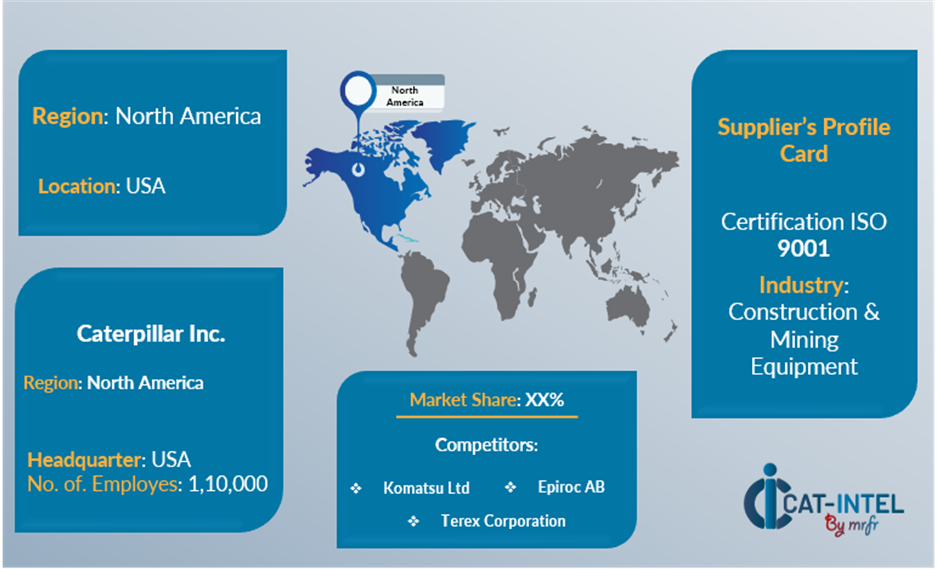

Supplier Landscape: Supplier Negotiations and Strategies

The supplier ecosystem for MRO Mining is diverse and highly competitive, comprising global manufacturers of mining equipment, regional service providers, and specialized suppliers of spare parts and maintenance solutions. These suppliers play a critical role in influencing key market aspects such as pricing, product quality, customization capabilities, and delivery reliability for mining operations.

The MRO Mining supply chain also relies heavily on logistics and distribution partners to ensure the timely and efficient delivery of maintenance parts, machinery components, and tools to mining sites. Major logistics firms provide end-to-end solutions, including bulk equipment transport, storage, and international trade facilitation, while smaller, specialized operators focus on last-mile delivery, equipment calibration, spare part storage, and environmentally sustainable packaging and handling practices for mining-specific MRO products.

Key suppliers in the MRO Mining market include

- Caterpillar Inc.

- Komatsu Ltd

- Sandvik Mining and Rock Solutions

- Volvo Construction Equipment

- Liebherr Group

- Epiroc AB

- Hitachi Construction Machinery

- Komatsu Mining Corp

- Terex Corporation

- Wirtgen Group

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The MRO Mining market is driven by expanding mining operations, technological advancements, and increasing demand for equipment reliability and operational efficiency. |

Sustainability Focus |

There is a growing emphasis focus industry through the adoption of eco-friendly maintenance practices, energy-efficient equipment, and the use of sustainable materials in repairs and parts replacement, all aimed at reducing the environmental impact of mining operations. |

Product Innovation |

Market Focuses on advanced technologies like AI, automation, and durable materials to improve equipment efficiency, longevity, and reduce operational downtime. |

Technological Advancements |

The new technology include the integration of AI, IoT, automation, and predictive maintenance tools to optimize equipment performance, reduce downtime, and enhance operational efficiency. |

Global Trade Dynamics |

MRO mining market are influenced by fluctuating commodity prices, international supply chain disruptions, and evolving regulations, affecting the availability and cost of mining equipment, spare parts, and maintenance services. |

Customization Trends |

Market focus on tailored maintenance solutions, bespoke spare parts, and specialized services designed to meet the unique needs of different mining operations, improving efficiency and reducing downtime. |

|

MRO Mining Attribute/Metric |

Details |

Market Sizing |

The global MRO Mining market is projected to reach USD 601.9 billion by 2035, growing at a CAGR of approximately 3.7% from 2025 to 2035. |

MRO Mining Technology Adoption Rate |

Around 50% of companies are adopting advanced technologies like AI, machine learning, and IoT for route optimization. |

Top MRO Mining Industry Strategies for 2025 |

Key strategies include digital transformation, focusing on sustainability, leveraging advanced analytics, enhancing supply chain resilience, and offering customized solutions for improved efficiency and reliability. |

MRO Mining Process Automation |

Approximately 45% of companies have implemented automation advanced technologies like AI, IoT, and robotics to automate maintenance tasks, monitor equipment health, predict failures. |

MRO Mining Process Challenges |

Equipment downtime, supply chain disruptions, skilled labor shortages, high maintenance costs, and the complexity of integrating advanced technologies like AI and automation into existing mining operations. |

Key Suppliers |

Leading players in the market include Caterpillar Inc, Komatsu Ltd, Sandvik, Mining and Rock Solutions, Volvo Construction Equipment, Liebherr Group. |

Key Regions Covered |

Prominent regions include North America, Asia-Pacific and Europe, driven by the growing sector and technological advancements. |

Market Drivers and Trends |

Increasing demand for mineral resources, advancements in automation and predictive maintenance technologies. |