Summary Overview

Lumber Market Overview

The global lumber market is experiencing robust growth, driven by increasing demand from sectors such as construction, furniture manufacturing, green building materials, and sustainable packaging. This market encompasses a broad network of suppliers and producers offering a wide range of engineered wood products, treated timber, and specialty lumber grades that are essential for structural integrity, design precision, and environmental performance in modern industrial and residential applications.

Our report provides a detailed analysis of procurement trends within the lumber sector, with a strong focus on cost control, supplier diversification, and the adoption of digital technologies to improve efficiency across milling operations, storage facilities, transportation networks, and broader supply chain ecosystems. Emerging challenges in lumber procurement include fluctuating raw material prices (particularly for softwood and hardwood logs), ensuring the resilience of supply chains amid global disruptions, and complying with increasingly stringent environmental regulations and forest certification standards across different markets.

To maintain competitiveness, companies are implementing strategic sourcing approaches, investing in blockchain for supply chain transparency, utilizing AI-powered demand forecasting tools, and leveraging real-time market intelligence platforms to fine-tune their purchasing strategies. As global demand for lumber intensifies, businesses are also placing greater emphasis on risk mitigation, end-to-end supply visibility, and securing a reliable supply of high-quality, sustainably sourced lumber that aligns with evolving structural, aesthetic, and regulatory requirements.

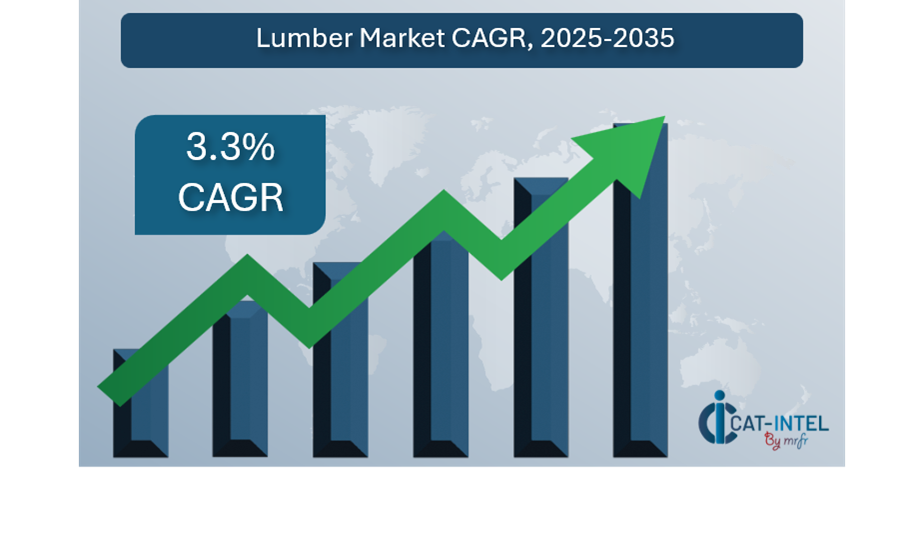

Market Size: The global Lumber market is projected to reach USD 480 billion by 2035, growing at a CAGR of approximately 3.3% from 2025 to 2035.

Growth Rate: 3.3%

-

Sector Contributions: Growth in the market is driven by: -

Rising Demand for Construction: Rising Lumber demand, particularly for residential and commercial construction, framing, flooring, roofing, and structural elements.

-

Industrial Expansion: The use of specialty lumber in applications such as precision equipment, machinery, and advanced manufacturing processes.

-

Technological Transformation: Advancements in lumber processing technologies, including digitalization, are enhancing operational efficiency, and reducing waste in lumber production.

-

Product Innovation: Development of engineered wood products, smart wood treatments, and sustainable alternatives to traditional lumber and reduce environmental impact.

-

Investment Initiatives: Leading companies are investing in advanced research, AI-driven quality control systems, and sustainable production technologies.

-

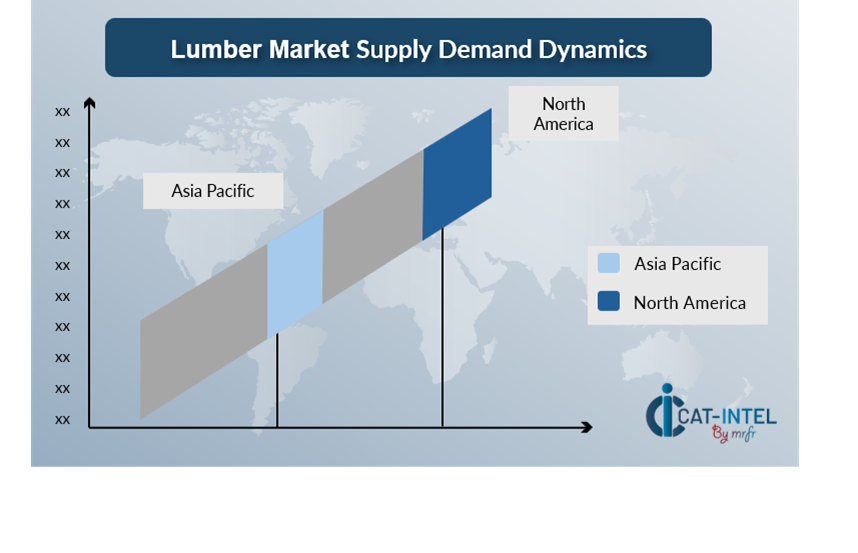

Regional Insights: Asia-Pacific & North America remain key regions for Lumber, construction growth, increased adoption of engineered wood products.

Key Trends and Sustainability Outlook:

-

Digital Integration: The industry is rapidly adopting technologies like IoT, and AI to track wood sourcing, enhance inventory management, and improve product quality.

-

Sustainability Focus: A shift toward responsible sourcing, reducing deforestation, promoting certified forestry practices, and developing eco-friendly products like cross-laminated timber.

-

Customer-Centric Delivery Models: As customer expectations rise, companies are adopting flexible delivery schedules and more personalized solutions.

-

Smart Inventory: Real-time data to optimize stock levels, reduce waste, and enhance supply chain efficiency, ensuring timely deliveries and accurate demand forecasting.

Growth Drivers:

-

Sector Expansion: The increasing demand for construction and housing is driving the need for more efficient lumber production and distribution services.

-

Customer Experience Expectations: Increasing demand for faster, more reliable, and more transparent options with new advance technology.

-

Sustainability Goals: The pressure to adopt environmentally friendly practices is shaping the services landscape, with many providers focusing on sustainable methods.

-

Technological Advancements: Adoption of new technologies, such as automation, AI, and IoT, is improving Lumber efficiency and helping companies stay competitive.

Overview of Market Intelligence Services for the Lumber Market:

Recent analyses have identified key challenges such as rising shipping costs, changing consumer expectations, and fluctuating demand. Market intelligence services provide actionable insights that help companies optimize their logistics procurement strategies, identify cost-saving opportunities, and enhance supply chain resilience. These insights also support companies in complying with regulations and maintaining high standards of service while managing costs effectively.

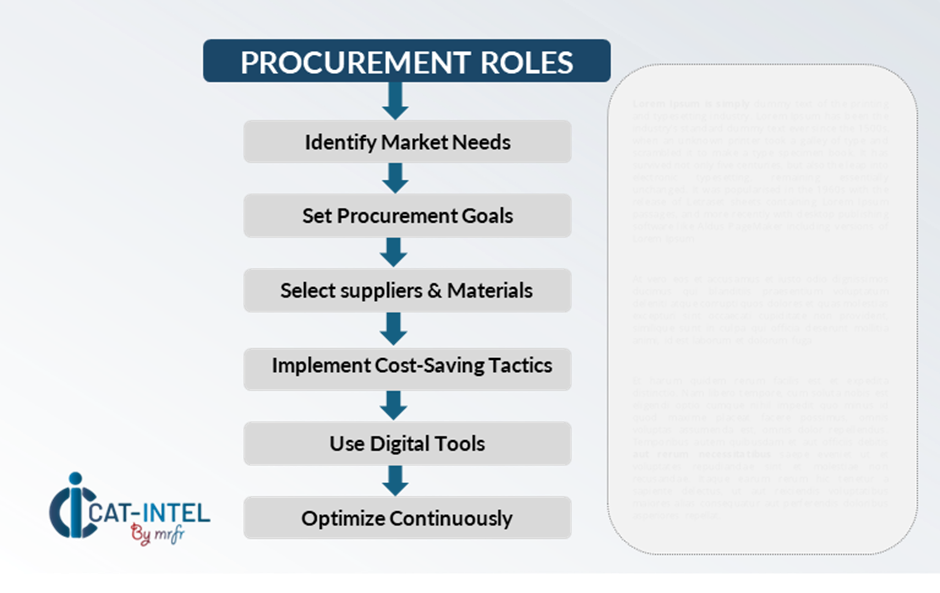

Procurement Intelligence for Lumber: Category Management and Strategic Sourcing

To stay competitive in the Lumber market, companies are streamlining their procurement processes using spend analysis and supplier performance tracking. Effective category management and strategic sourcing are essential for reducing procurement costs and ensuring consistent, high-quality service delivery. By leveraging market intelligence, businesses can refine their procurement strategies and negotiate favourable terms for logistics services, ensuring timely delivery and customer satisfaction while optimizing costs.

Pricing Outlook for Lumber: Spend Analysis

The pricing outlook for Lumber is expected to remain dynamic, influenced by various factors that affect both operational and service delivery costs. Key drivers of pricing trends include fluctuations in fuel and transportation expenses, labor costs, technological advancements in automation, and increasing demands for faster delivery times. Additionally, the rising need for sustainable packaging solutions and carbon-neutral delivery services is contributing to cost pressures.

Efforts to optimize procurement processes, improve supplier relationships, and adopt advanced technology solutions are crucial for managing costs effectively. Leveraging digital tools for real-time monitoring, route optimization, and inventory management can further enhance cost efficiency.

Partnering with reliable logistics service providers, negotiating long-term contracts, and streamlining operational workflows are essential strategies to maintain cost control in the e-commerce logistics sector. Despite these challenges, maintaining high service standards, reducing delivery times, and investing in automation will be key to sustaining profitability.

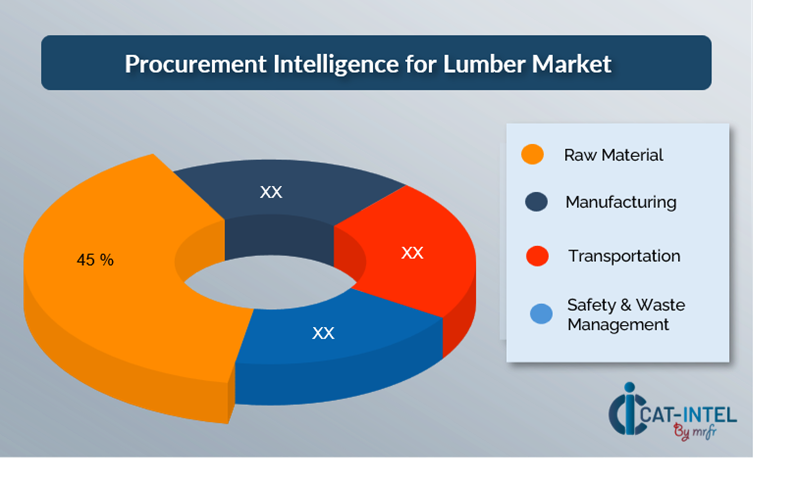

Cost Breakdown for Lumber: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

-

Raw Material (45%)

-

Description: The largest cost in Lumber comes from Raw material. -

Trends: The adoption of new technology and autonomous systems is helping companies reduce labour costs and enhance efficiency.

- Manufacturing (XX%)

- Transportation (XX%)

- Safety & Waste Management (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Lumber industry, optimizing procurement processes and utilizing effective negotiation tactics can drive significant cost savings while enhancing service efficiency. Key strategies for achieving cost reductions include establishing long-term partnerships with logistics service providers, particularly in strategic regions, to secure better pricing, volume discounts, and more favorable terms for shipping and delivery.

Negotiation levers such as bulk purchasing, consolidating shipments, and securing forward contracts can help mitigate the effects of fluctuating transportation costs and supply chain disruptions. Companies can also negotiate for flexible delivery schedules or volume-based pricing that supports both operational needs and cost control.

Working with logistics providers that emphasize sustainability, and operational innovation can offer additional benefits, including access to eco-friendly delivery options and cost savings driven by improved efficiency in routing and warehouse management.

Supply and Demand Overview for Lumber: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lumber market is experiencing accelerated growth, driven by increasing demand from sectors such as construction, furniture, packaging, and engineered wood applications. Balancing supply and demand in this sector requires close attention to sustainable forest resource management, efficient logistics, evolving regulatory landscapes, and the integration of advanced technologies like automation and digital tracking systems..

Demand Factors:

-

Construction and Infrastructure Growth: The global rise in residential, commercial, and infrastructure development is driving demand for structural lumber and engineered wood products. -

Advanced Manufacturing: The expansion of industries using precision wood components, such as furniture and modular construction, is boosting the need for high-quality. -

Sustainability Initiatives: Buyers are increasingly prioritizing lumber sourced from certified sustainable forests, low-carbon production processes. -

Customization Requirements: Different industries require including specific dimensions, finishes, moisture content, and treatment protocols.

Supply Factors:

-

Transportation Infrastructure: The availability and efficiency of transportation networks, including road, rail, and air freight, significantly influence the supply of logistics services. -

Technological Advancements: Integration of AI, IoT, and automation in warehouse management, route optimization, and fleet management is improving the reliability and cost-effectiveness of services. -

Global Trade and Regulatory Challenges: International trade policies, forestry regulations, and environmental restrictions on logging and exports can limit raw material availability and influence global supply dynamics. -

Labor Availability: The lumber industry depends on skilled workers for harvesting, milling, and quality control shortages in specialized labor can disrupt supply and slow production.

Regional Demand-Supply Outlook: Lumber

North America: Dominance in Lumber

Region is expected to dominate the lumber market, driven by strong demand from the construction and housing sectors, along with increasing use of engineered wood in commercial projects. The United States plays a critical role in global lumber dynamics, with its growing residential development and infrastructure investments significantly influencing global supply chains

-

High Production Capacity and Infrastructure: Strong industrial zones and port infrastructure enable the efficient global lumber and engineered wood products.

-

Technological Integration: The adoption of automation in milling, combined with AI-powered inventory and logistics systems, is enhancing operational efficiency and enabling real-time visibility.

-

Retail Growth: The expansion of e-commerce platforms and the growth of DIY home improvement and construction markets are increasing demand for consumer-ready lumber products.

-

Sustainability Focus: Industry leaders are increasingly adopting green logistics practices, such as deploying electric delivery fleets, low-emission warehouse operations.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier ecosystem for lumber is diverse and highly competitive, comprising global producers, regional sawmills, and specialized providers of engineered and treated wood products. These suppliers play a crucial role in influencing key market aspects such as pricing, product quality, customization capabilities, and delivery reliability.

The lumber supply chain also relies heavily on logistics and distribution partners to ensure the timely and compliant movement of wood products. Major logistics firms offer end-to-end solutions—including bulk timber transport, storage, and international trade facilitation—while smaller, specialized operators handle last-mile delivery, moisture-controlled storage, and sustainable packaging for retail-ready lumber.

Key suppliers in the Lumber market include:

- Weyerhaeuser Company

- West Fraser Timber Co. Ltd.

- Interfor Corporation

- Canfor Corporation

- Georgia-Pacific LLC

- Sierra Pacific Industries

- Hampton Affiliates

- Idaho Forest Group

- PotlatchDeltic Corporation

- Biewer Lumber

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The Lumber market is expanding rapidly due to the increasing volume of construction, Furniture, building materials particularly in emerging markets. |

Sustainability Focus |

There is a growing emphasis focus centers on responsible forest management, certified wood sourcing, carbon footprint reduction, and increased use of eco-friendly, renewable timber products. |

Product Innovation |

Advancements in engineered wood, sustainable treatments, and modular construction components designed for strength, efficiency, and environmental performance. |

Technological Advancements |

The new technology include automation in sawmilling, AI-driven inventory management, IoT-enabled tracking, and digital platforms enhancing efficiency, precision, and sustainability across the supply chain. |

Global Trade Dynamics |

Lumber market are shaped by shifting demand from emerging markets, trade tariffs, export restrictions, and supply chain disruptions, all influencing pricing, availability, and cross-border lumber flows. |

Customization Trends |

Market focus on tailored dimensions, finishes, and engineered wood solutions to meet specific architectural, structural, and sustainability requirements.. |

|

Lumber Attribute/Metric |

Details |

Market Sizing |

The global Lumber market is projected to reach USD 480 billion by 2035, growing at a CAGR of approximately 3.3% from 2025 to 2035. |

Lumber Technology Adoption Rate |

Around 50% of companies are adopting advanced technologies like AI, machine learning, and IoT for route optimization. |

Top Lumber Industry Strategies for 2025 |

Key strategies include investing in sustainable forestry, expanding engineered wood production, embracing digital supply chains, and enhancing global market reach. |

Lumber Process Automation |

Approximately 45% of companies have implemented automation in warehousing, sorting, and packaging to enhance efficiency and reduce costs. |

Lumber Process Challenges |

Maintaining formulation stability, managing raw material variability, meeting stringent environmental regulations, ensuring consistent quality, and optimizing production efficiency at scale. |

Key Suppliers |

Leading players in the market include Weyerhaeuser Company, West Fraser, Timber Co. Ltd., Interfor Corporation, Canfor Corporation, Georgia-Pacific LLC. |

Key Regions Covered |

Prominent regions include, North America, Asia-Pacific and Europe, driven by the growing sector and technological advancements. |

Market Drivers and Trends |

Rising construction demand, sustainable building practices, growth in engineered wood, and increased automation across the supply chain.. |