Summary Overview

Lithium And Organometallic Compounds Market Overview

The global Lithium and Organometallic Compounds market is experiencing substantial growth, driven by rising demand across sectors such as electric vehicles, energy storage, pharmaceuticals, and advanced electronics. This market encompasses a diverse range of suppliers and manufacturers offering high-purity lithium products and organometallic reagents essential for catalysis, battery production, and chemical synthesis. Our report provides a comprehensive analysis of procurement trends, with a focus on cost optimization strategies and the adoption of digital technologies to streamline production, distribution, and supply chain operations.

Key future challenges in Lithium and Organometallic Compounds procurement include managing fluctuating raw material prices, ensuring the stability of global supply chains, and meeting stringent quality and regulatory requirements. Companies are increasingly leveraging digital tools and strategic sourcing to enhance supply chain transparency, improve efficiency, and maintain competitive advantage. As global demand continues to surge, businesses are utilizing advanced market intelligence to mitigate risks, respond to market volatility, and ensure consistent, high-quality supply.

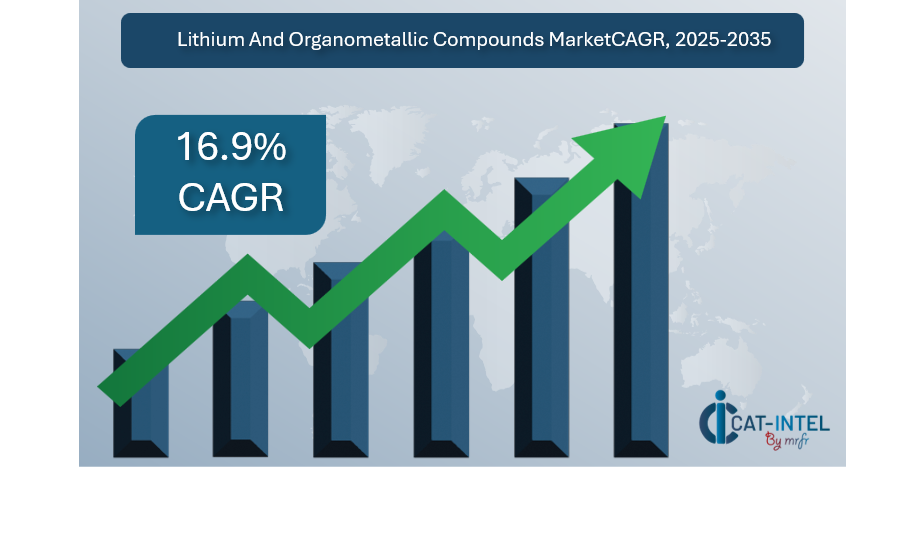

Market Size: The global Lithium and Organometallic Compounds market is projected to reach USD 33.5 billion by 2035, growing at a CAGR of approximately 16.9% from 2025 to 2035.

Growth Rate: 16.9%

Sector Contributions: Growth in the market is driven by:

Rising Demand for Advanced Energy Solutions: The rapid adoption of electric vehicles (EVs) is fueling the demand for lithium-based compounds and organometallic reagents.

Industrial and Pharmaceutical Expansion: Industries are increasingly utilizing organometallic compounds in catalysts, synthesis processes, and specialty chemical production.

Technological Transformation: Advancements in lithium extraction methods and organometallic synthesis processes are enhancing efficiency, yield, and environmental sustainability.

Product Innovation: The integration of automated processing lines is reducing contamination risks, and boosting output in production facilities handling sensitive lithium and organometallic materials.

Investment Initiatives: Leading companies are investing in advanced research, AI-driven quality control systems, and sustainable production technologies.

Regional Insights: Asia-Pacific & North America remain key regions for Lithium and Organometallic Compounds, with increasing adoption of automation technologies.

Key Trends and Sustainability Outlook

Digital Integration: The lithium organometallic market is increasingly embracing digitalization and automation—especially in synthesis, quality control, and logistics.

Sustainability Focus: A shift toward greener synthesis routes, reducing reliance on toxic solvents or heavy metals.

Customer-Centric Delivery Models: As customer expectations rise, companies are adopting flexible delivery schedules and more personalized solutions.

Smart Inventory: Predict customer demand based on industry cycles (e.g., automotive battery production, semiconductor trends).

Growth Drivers

Sector Expansion: The growing volume of electric vehicles is driving demand for efficient services.

Customer Experience Expectations: Increasing demand for faster, more reliable, and more transparent delivery options.

Sustainability Goals: The pressure to adopt environmentally friendly practices is shaping the services landscape, with many providers focusing on sustainable delivery methods.

Technological Advancements: Adoption of new technologies, such as automation, AI, and IoT, is improving logistics efficiency and helping companies stay competitive.

Overview of Market Intelligence Services for the Lithium And Organometallic Compounds Market

Recent analyses have identified key challenges such as rising shipping costs, changing consumer expectations, and fluctuating demand. Market intelligence services provide actionable insights that help companies optimize their logistics procurement strategies, identify cost-saving opportunities, and enhance supply chain resilience. These insights also support companies in complying with regulations and maintaining high standards of service while managing costs effectively.

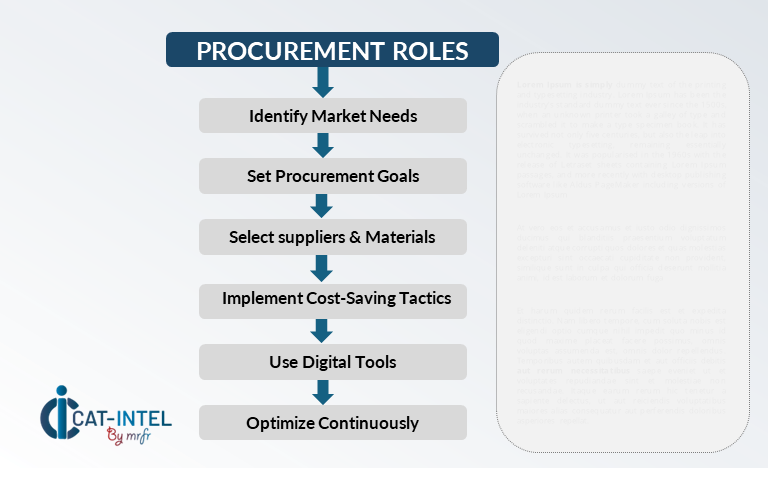

Procurement Intelligence for Lithium And Organometallic Compounds: Category Management and Strategic Sourcing

To stay competitive in the Lithium and Organometallic Compounds market, companies are streamlining their procurement processes using spend analysis and supplier performance tracking. Effective category management and strategic sourcing are essential for reducing procurement costs and ensuring consistent, high-quality service delivery. By leveraging market intelligence, businesses can refine their procurement strategies and negotiate favourable terms for logistics services, ensuring timely delivery and customer satisfaction while optimizing costs.

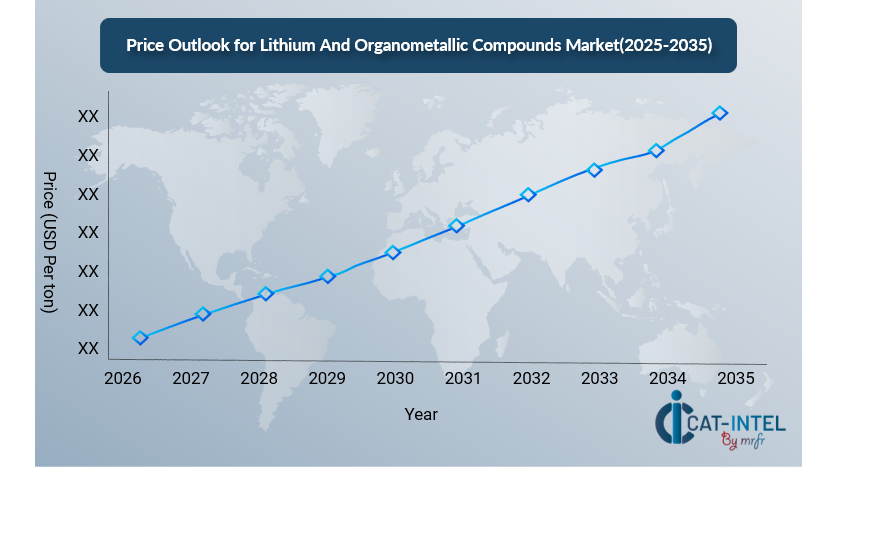

Pricing Outlook for Lithium And Organometallic Compounds: Spend Analysis

The pricing outlook for Lithium and Organometallic Compounds is expected to remain dynamic, influenced by various factors that affect both operational and service delivery costs. Key drivers of pricing trends include fluctuations in fuel and transportation expenses, labor costs, technological advancements in automation, and increasing demands for faster delivery times. Additionally, the rising need for sustainable packaging solutions and carbon-neutral delivery services is contributing to cost pressures.

Efforts to optimize procurement processes, improve supplier relationships, and adopt advanced technology solutions are crucial for managing costs effectively. Leveraging digital tools for real-time monitoring, route optimization, and inventory management can further enhance cost efficiency.Partnering with reliable logistics service providers, negotiating long-term contracts, and streamlining operational workflows are essential strategies to maintain cost control in the e-commerce logistics sector. Despite these challenges, maintaining high service standards, reducing delivery times, and investing in automation will be key to sustaining profitability.

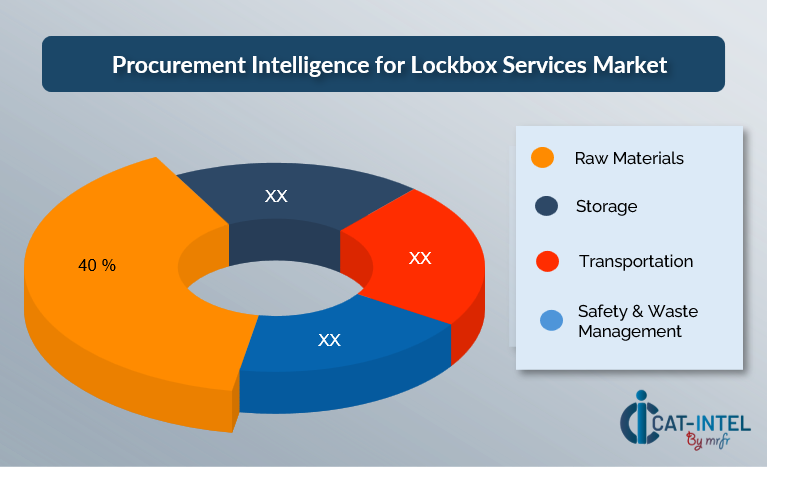

Cost Breakdown for Lithium And Organometallic Compounds: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Raw Materials (45%)

Description: The largest cost in Lithium And Organometallic Compounds comes from raw materials.

Trends: The adoption of new technology and autonomous systems is helping companies reduce labour costs and enhance efficiency.

Storage (XX%)

Transportation (XX%)

Safety & Waste Management (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Lithium And Organometallic Compounds industry, optimizing procurement processes and utilizing effective negotiation tactics can drive significant cost savings while enhancing service efficiency. Key strategies for achieving cost reductions include establishing long-term partnerships with logistics service providers, particularly in strategic regions, to secure better pricing, volume discounts, and more favorable terms for shipping and delivery.

Negotiation levers such as bulk purchasing, consolidating shipments, and securing forward contracts can help mitigate the effects of fluctuating transportation costs and supply chain disruptions. Companies can also negotiate for flexible delivery schedules or volume-based pricing that supports both operational needs and cost control.

Working with logistics providers that emphasize sustainability, and operational innovation can offer additional benefits, including access to eco-friendly delivery options and cost savings driven by improved efficiency in routing and warehouse management.

Supply and Demand Overview for Lithium And Organometallic Compounds: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The lithium and organometallic compounds market is experiencing accelerated growth, driven by increasing demand from sectors such as electric vehicles (EVs), energy storage, electronics, pharmaceuticals, and advanced materials. Balancing supply and demand in this sector requires close attention to material availability, logistics efficiency, regulatory landscapes, and technological advancements.

Demand Factors:

EV and Energy Storage Expansion: Lithium-based compounds are essential for lithium-ion and next-generation batteries, and semiconductor production.

Advanced Manufacturing & Pharma: Organometallic reagents play a critical role in fine chemical synthesis, active pharmaceutical ingredients (APIs) materials.

Sustainability Initiatives: Buyers are increasingly favoring suppliers that align with green chemistry practices, low-carbon lithium sourcing, and responsible waste management.

Customization Requirements: Different industries require tailored formulations, custom solvent systems, or special handling protocols.

Supply Factors:

Transportation Infrastructure: The availability and efficiency of transportation networks, including road, rail, and air freight, significantly influence the supply of logistics services.

Technological Advancements: Integration of AI, IoT, and automation in warehouse management, route optimization, and fleet management is improving the reliability and cost-effectiveness of services.

Global Trade and Regulatory Challenges: Lithium and organometallics are subject to stringent safety. Varying international standards can complicate global supply.

Labor Availability: The production and distribution of reactive organometallic compounds require specialized technical expertise.

Asia Pacific: Dominance in Lithium and Organometallic Compounds

The region is expected to dominate the lithium market, driven by rapid EV adoption and energy storage solutions. China's increasing demand is a significant factor influencing global supply chains.

High Production Capacity and Infrastructure: Lithium mining and refining. Robust industrial zones and port networks enable efficient export of lithium concentrates and refined lithium products to global markets.

Technological Integration: Integration of automation in lithium extraction and refining processes, combined with AI-driven logistics platforms, improves throughput and real-time supply chain visibility.

E-commerce and Retail Growth: The growth of e-mobility and portable electronics, fueled by e-commerce trends, increases downstream demand for lithium-ion batteries.

Sustainability Focus: Environmentally conscious logistics practices like using EV fleets for lithium transport and low-emission port operations.

Supplier Landscape: Supplier Negotiations and Strategies

The supplier landscape for Lithium and Organometallic Compounds is diverse and competitive, comprising a range of global logistics providers, regional experts, and specialized service firms. These suppliers play a crucial role in determining factors like pricing, service quality, delivery speed, and technological innovation. The e-commerce logistics industry includes major logistics companies offering comprehensive global and regional solutions, while smaller, niche players focus on specific services such as last-mile delivery, temperature-controlled shipping, and sustainable packaging solutions.

As demand continues to grow, especially due to the rise in the increasing need for faster delivery, logistics service providers are enhancing their service offerings, investing in technological advancements, and expanding their network capabilities. The focus on sustainability and cost efficiency is also driving the adoption of eco-friendly logistics solutions and the use of automation in warehousing and transportation.

Key suppliers in the Lithium and Organometallic Compounds market include:

FMC Corporation

Ganfeng Lithium Group Co.

Lithium Americas Corp.

Albemarle Corporation

Orocobre Limited Pty Ltd

Neometals Ltd

SQM SA

Nemaska Lithium

Livent

China Lithium Products Technology

Key Developments Procurement Category Significant Development

Significant Development |

Description |

Market Growth |

The Lithium And Organometallic Compounds market is expanding rapidly due to the increasing volume of batteries, particularly in emerging markets. |

Sustainability Focus |

There is a growing emphasis on environmentally friendly services, with an increasing demand for recyclable packaging, electric vehicles, and carbon-neutral shipping methods. |

Product Innovation |

To meet surging demand from EV and electronics manufacturers, logistics firms are deploying same-day delivery solutions near gigafactories and assembly lines.

|

Technological Advancements |

AI-powered route optimization is slashing delivery times from extraction sites to processing plants. IoT-enabled containers track humidity and movement to ensure safe transit of lithium compounds. |

Global Trade Dynamics |

Trade tensions or tariff changes significantly impact shipping costs and lead times, making flexible logistics strategies a competitive necessity. |

Customization Trends |

Battery manufacturers are demanding just-in-time delivery with customizable packaging, especially for solid-state lithium materials and lithium-ion modules. |

|

Lithium And Organometallic Compounds Attribute/Metric |

Details |

Market Sizing |

The global Lithium and Organometallic Compounds market is projected to reach USD 33.5 billion by 2035, growing at a CAGR of approximately 16.9% from 2025 to 2035.

|

Lithium And Organometallic Compounds Technology Adoption Rate |

Around 50% of companies are adopting advanced technologies like AI, machine learning, and IoT for route optimization and real-time tracking.

|

Top Lithium and Organometallic Compounds Industry Strategies for 2025 |

Key strategies include expanding last-mile delivery capabilities, integrating sustainable practices, and enhancing supply chain automation. |

Lithium And Organometallic Compounds Process Automation |

Approximately 45% of companies have implemented automation in warehousing, sorting, and packaging to enhance efficiency and reduce costs. |

Lithium And Organometallic Compounds Process Challenges |

Major challenges include managing last-mile delivery costs, meeting consumer expectations for fast delivery, and navigating complex global supply chains. |

Key Suppliers |

Leading players in the market include FMC Corporation, Ganfeng Lithium Group Co., Lithium Americas Corp., Albemarle Corporation, Orocobre Limited Pvt Ltd

|

Key Regions Covered |

Prominent regions include, Asia-Pacific, North America and Europe, driven by the growing sector and technological advancements.

|

Market Drivers and Trends |

Growth is driven by the rise of Massive growth in EV production globally is driving demand for lithium-ion batteries. |