Summary Overview

Iron Ore Market Overview

The worldwide iron ore market is growing steadily, driven by increasing demand in major sectors such as building, manufacturing, and steel production. This market encompasses a wide range of iron ore products, from high-grade to low-grade ores, with a rising emphasis on more sustainable and efficient mining processes. Our paper provides a detailed examination of upcoming trends, with an emphasis on cost-cutting initiatives and the use of modern technology to expedite manufacturing and distribution operations.

Key future difficulties for the iron ore market include controlling volatile commodity prices, guaranteeing sustainable mining techniques, and mitigating the environmental impact of extraction activities. Advanced technology and strategic sourcing are essential for increasing operating efficiency, minimizing risks, and remaining competitive in a changing global market. As demand grows, businesses are using market information to enhance operations and stay ahead of industry changes.

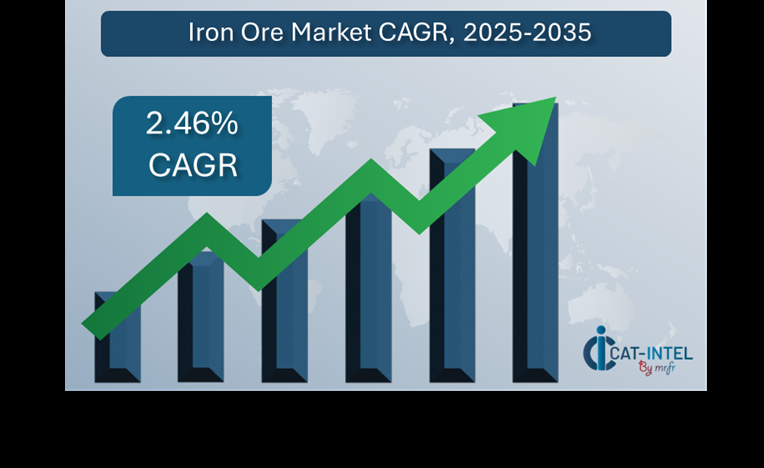

Market Size: The global Iron Ore market is projected to reach USD 493.6 billion by 2035, growing at a CAGR of approximately 2.46% from 2025 to 2035.

Sector Contributions: Growth in the market is driven by:

Manufacturing and Supply Chain Optimization: The global iron ore market is placing a greater emphasis on real-time data integration and process optimization to streamline production and distribution.

Growth in the Steel and Construction Sectors: With continued infrastructure development and industrial growth, demand for steel remains strong, resulting in large increases in iron ore consumption.

Technological Advancements: Automation, artificial intelligence (AI), and machine learning are transforming the global iron ore industry.

Innovations: Modular mining systems and sophisticated ore-processing procedures, which allow enterprises to collect and treat iron ore more efficiently.

Investment Initiatives: Major participants in the iron ore sector are investing in technology that promote sustainability, such as renewable energy for mining operations and carbon capture systems.

Regional Insights: Asia-Pacific and North America continue to dominate the global iron ore market, thanks to significant infrastructural investments and the use of modern mining technology.

Key Trends and Sustainability Outlook:

Sustainability and Environmental Compliance: There is an increased emphasis on lowering the carbon footprint of iron ore extraction and processing.

Technology Advancements: AI, the Internet of Things (IoT), and blockchain are being incorporated into iron ore supply chains to increase transparency, automate procedures, and improve real-time decision-making.

Customized Solutions: Iron ore providers are focused on customised offerings for industries such as steel production and construction, addressing specific regional issues and requirements.

Data-Driven Decision: Advanced analytics are altering the global iron ore business, enabling corporations to estimate demand and enhance pricing tactics.

Growth Drivers:

Growing Urbanization: Urbanization in developing economies, combined with infrastructural development, increasing the demand for steel and, by extension, iron ore.

Automation in Mining Operations: With the growing use of automated machinery and smart mining processes, iron ore extraction is becoming more efficient.

Global Steel Demand: Global commerce continues to have an impact on the iron ore market, with steel consumption increasing in key industrial economies.

Regulatory Compliance: Iron ore producers are investing in cleaner technology to meet these demands while also enhancing resource extraction efficiency.

Scalability and Flexibility: In an increasingly competitive global context, iron ore producers are looking for ways to increase capacity, adjust to regional market demands, and optimize their operations for efficiency and profitability.

Overview of Market Intelligence Services for the Iron Ore Market:

Recent investigations have highlighted substantial issues in the iron ore market, including as price volatility and the necessity for efficient resource management. Market intelligence reports contain practical data that help businesses uncover cost-cutting possibilities, manage supplier relationships, and improve supply chain efficiency. These insights are critical for complying with industry rules, maintaining high-quality production standards, and successfully controlling costs.

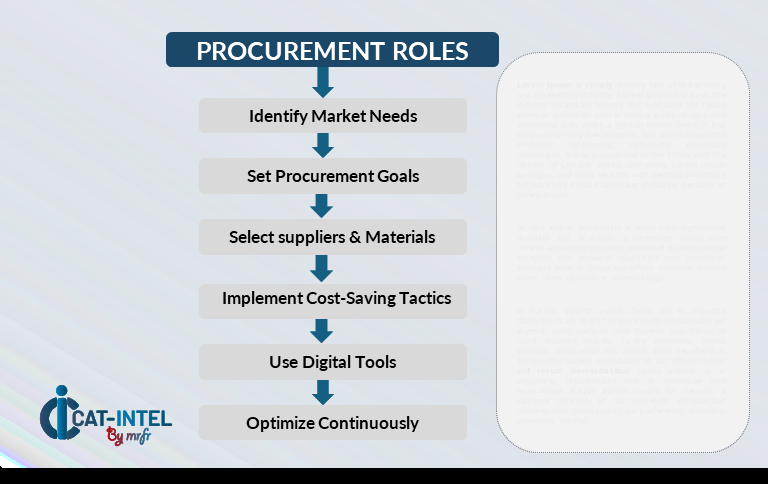

Procurement Intelligence for Iron Ore: Category Management and Strategic Sourcing

To remain competitive in the iron ore market, organizations are improving procurement strategies through rigorous spend monitoring and supplier performance tracking. Strategic category management and effectiveness sourcing is critical for lowering procurement costs and maintaining a continuous supply of high-quality iron ore. Companies may use market intelligence to optimize procurement decisions, negotiate better terms with suppliers, and increase their overall supply chain resilience.

Pricing Outlook for Iron Ore: Spend Analysis

The price outlook for iron ore is projected to remain moderately variable, impacted by a variety of market conditions. Global demand trends, supply chain interruptions, mining technological breakthroughs, and regional pricing variances are all key drivers of these changes. The growing emphasis on sustainability, combined with stronger environmental restrictions and more demand from emerging countries, is anticipated to drive up iron ore prices.

Graph shows general upward trend pricing for Iron Ore and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

Efforts to streamline procurement processes, strengthen supplier relationships, and diversify sourcing tactics are crucial for cost management. The use of digital tools for real-time market monitoring, price forecasting using advanced analytics, and effective contract management can considerably improve cost efficiency.

Partnering with dependable suppliers, negotiating long-term contracts, and investigating flexible pricing methods are all effective strategies for controlling iron ore costs. Despite these obstacles, focusing on supply chain resilience, guaranteeing quality consistency, and adopting technology improvements in mining and transportation will be critical to sustaining cost-effectiveness and operational excellence in the iron ore sector.

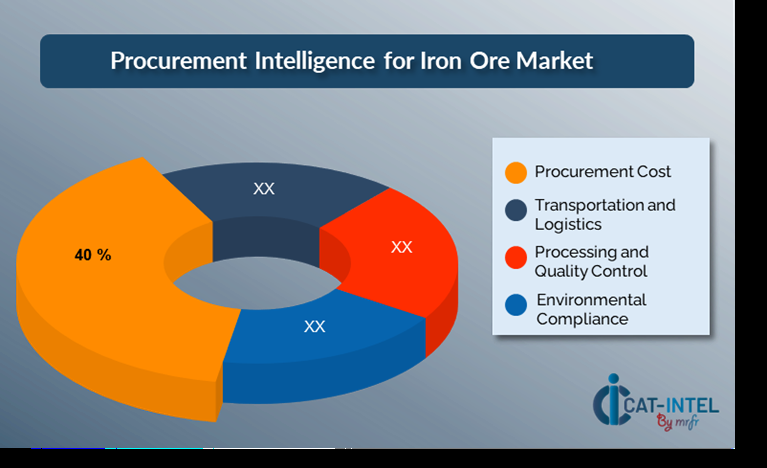

Cost Breakdown for Iron Ore: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Procurement Cost: (40%)

Description: Procurement expenses are the direct purchase price of iron ore from the supplier. Ore quality and regional price disparities are important considerations

Trend: Long-term contracts and fixed-price agreements are becoming increasingly popular for managing volatility and ensuring pricing certainty.

Transportation and Logistics: (XX%)

Processing and Quality Control: (XX%)

Environmental Compliance: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the iron ore sector, streamlining procurement processes and using strategic bargaining strategies can result in significant cost savings and improved supply chain efficiency. Long-term relationships with dependable iron ore suppliers, particularly those that provide flexible pricing models and constant supply capabilities, can lead to more attractive pricing arrangements. Volume-based discounts and bundled service packages can also help businesses get better deals, mitigating the impact of pricing swings over time.

Multi-year contracts and flexible pricing structures can provide chances to lock in competitive rates while protecting firms from price increases. Partnering with suppliers who promote innovation in logistics, mining technology, and environmental practices can result in additional benefits, such as lower operational costs and more effective resource extraction. Companies that diversify their suppliers and use a multi-vendor method can reduce their reliance on a single provider, reduce risks such as supply disruptions, and increase their bargaining power.

Supply and Demand Overview for Iron Ore: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The iron ore market is also witnessing continual variations, which are caused by several variables influencing both supply and demand dynamics. These include technology developments in mining and logistics, evolving global trade patterns, and macroeconomic situations.

Demand Factors:

Infrastructure and Construction Growth: Rising global demand for infrastructure development, particularly in emerging nations, is increasing demand for iron ore, a vital component of steel production.

Steel Production Need: The need for steel in industries such as automotive, construction, and manufacturing continues to drive iron ore consumption, with oscillations linked to economic cycles.

Technological Advances: Innovations such as electric arc furnaces and green steel production processes are pushing demand for higher-quality iron ore, potentially increasing the need for specific grades.

Sustainability Efforts: Increased pressure to minimize carbon emissions is driving industries to pursue greener options, which may affect demand patterns for more sustainable iron ore production technologies.

Supply Factors:

Technological Innovations: New mining technologies, such as automation and AI-driven exploration approaches, are enhancing iron ore extraction efficiency, lowering prices, and expanding supply.

Global Supply Chain Dynamics: Trade policies, geopolitical conflicts, and regional supply interruptions (such as those in key exporting countries like Brazil and Australia) all have a substantial impact on iron ore availability and pricing.

Labor and Environmental Standards: Compliance with increasingly demanding labor and environmental standards can have an impact on supply, either by increasing operational costs or limiting mining operations.

Scale and Efficiency: Larger, more efficient mines with better processing capabilities are helping to reduce costs and enhance total iron ore supply, but small-scale companies may struggle to compete.

Regional Demand-Supply Outlook: Iron Ore

The Image shows growing demand for Iron Ore in both North America and Asia Pacific, with potential price increases and increased Competition.

Asia Pacific: Dominance in the Iron Ore Market

Asia Pacific, particularly China, is a dominant force in the global Iron Ore market due to several key factors:

High Steel Demand: Asia-Pacific, particularly China and India, is the world's largest consumer of steel, owing to massive infrastructure development, industrialization, and urbanization.

Leading Producers: The region's substantial iron ore reserves, and extensive mining infrastructure make it the primary source of iron ore exports.

Manufacturing Hub: Asia-Pacific is the global manufacturing hub, with countries such as China, Japan, and South Korea producing a wide range of items, including vehicles and electronics.

Geopolitical Proximity: With shorter shipping durations and lower transportation costs, the region is very efficient in terms of iron ore trading.

Infrastructure Development: Rapid economic expansion in countries necessitates considerable amounts of steel, increasing the demand for iron ore.

Asia Pacific Remains a key hub, Iron Ore Price Drivers Innovation and Growth

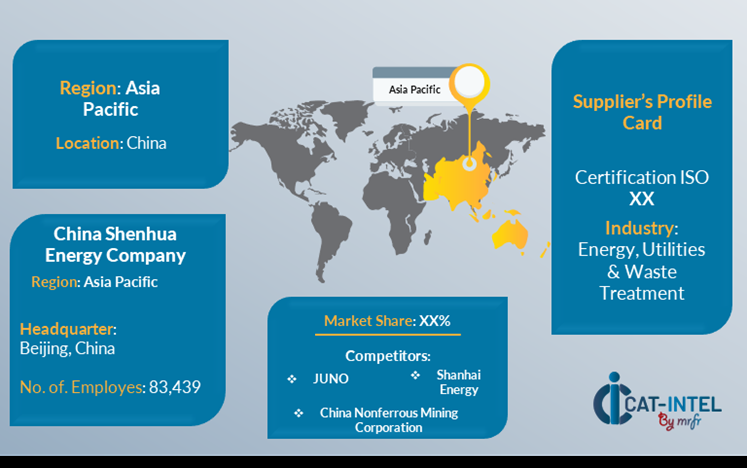

Supplier Landscape: Supplier Negotiations and Strategies

The supplier environment in the iron ore industry is both diversified and competitive, with a combination of global mining behemoths and regional producers affecting market dynamics. These suppliers play an important role in determining pricing, ore quality, and delivery reliability. The market is dominated by well-established mining corporations that provide large-scale production and continuous supply, but smaller, niche producers may concentrate on specialty goods like high-grade iron ore or ores suitable for specific steelmaking processes.

The iron ore supplier ecosystem spans key mining regions such as Australia, Brazil, and Africa, and includes both major global suppliers and localized firms that cater to specific market needs. As demand for iron ore rises, providers are developing extraction technology, expanding logistical capacities, and optimizing production processes to suit the changing needs of steel producers.

Key Suppliers in the Iron Ore Market Include:

China Shenhua Energy Company

Vale SA

Rio Tinto Group

BHP Group

Fortescue Metals Group Limited

Anglo American PLC

ArcelorMittal

China Northern Rare Earth Group High-Tech Co., Ltd.

Cleveland-Cliffs, Inc.

Minas-Rio

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The iron ore market is expanding rapidly, driven by rising demand for steel in the infrastructure, manufacturing, and construction sectors, particularly in emerging regions where urbanization and industrialization are accelerating.

|

Cloud Adoption |

As iron ore suppliers and steel producers increasingly turn to digital solutions, cloud-based platforms for real-time tracking, logistics optimization, and supply chain management are becoming more popular as a way to improve efficiency and save operational costs.

|

Product Innovation |

Iron ore companies are using modern technologies such as AI-powered predictive maintenance, IoT-enabled sensors for real-time monitoring, and mining process automation to improve production efficiency, quality, and safety.

|

Technological Advancements |

Machine learning algorithms are used to estimate mineral grade, optimize extraction procedures, and automate sorting. Furthermore, robotics and drones are increasingly being used in mining operations to improve exploration and operational efficiency.

|

Global Trade Dynamics |

Changes in global trade restrictions, tariffs, and geopolitical conflicts are influencing iron ore pricing and supply, particularly for large-scale international purchasers. |

Customization Trends |

Suppliers are providing more customized items. Furthermore, variable logistics solutions, such as specialized transportation techniques, are becoming increasingly important in meeting the diverse needs of various markets.

|

|

Iron Ore Attribute/Metric |

Details |

Market Sizing |

The global Iron Ore market is projected to reach USD 493.6 billion by 2035, growing at a CAGR of approximately 2.46% from 2025 to 2035.

|

Iron Ore Technology Adoption Rate |

Approximately 75% of steel makers worldwide rely on iron ore as their major raw material, with considerable movements toward procuring higher-quality iron ore to meet stricter environmental and efficiency demands in steel manufacturing.

|

Top Iron Ore Industry Strategies for 2025 |

Key tactics include optimizing extraction methods utilizing automation and artificial intelligence, focusing on sustainable mining practices, diversifying supply chains to reduce risks, and harnessing real-time data for inventory and logistics management.

|

Iron Ore Process Automation |

To improve productivity and minimize operational costs, around 45% of iron ore producers have automated processes such as ore sorting, material processing, and transportation.

|

Iron Ore Process Challenges |

Major problems include fluctuating worldwide prices, environmental laws, labor shortages, and logistical constraints that impede the timely delivery of iron ore to steel factories.

|

Key Suppliers |

China Shenhua Energy Company, Vale SA and Rio Tinto Group are the world's largest iron ore producers, while smaller regional competitors supply niche markets with specialized ore varieties.

|

Key Regions Covered |

Asia Pacific and North America are major producers and consumers of iron ore, with significant demand being driven by infrastructure development.

|

Market Drivers and Trends |

Rising demand for steel in the building, automotive, and manufacturing sectors, technological breakthroughs in mining, a greater emphasis on sustainability, and the expansion of infrastructure projects in emerging regions all contribute to growth.

|