Summary Overview

Industrial Supply, Hardware & Fasteners Product Categories Market Overview:

The global market for Industrial Supply, Hardware, and Fasteners goods is steadily expanding, driven by rising demand in industries such as manufacturing, construction, automotive, and logistics. This market includes a wide range of products such as mechanical components, fastening solutions, and industrial hardware that are critical for maintaining and optimizing production and operating efficiency. Our research includes a thorough examination of procurement trends, emphasizing cost-cutting methods as well as the use of sophisticated technologies to streamline sourcing and procurement procedures.

Key future procurement difficulties for this sector include managing pricing variations, guaranteeing product availability and supply chain resilience, and maintaining high quality control standards. Furthermore, linking inventory management systems with real-time demand forecasting and incorporating digital technologies for better procurement decisions will be vital for staying competitive. Strategic sourcing, combined with efficient supplier relationship management, will be key to achieving long-term growth and operational success.

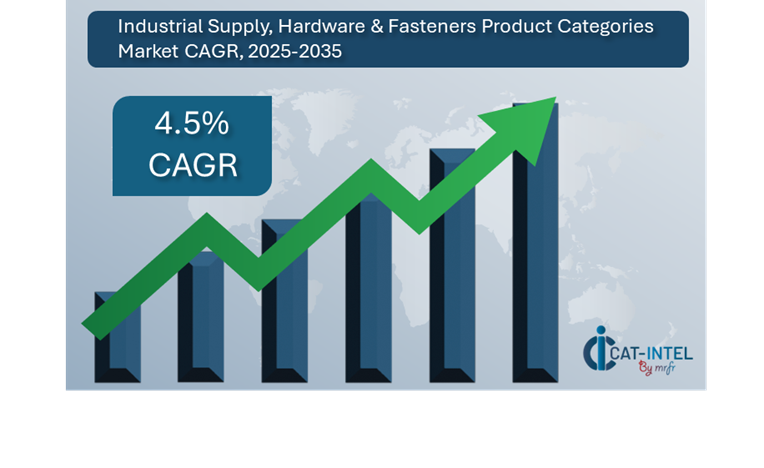

Market Size: The global Industrial Supply, Hardware & Fasteners Product Categories market is projected to reach USD 1350.2 billion by 2035, growing at a CAGR of approximately 4.5% from 2025 to 2035.

Manufacturing and Supply Chain Optimization: Businesses are working on increasing supply chain visibility, boosting logistics, and assuring material coordination for manufacturing operations.

Retail and E-Commerce Growth: The rise of the retail industry, including e-commerce platforms, is increasing need for more sophisticated inventory management, demand forecasting, and improved customer relationship management (CRM).

Technological Transformation: Advances in artificial intelligence (AI) and machine learning are improving supply chain and procurement procedures, allowing for predictive analytics and better inventory management.

Innovations: Modular supply chain solutions are gaining traction, allowing industrial companies to pick and integrate only the features they require.

Investment Initiatives: As businesses strive to reduce infrastructure costs, there is a growing preference for cloud-based systems for inventory and supply chain management.

Regional Insights: North America and Asia Pacific continue to dominate the market, owing to robust digital infrastructures and rising usage of cloud-based solutions.

Key Trends and Sustainability Outlook:

Cloud Integration: Businesses are increasingly using cloud-based solutions to improve scalability, cost efficiency, and accessibility, as well as to promote cross-regional collaboration, which is critical for managing industrial supply chains.

Advanced Features: Integrating AI, IoT, and blockchain into industrial supply management solutions improves decision-making, automation, and transparency.

Focus on Sustainability: As environmental concerns rise; businesses are turning to innovative supply chain and procurement systems that enable more effective resource management.

Customization Trends: Tailored solutions for certain industries, such as construction, automotive, and manufacturing, are becoming increasingly crucial.

Data-Driven Insights: Real-time analytics and predictive tools are changing the way businesses forecast demand, optimize inventory levels, and monitor supply chain performance.

Growth Drivers:

Digital Transformation: Automation, AI-powered technologies, and improved data integration are assisting organizations in the industrial supply and hardware sectors to improve operational efficiency.

Demand for Process Automation: As businesses look to optimize their operations, the need for automated solutions to manage regular procurement and inventory processes is increasing.

Scalability Needs: With expanding global demand for industrial supplies, enterprises require adaptable solutions that interface seamlessly with existing systems.

Regulatory Compliance: As the industrial sector faces increased regulatory pressure, organizations are investing in technologies that ensure industry standards are met.

Globalization: As the industrial supply and hardware sectors grow globally, there is a greater demand for systems that can meet multi-currency, multi-language, and international compliance requirements.

Overview of Market Intelligence Services for the Industrial Supply, Hardware & Fasteners Product Categories Market:

Recent research has identified numerous important problems in the Industrial Supply, Hardware, and Fasteners sector, including the need for effective cost control and system customization. Market intelligence studies offer useful insights into procurement opportunities, assisting firms in identifying cost-cutting measures, optimizing supplier relationships, and ensuring efficient procurement procedures. These insights are also critical in fulfilling industry standards, maintaining operational efficiency, and successfully managing expenses while assuring high-quality results in supply chain management.

Procurement Intelligence for Industrial Supply, Hardware & Fasteners Product Categories: Category Management and Strategic Sourcing

Companies in the industrial supply and hardware sectors are increasingly streamlining their procurement operations with strong category management and strategic sourcing. Businesses may improve supplier relationships, lower procurement costs, and maintain consistent access to high-quality materials and goods by reviewing expenditure data and tracking vendor performance. Leveraging actionable market intelligence enables businesses to fine-tune their procurement strategy, allowing them to negotiate better terms with suppliers and make educated decisions that improve cost efficiency and product quality.

Pricing Outlook for Industrial Supply, Hardware & Fasteners Product Categories: Spend Analysis

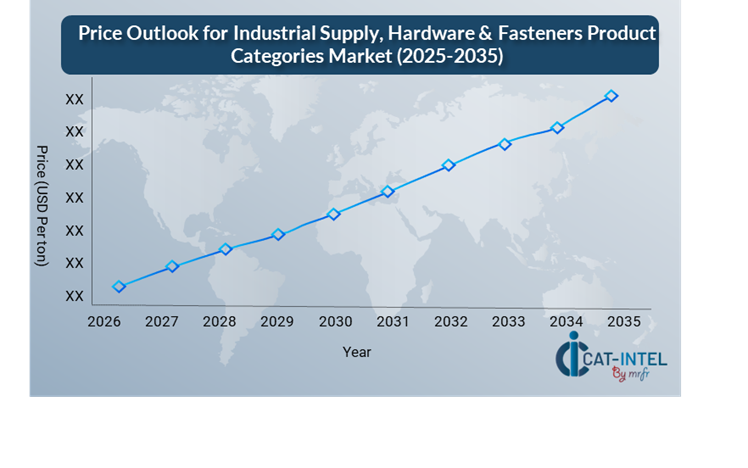

The pricing forecast for the Industrial Supply, Hardware, and Fasteners market is likely to be moderately dynamic, affected by a variety of factors including technological improvements, desire for efficient and automated solutions, customisation requirements, and regional pricing variances.

Graph shows general upward trend pricing for Industrial Supply, Hardware & Fasteners Product Categories and growing demand. However, there may be fluctuations influenced by economic conditions, technological advancements, and competitive dynamic.

To minimize costs and remain competitive, businesses must optimize procurement procedures and improve vendor management tactics. Adopting modular supply chain solutions that are suited to individual requirements can help eliminate wasteful costs and streamline processes. Furthermore, using digital tools for market monitoring, price forecasting with advanced analytics, and efficient contract administration would allow businesses to analyse price trends and negotiate better terms with suppliers.Strategic alliances with dependable suppliers, researching bulk or multi-year procurement agreements, and employing subscription-based models for ongoing supply are critical ways for cost management. Despite the obstacles created by growing prices, focusing on scalability, keeping high-quality standards, and using innovative solutions such as cloud-based platforms or automation tools will be crucial in maintaining operational excellence and cost efficiency in the long term.

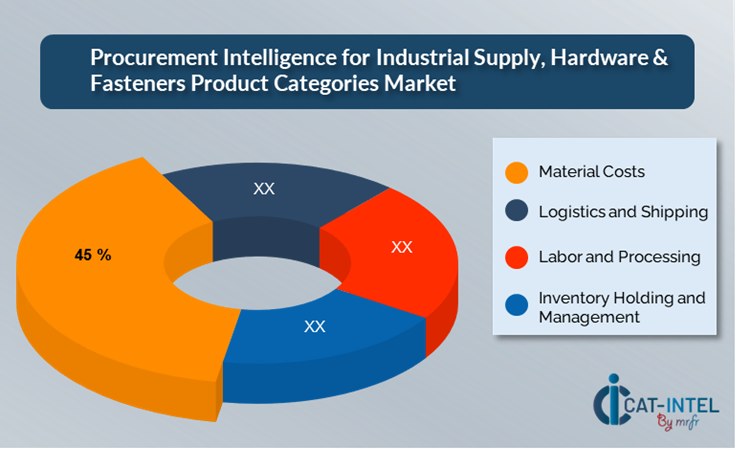

Cost Breakdown for Industrial Supply, Hardware & Fasteners Product Categories: Total Cost of Ownership (TCO) and Cost-Saving Opportunities

Material Cost: (45%)

Description: This covers the cost of raw materials like steel, aluminium, and other metals that are used to make hardware, fasteners, and industrial supplies.

Trend: Global supply chain disruptions and rising raw material prices, caused by causes such as geopolitical conflicts and natural resource scarcity, are driving material costs upward.

Logistics and Shipping: (XX%)

Labor and Processing: (XX%)

Inventory Holding and Management: (XX%)

Cost-Saving Opportunities: Negotiation Levers and Purchasing Negotiation Strategies

In the Industrial Supply, Hardware, and Fasteners business, managing procurement processes and utilizing strategic negotiation methods are critical for achieving considerable cost savings and boosting operational efficiency. Long-term collaborations with dependable suppliers, particularly those offering new technologies or modular solutions, might result in more advantageous price structures and terms, such as volume-based discounts, bundled service packages, or shorter lead times.

Collaborating with suppliers who value innovation, scalability, and technology adoption provides major long-term benefits, including access to more efficient processes, enhanced forecasting tools, and predictive analytics. These capabilities not only lower operational expenses but also boost inventory management and overall supply chain efficiency. Furthermore, modular solutions enable firms to select and integrate exactly the products or services they require, thereby optimizing spending.

Supply and Demand Overview for Industrial Supply, Hardware & Fasteners Product Categories: Demand-Supply Dynamics and Buyer Intelligence for Effective Supplier Relationship Management (SRM)

The Industrial Supply, Hardware, and Fasteners market is steadily expanding, fuelled by technological developments and rising need for operational efficiency and process optimization. Technological advancements, industry-specific customized requirements, and overall economic conditions all have an impact on supply and demand dynamics in this market.

Demand Factors:

Digital Transformation Initiatives: The growing push for digitalization across industries is creating a demand for more complex tools and solutions to centralize data management, automate operations, and increase supply chain visibility.

Cloud Adoption Trends: As more firms adopt cloud-based technologies, the demand for scalable and adaptable procurement solutions grows.

Industry-Specific Requirements: Manufacturing, construction, and automotive industries all require highly personalized solutions that address specific operational needs, regulatory standards, and supply chain workflows.

Integration Capabilities: The growing need for seamless connection with other company software, such as inventory management systems, ERP solutions, and IoT devices, is driving demand for advanced, linked industrial supply solutions.

Supply Factors:

Technological Advancements: AI, IoT, and automation innovations are altering the industrial supply landscape, enhancing everything from inventory tracking to demand forecasting, benefiting the whole supply chain

Vendor Ecosystem: As the number of industrial suppliers grows, from huge multinationals to specialized companies, firms' options expand and competition in the marketplace increases.

Global Economic Factors: Exchange rate fluctuations, labour prices, and regional technology adoption all have an impact on the cost and lead time of industrial supply goods, necessitating that organizations be up to date on global economic trends.

Scalability and Flexibility: Modern industrial supply solutions are becoming more modular, allowing providers to serve a wide spectrum of customers, from small firms to major corporations.

Regional Demand-Supply Outlook: Industrial Supply, Hardware & Fasteners Product Categories

The Image shows growing demand for Industrial Supply, Hardware & Fasteners Product Categories in both North America and Asia Pacific, with potential price increases and increased Competition.

North America: Dominance in the Industrial Supply, Hardware & Fasteners Product Categories Market

North America, particularly the United States, is a dominant force in the global Industrial Supply, Hardware & Fasteners Product Categories market due to several key factors:

Advanced Manufacturing Base: North America has a well-established industrial infrastructure, including a sizable manufacturing sector that requires a steady supply of hardware, fasteners, and industrial supplier

Technological Advancements: North America is at the forefront of technological innovation, particularly in automation, robotics, and advanced manufacturing, which drives demand for specialist industrial supplies and fasteners.

Strong Supplier Ecosystem: North America is home to a number of major suppliers and manufacturers of industrial supplies, hardware, and fasteners. The extensive supplier ecosystem promotes market stability and competitiveness.

Increased Focus on Sustainability: North American businesses are prioritizing sustainability and operational efficiency, advocating for more durable and environmentally friendly materials in their industrial supply chains.

High Investment in Construction Projects: The expansion of public and private sector projects, such as roads, bridges, and commercial buildings, contributes greatly to regional market growth.

North America Remains a key hub Industrial Supply, Hardware & Fasteners Product Categories Price Drivers Innovation and Growth.

Supplier Landscape: Supplier Negotiations and Strategies

The Industrial Supply, Hardware, and Fasteners market also has a broad and highly competitive supplier ecosystem, with both global industry leaders and regional players influencing market trends. Well-established providers dominate the industry, offering broad product portfolios that include a diverse range of industrial hardware, fasteners, and supply chain solutions. Smaller, niche suppliers, on the other hand, specialize in specific industries and provide personalized solutions with distinguishing features such as customized fasteners, specialty materials, or advanced inventory management solutions.

The combination of global industry heavyweights and innovative niche companies in the industrial supply sector offers businesses a variety of options for meeting their specific operating needs. Companies that remain nimble, proactively managing relationships with both large and small suppliers, will be better positioned to improve procurement processes and preserve a competitive advantage in an increasingly complicated and digitalized supply market.

Key Suppliers in the Industrial Supply, Hardware & Fasteners Product Categories Market Include:

Grainger

Fastenal

Hilti

Bosch

Stanley Black & Decker

Würth Group

Rexnord Corporation

Screwfix

Makita Corporation

Parker Hannifin

Key Developments Procurement Category Significant Development:

Significant Development |

Description |

Market Growth |

The Industrial Supply, Hardware, and Fasteners market is expanding rapidly, driven by rising demand for better supply chain management, increased productivity, and the requirement for real-time data to aid decision-making. |

Cloud Adoption |

Businesses are rapidly using cloud technology to improve scalability, cut operational expenses, and provide remote access, especially as hybrid work patterns grow more common. |

Product Innovation |

Suppliers in the industrial supply business are heavily investing in innovation to provide more improved, technologically advanced products. AI-powered analytics and real-time data processing tools are supporting enterprises optimize inventory, enhance demand forecasting, and improve supplier performance tracking.

|

Technological Advancements |

Machine learning, IoT integration, and robotic process automation (RPA) are examples of technology breakthroughs that enable firms automate mundane processes such as order processing, warehouse management, and shipping while giving predictive insights. |

Global Trade Dynamics |

Changes in global trade dynamics, such as new trade legislation, compliance requirements, and shifting regional economic policies, are altering supply chain tactics. |

Customization Trends |

Companies are searching for solutions that have modular architectures and can interact with third-party technologies, allowing them to adjust their procurement and inventory management systems to unique operational requirements. |

Industrial Supply, Hardware & Fasteners Product Categories Attribute/Metric |

Details |

Market Sizing |

The global Industrial Supply, Hardware & Fasteners Product Categories market is projected to reach USD 1350.2 billion by 2035, growing at a CAGR of approximately 4.5% from 2025 to 2035.

|

Industrial Supply, Hardware & Fasteners Product Categories Technology Adoption Rate |

Around 60% of organizations in the industrial supply sector have implemented digital solutions for inventory management, logistics, and procurement, with a growing emphasis on IoT-enabled tracking and cloud-based systems to boost productivity.

|

Top Industrial Supply, Hardware & Fasteners Product Categories Industry Strategies for 2025 |

Key initiatives include embracing automation for inventory management, employing sophisticated analytics to optimize supply chains, adding AI for demand forecasting, and putting more emphasis on sustainable sourcing techniques. |

Industrial Supply, Hardware & Fasteners Product Categories Process Automation |

To boost operational efficiency and minimize costs, about 50% of industrial supply companies automate regular activities such as order fulfilment, stock replenishment, and compliance reporting. |

Industrial Supply, Hardware & Fasteners Product Categories Process Challenges |

High shipping costs, fluctuating raw material prices, reliance on global supply networks, and the difficulty of complying with regional rules are all significant issues. |

Key Suppliers |

Grainger, Fastenal and Hilti are leading supplier in the industrial supply sector, provides a wide range of hardware, fasteners, and related solutions for a variety of industries. |

Key Regions Covered |

North America, Europe, and Asia-Pacific are popular regions for industrial supply adoption, with strong demand in the construction, automotive, and manufacturing industries.

|

Market Drivers and Trends |

Increased automation in industrial operations, rising demand for high-quality, long-lasting materials, the use of IoT for real-time tracking, and supply chain management technologies for greater efficiency and sustainability all contribute to growth. |