Healthcare Contract Manufacturing: The Backbone of Pharma & Medtech Growth

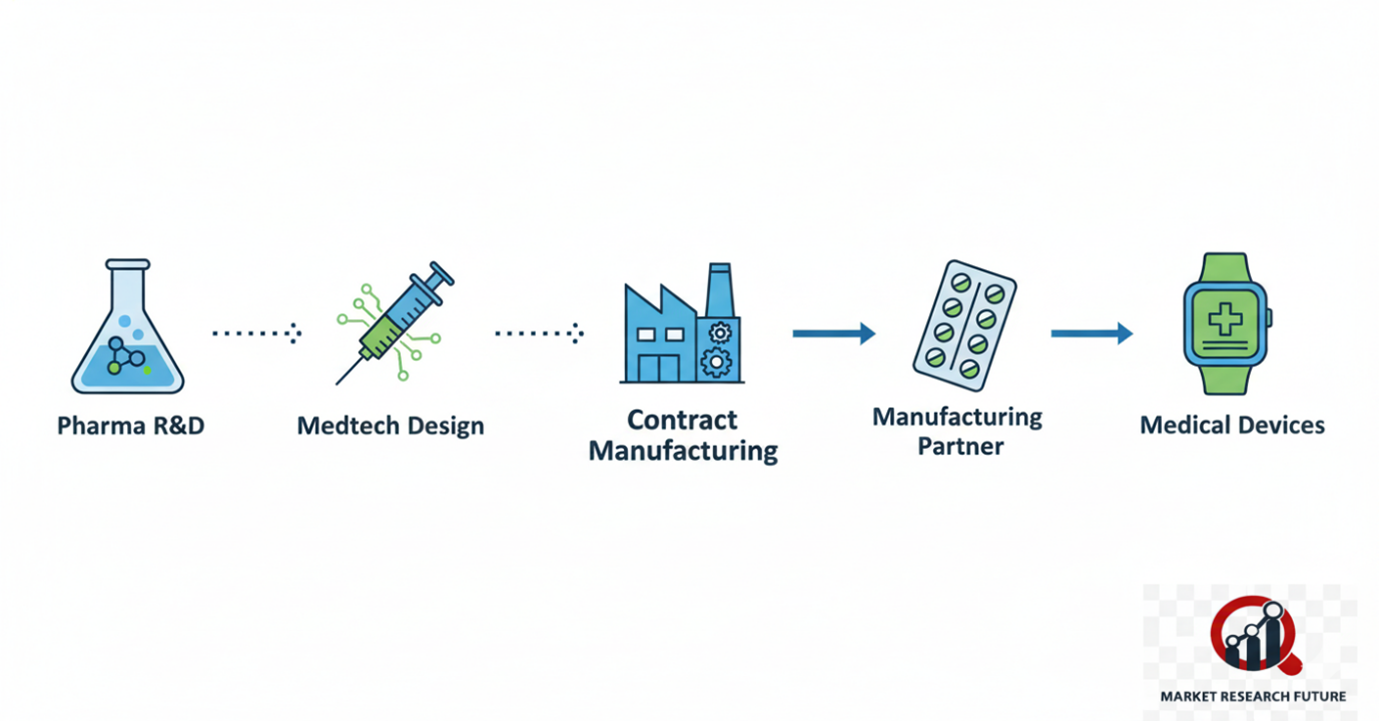

Contract manufacturing involves one business hiring another to make parts or entire products based on certain conditions. In healthcare, contractors (typically called CDMOs or CMOs) take on various roles for pharmaceutical and medical device companies, from the development stage to the end-stage production.

Pharmaceutical services are inclusive of API (active pharmaceutical ingredient) production, finished dosage form (FDF) manufacturing (which comprises solid, semi-solid, liquid, and injectable forms), advanced drug delivery systems, packaging, and over-the-counter products or nutraceuticals. In the realm of medical devices, contract manufacturing may comprise design collaboration, part manufacture, electronic assembly, and complete device integration.

What Does the Surge Come From?

1. The Expiring Patents & Generics Wave

A large wave of blockbuster patented drugs has or will shortly expire. This “patent cliff” is causing originators and generic and biosimilar producers to outsource cost-effective production to CDMOs/CMOs. Because contract-manufacturing firms work on several projects and clients simultaneously, they can achieve economies of scale, which lowers the cost of input materials and the final price given to customers.

2. Biologics and Specialty Drugs

The rapid development of biologics, gene and cell therapies, and other complex treatment modalities is straining In-house production capacities. Many biopharma firms do not have the necessary infrastructure or the regulatory knowledge, which is why they outsource these tasks to specialized CDMOs that handle viral vectors, aseptic fill/finish, and advanced containment systems.

3. Strategic Partnerships & Mergers

Through acquisitions, alliances, and integrations, CDMOs are broadening their capabilities. Many are blending development services with manufacturing and providing turnkey solutions (from process R&D at early stages to commercial scales). Clients are looking for fewer vendor handoffs and reduced risk, and shorter timelines. These integrated service portfolios provide all of that.

4. Technology Adoption & Smart Manufacturing

Next-gen contract manufacturing is characterized by digitalization, continuous manufacturing, modular plants, single-use systems, AI/ML for process control, and advanced analytics. As global regulation becomes stricter, strong quality systems, compliance platforms, and data integrity frameworks will all become key differentiators.

Challenges That Loom

- The involvement of subcontractors or remote suppliers potentially increases vulnerability regarding contractual obligations and responsible partners in a given supply chain during the subcontracting of inter-organizational activities.

- The Disparate Compliance Complexity and Cost in the Global Marketplace: Attention from varied geographies (FDA, EMA, NMPA, CDSCO) in respect of soft, technical, and hard compliance demands a considerable spend on the provision of quality, validations, audits, and overall compliance.

- Lack of Trust and/or Oversight in Intellectual Property (IP) Control: Clients expect a company to secure proprietary molecules, processes, or device designs.

- Lack of Standardization and/or Interoperability: Varied processes, formats, and systems across CDMOs may create barriers in scaling or handing over inter-organizational activities.

- The cost of noncompliance, recalls, or the infiltration of counterfeits is extremely high. This is why trusted and audited partners are in high demand.

What the Future Looks Like

- Shift to Turnkey/CDMO Models: More firms will favor integrated development-to-manufacture partners.

- Near-shoring & Regional Diversification: Especially in the wake of supply chain stress, companies will bring manufacturing closer to demand markets.

- Personalization & Advanced Device Manufacturing: The rise of smart medical devices and personalized therapies (e.g., wearables, implantable) will create niche contract manufacturing demand.

- Sustainability & Green Pharma: Expect growth in low-waste, greener processes, biocatalysis, and circular manufacturing models.

- Stronger Regulatory Convergence & Digital Compliance: Harmonized regulation, cloud quality systems, and real-time monitoring will be more standard.

Conclusion

Instead of being a cost reduction tactic, healthcare firms now view contract manufacturing as a means of agility, cost control, and expansion. The intricacies of modern biologics and devices demand a more flexible approach. As CDMOs become more and more sophisticated from a technology standpoint, the distinctions between “outsourced partner” and “core infrastructure” fade. I’d be happy to provide a bullet summary and infographic, or a table of market projections, to accompany this.