Acrylic Acid Market Overview

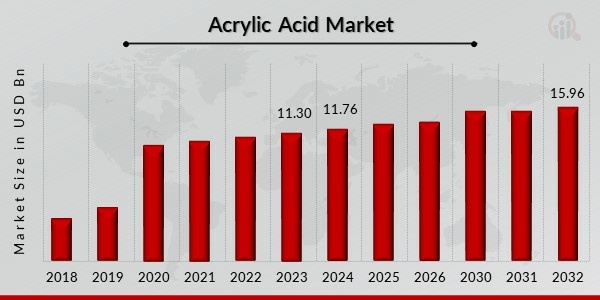

Acrylic Acid Size was valued at USD 11.30 billion in 2023. The Acrylic Acid industry is projected to grow from USD 11.76 Billion in 2024 to USD 15.96 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 3.89% during the forecast period (2024 - 2032). Acrylic acid is an organic liquid that is colorless and has a strong odor. It is commonly used as a monomer in the synthesis of a wide range of polymer compounds. This liquid is extremely reactive, volatile, and flammable. One of the most important derivatives of acrylic acids is acrylic esters. It is used in many industries, including food processing, pharmaceuticals, cosmetics, paints, coatings, adhesives, papermaking, textiles, rubber, plastics, cement, detergents, and water treatment.

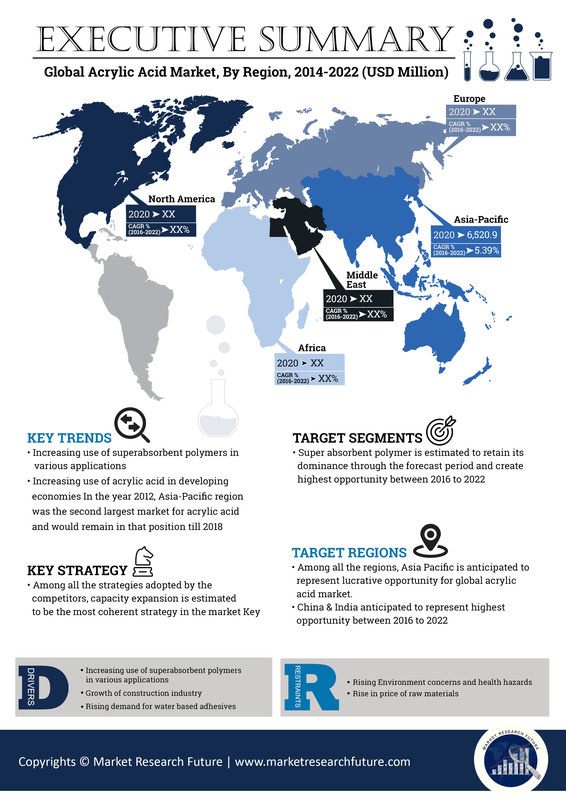

The global acrylic acid market is being propelled by rising demand for polymers, paints and coatings, and personal care products. The growing demand for superabsorbent polymers in the personal care industry, expansion of the construction industry, and rising demand for water-based adhesives are some of the major factors driving growth in this market. Surging demand for acrylic acid from emerging economies such as India and China is also fueling the global acrylic acid market's expansion. Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced in 2023 that it has reached an agreement with Air Liquide Engineering & Construction to acquire the rights to license and market ester grade acrylic acid technology as well as light and heavy acrylates process technology. The expansion broadens Lummus' portfolio of propylene production and derivative products, giving clients more alternatives for upstream and downstream operations. Nippon Shokubai, a Japanese company, has opened its new acrylic acid (AA) factory in Indonesia and signed an initial agreement with local producer Chandra Asri Petrochemical to investigate green chemical business potential. The new 100,000 tonne/year AA facility in Cilegon, Banten province, operated by its subsidiary Nippon Shokubai Indonesia, increases its overall AA capacity in the southeast Asian country to 240,000 tonnes/year.

Competitive Landscape

The noteworthy companies in the Acrylic Acid Market are:

- BASF SE

- The Dow Chemical Company

- Arkema SA

- Evonik Industries

- Nippon Shokubai Co. Ltd

- Taixing Jurong Chemical Co Ltd

- PJSC Sibur Holding, LG Chemicals

- Shenyang Chemical Co Ltd

- Mitsubishi Chemical, and Hexion Inc

COVID-19 Analysis

The current disease outbreak has interrupted the supply chains in critical regions persuaded by the deterioration in demand owing to vagueness in the global capital markets. The acrylic acid industry is reeling from the hard hit by the COVID-19 outbreak on many fronts, such as lower demand and productivity, operational & supply chain disruptions, possibly dwindling credit markets, and their workforce's condition. The companies should expect that widening outbreaks of COVID-19 may affect workers in the market, which may need to be considered before outsourcing some corporate functions. Companies in regions struck severely by the pandemic may face trials in concluding financial statements with processes halted. With the economic disruption showing indeterminate severity, some companies may be realizing the prospect of activating events for long-lived asset damages and escalating concerns over the restructuring actions, recoverability of receivables, and liquidity problems.

Market Dynamics

Drivers Increasing Use of Superabsorbent Polymers in Various Applications The developing demand for

superabsorbent polymers in the personal care industry is anticipated to drive global acrylic acid market share growth through the forecast period.

Growth of the Construction Industry The resumption of services in the construction industry is anticipated to create an optimistic outlook for the acrylic acid market size.

Rising Demand for Water-Based Adhesives The use of water-based adhesives has risen due to the surge in applications, which is estimated to create a pronounced effect on market expansion strategies.

Opportunities Increase in the Use of Bio-Based Acrylic Acid Intensive R&D by regional companies to develop bio-based alternatives due to the Augmented regulatory stress on companies is projected to spur the market.

Increasing Demand from Emerging Economies The emerging economies are seeing development in key sectors that involve the use of acrylic acids to bolster the global market.

Restraints Rising Environment Concerns The environmental repercussions of acrylic acid are estimated to encumber global market development in the forecast period.

Rise In Price Of Raw Materials The raw materials needed to manufacture acrylic acid are likely to get more expensive owing to the restrictions placed in the current pandemic.

Segment Overview

By Type The superabsorbent polymer segment is projected to enhance the overall market share in the impending period.

By Application The diapers segment is forecasted to create promising momentum in the impending period.

Regional Analysis

Asia Pacific to Control Majority Stake The Asia Pacific acrylic acid market led the global market with national markets like China and India, controlling 70% of the regional demand. Escalating derivatives use in personal care products, surfactants, coatings, and adhesives are anticipated to push the acrylic acid market trends in the forecast period.

North America is Projected to Shape Global Market The exhaustive R&D by resident companies to advance bio-based alternatives is anticipated to deliver acrylic acid market share development prospects. The collective elderly population in the U.S. and Canada are anticipated to push the adult incontinence products demand, leading to amplified superabsorbent polymer consumption. Mexico is also foreseen to list elevated demand due to speedy growth in several end-use industries such as adhesives & sealants and personal care. With the strong regulations on organic compounds in North America, their growth is limited because of the likely drawbacks. The manufacturers intend to locate eco-based origins for nurturing the market size & manufacture. Moreover, the advanced demand for PMMA resins among end-users will create favorable prospects for investors.

Recent Developments

May 2023

Japanese producer Nippon Shokubai and the local enterprise Chandra Asri Petrochemical have reached a preliminary agreement to explore business opportunities for green chemicals. In Indonesia, Nippon Shokubai recently inaugurated a new acrylic acid (AA) facility.

Now, its subsidiary Nippon Shokubai Indonesia can produce 240,000 tonnes of AA yearly in the country of Southeast Asia thanks to the opening of a new 100,000 tonne/year AA factory in Cilegon, Banten province.

With a capacity increase of more than 11%, the Japanese group currently produces 980,000 tonnes of AA annually. The company manufactures superabsorbent polymers (SAP), which are used to make disposable diapers, whose use is predicted to "grow steadily."

In the meantime, the Japanese manufacturer and Chandra Asri, the only cracker operator in Indonesia, have signed a memorandum of understanding (MoU) to jointly investigate economic prospects for ecologically friendly or "green" chemicals.

October 2023

As a global supplier of process technologies and value-driven energy solutions, Lummus Technology recently announced that it has entered into a licensing and marketing agreement with Air Liquide Engineering & Construction for the ester-grade acrylic acid and light and heavy acrylates processes.

In order to create extremely absorbent polymers, adhesives, and a variety of coatings, acrylic acid is the primary component. A variety of acrylate esters, which are essential components of resins, plastics, rubber, and many other common commodities, are synthesized using ester-grade acrylic acid. With less capital needed and the lowest carbon footprint in the industry, the acquired technology transforms propylene into ester-grade acrylic acid.

Report Overview By Type

- Methyl Acrylate

- Ethyl Acrylate

- Butyl Acrylate

- 2-Ethylhexyl Acrylate

- Elastomers

- Superabsorbent Polymers

- Water Treatment Polymers

- Others

By Application

- Adhesives & sealants

- Diapers

- Surface Coating

- Cement Modifiers

- Paper Industry

- Textile

- Anti-Scalant

- Adult Incontinence Products

- Others

| Attribute/Metric |

Details |

| Market Size 2023 |

USD 11.30 billion |

| Market Size 2024 |

USD 11.76 billion |

| Market Size 2032 |

USD 15.96 billion |

| Compound Annual Growth Rate (CAGR) |

3.89%(2024 - 2032) |

| Base Year |

2023 |

| Forecast Period |

2024 - 2032 |

| Historical Data |

2019 & 2020 |

| Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

By Type, Application and Region |

| Geographies Covered |

North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

BASF SE,The Dow Chemical Company,Arkema SA,Evonik Industries,Nippon Shokubai Co. Ltd,Taixing Jurong Chemical Co Ltd,PJSC Sibur Holding, LG Chemicals,Shenyang Chemical Co Ltd,Mitsubishi Chemical, and Hexion Inc |

| Key Market Opportunities |

Increase in the Use of Bio-Based Acrylic Acid |

| Key Market Dynamics |

Increasing Use of Superabsorbent Polymers in Various Applications |

Acrylic Acid Market Highlights:

Frequently Asked Questions (FAQ) :

The valuation of the global acrylic acid market is projected to reach approximately USD 15.96 BN by 2032, growing at 3.89% CAGR during 2024-2032

Growth in the packaging and construction industry.

The superabsorbent polymer segment by type is the largest segment estimated to lead in the global acrylic acid market.

Asia Pacific holds the largest share in the global acrylic acid market followed by Europe and North America, respectively.

The Dow Chemical Company, BASF SE, Arkema SA, Nippon Shokubai Co. Ltd, Evonik Industries, Taixing Jurong Chemical Co Ltd, Shenyang Chemical Co Ltd, PJSC Sibur Holding, LG Chemicals, Hexion Inc., and Mitsubishi Chemical, are some of the major players operating in the global acrylic acid market.

The global acrylic acid market is being propelled by rising demand for polymers, paints and coatings, and personal care products. The growing demand for superabsorbent polymers in the personal care industry, expansion of the construction industry, and rising demand for water-based adhesives are some of the major factors driving growth in this market. Surging demand for acrylic acid from emerging economies such as India and China is also fueling the global acrylic acid market's expansion. Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced in 2023 that it has reached an agreement with Air Liquide Engineering & Construction to acquire the rights to license and market ester grade acrylic acid technology as well as light and heavy acrylates process technology. The expansion broadens Lummus' portfolio of propylene production and derivative products, giving clients more alternatives for upstream and downstream operations. Nippon Shokubai, a Japanese company, has opened its new acrylic acid (AA) factory in Indonesia and signed an initial agreement with local producer Chandra Asri Petrochemical to investigate green chemical business potential. The new 100,000 tonne/year AA facility in Cilegon, Banten province, operated by its subsidiary Nippon Shokubai Indonesia, increases its overall AA capacity in the southeast Asian country to 240,000 tonnes/year.

The global acrylic acid market is being propelled by rising demand for polymers, paints and coatings, and personal care products. The growing demand for superabsorbent polymers in the personal care industry, expansion of the construction industry, and rising demand for water-based adhesives are some of the major factors driving growth in this market. Surging demand for acrylic acid from emerging economies such as India and China is also fueling the global acrylic acid market's expansion. Lummus Technology, a global provider of process technologies and value-driven energy solutions, announced in 2023 that it has reached an agreement with Air Liquide Engineering & Construction to acquire the rights to license and market ester grade acrylic acid technology as well as light and heavy acrylates process technology. The expansion broadens Lummus' portfolio of propylene production and derivative products, giving clients more alternatives for upstream and downstream operations. Nippon Shokubai, a Japanese company, has opened its new acrylic acid (AA) factory in Indonesia and signed an initial agreement with local producer Chandra Asri Petrochemical to investigate green chemical business potential. The new 100,000 tonne/year AA facility in Cilegon, Banten province, operated by its subsidiary Nippon Shokubai Indonesia, increases its overall AA capacity in the southeast Asian country to 240,000 tonnes/year.