Growth in the Construction Industry

The Acrylic Acid Market is poised to benefit from the ongoing growth in the construction industry. Acrylic acid is extensively used in the production of various construction materials, including sealants, adhesives, and paints. The construction sector is projected to witness a steady growth rate, driven by urbanization and infrastructure development initiatives. For instance, the construction market is anticipated to reach over 10 trillion USD by 2025. This expansion is likely to create a substantial demand for acrylic acid, as it is essential for enhancing the performance and durability of construction materials. Thus, the Acrylic Acid Market stands to gain from these trends.

Increasing Use in Textiles and Fibers

The Acrylic Acid Market is experiencing a shift due to the increasing use of acrylic acid in textiles and fibers. Acrylic fibers, known for their lightweight and soft texture, are gaining popularity in the fashion and home textiles sectors. The global market for acrylic fibers is expected to grow steadily, driven by consumer preferences for comfortable and durable fabrics. This trend is likely to enhance the demand for acrylic acid, as it is a key raw material in the production of these fibers. As manufacturers adapt to changing consumer preferences, the Acrylic Acid Market may see a corresponding increase in production and innovation.

Advancements in Production Technologies

The Acrylic Acid Market is significantly impacted by advancements in production technologies. Innovations such as the development of more efficient catalytic processes and the use of renewable feedstocks are enhancing the production efficiency of acrylic acid. These advancements not only reduce production costs but also minimize environmental impact, aligning with the growing emphasis on sustainability. As production technologies evolve, the Acrylic Acid Market is likely to witness increased competitiveness and profitability. Furthermore, these technological improvements may lead to a broader application range for acrylic acid, thereby expanding its market potential.

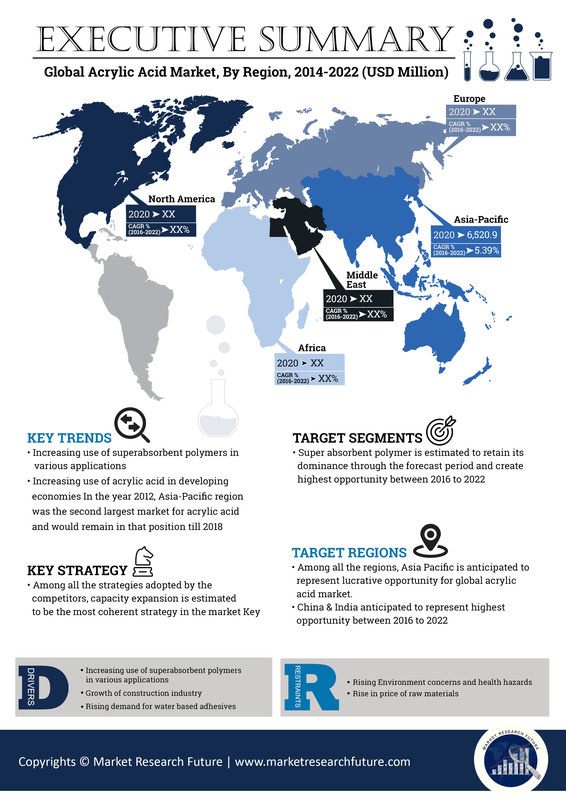

Rising Demand in Superabsorbent Polymers

The Acrylic Acid Market experiences a notable surge in demand for superabsorbent polymers, primarily utilized in personal care products such as diapers and feminine hygiene items. This demand is driven by an increasing global population and a growing awareness of hygiene and comfort. The market for superabsorbent polymers is projected to reach approximately 9 billion USD by 2026, indicating a robust growth trajectory. As a key raw material, acrylic acid plays a pivotal role in the production of these polymers, thereby enhancing its significance in the Acrylic Acid Market. Manufacturers are likely to invest in expanding production capacities to meet this rising demand, which could further stimulate market growth.

Expansion in Coatings and Adhesives Sector

The Acrylic Acid Market is significantly influenced by the expansion of the coatings and adhesives sector. Acrylic acid is a vital component in the formulation of water-based coatings and adhesives, which are increasingly favored due to their low environmental impact. The global market for water-based coatings is expected to grow at a compound annual growth rate of around 5% through 2025. This growth is attributed to stringent regulations on volatile organic compounds and a shift towards sustainable products. Consequently, the demand for acrylic acid is likely to increase as manufacturers seek to develop innovative and eco-friendly solutions, thereby bolstering the Acrylic Acid Market.