UK Markets Respond As The Next PM, Rishi Sunak, Prepares To Take Office

By Indu Tyagi Ketan , 25 October, 2022

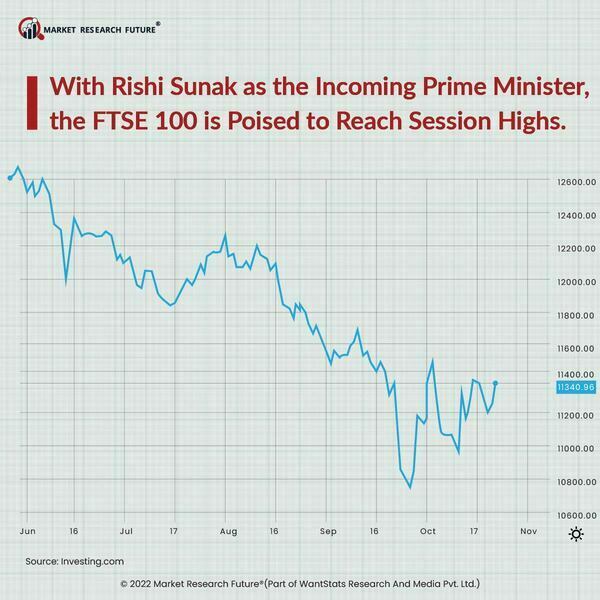

The markets are responding to the news of Rishi Sunak being the next prime minister of the UK after Liz Truss' 44 historic days in office. The markets have already stabilized on the belief that Sunak might be able to repair the UK's finances.

Mr. Johnson, who only recently resigned as prime minister, asserted that he had enough support to run but conceded that this was "not the right time." Sunak will take office at a time when Ex-PM Liz Truss' mini budget exacerbated an economic crisis and put pressure on public finances. Truss tweeted to congratulate him and offer her "full support" post the announcement.

His rival Penny Mordaunt withdrew after her inability to garner enough support from MPs. In his opening remarks, Mr. Sunak declared that uniting his party and the UK would be his "utmost priority." He is the first British Asian prime minister in more than 200 years and, at 42, also the youngest.

Prior to the announcement, the pound rose to $1.13 on Monday morning after Boris Johnson withdrew from the leadership race. The FTSE 100 also started the day higher by 0.5%, crossing the 7,000-point threshold for the first time in a week. Investors are now factoring in a slightly less hawkish hike from the Bank of England, just around 5%, which is lower than the 6% projected in the wake of the Government's dismal mini-budget. Ultimately, this can also result in lower monthly mortgage payments for homeowners.

Since the Conservatives won the most recent general election in 2019, Sunak will be the third prime minister to lead the party, leading to calls for an early election from Labour.With Rishi Sunak as the Incoming Prime Minister, the FTSE 100 is Poised to Reach Session Highs.

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

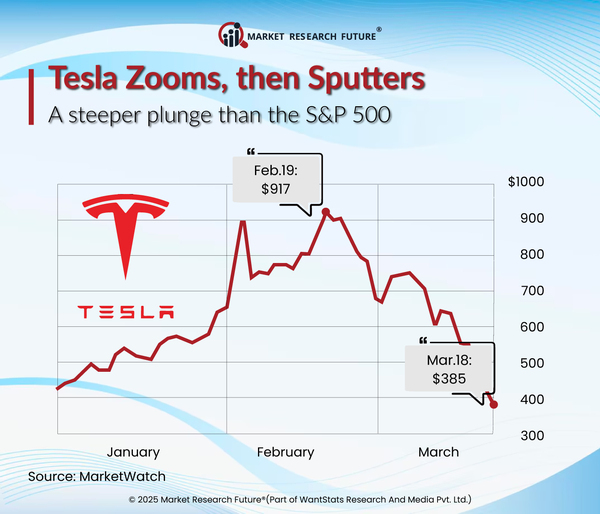

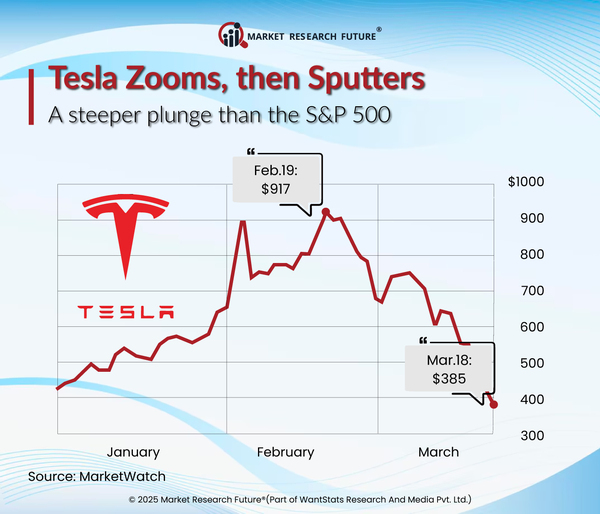

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

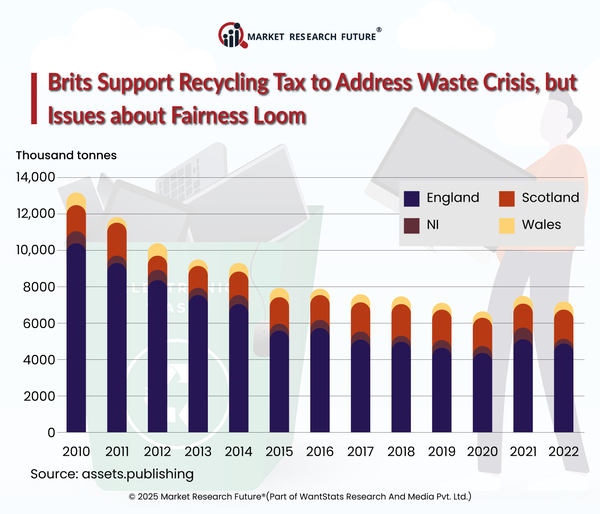

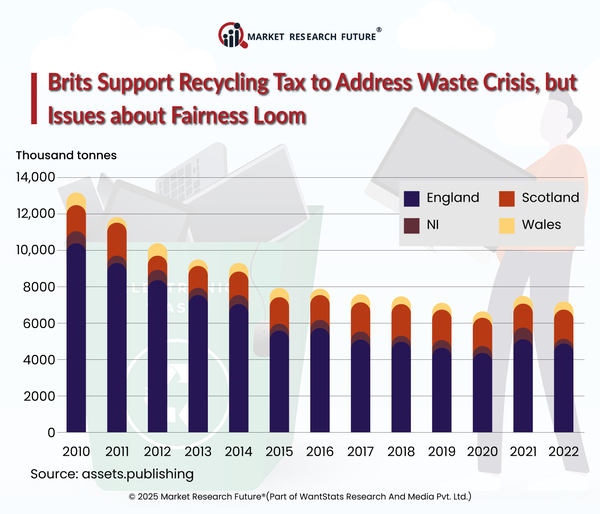

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

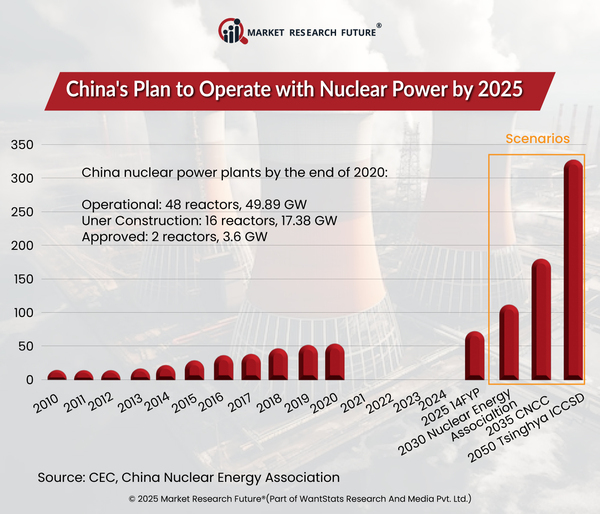

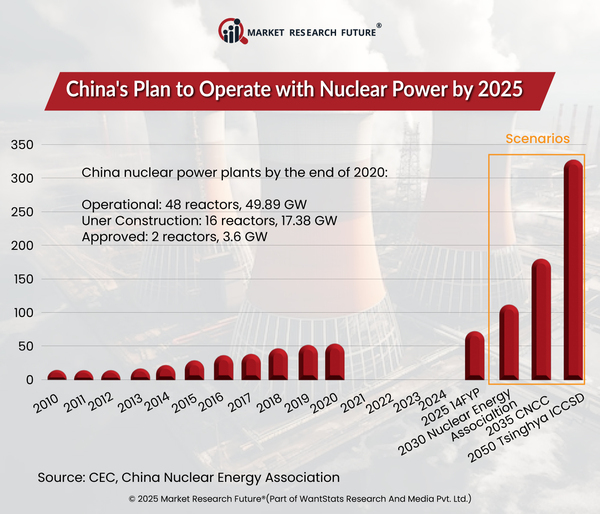

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Chief Strategy Officer

Latest News