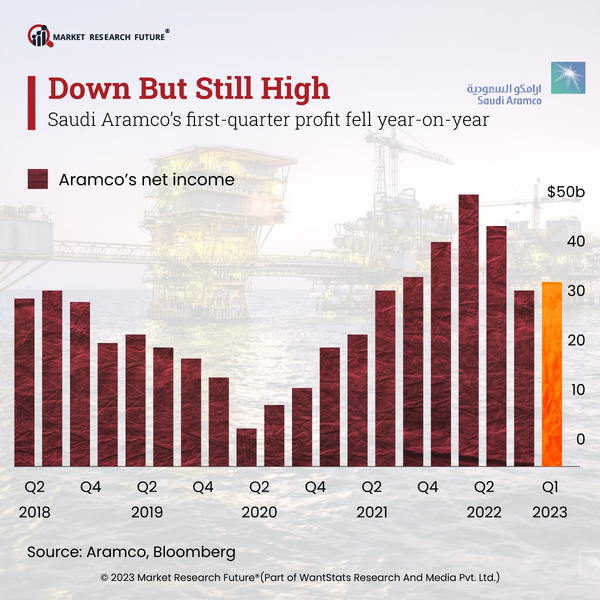

Saudi Aramco’s Gains Declined by 30 Percent in Initial Months of 2023

By Shubhendra Anand , 18 September, 2023

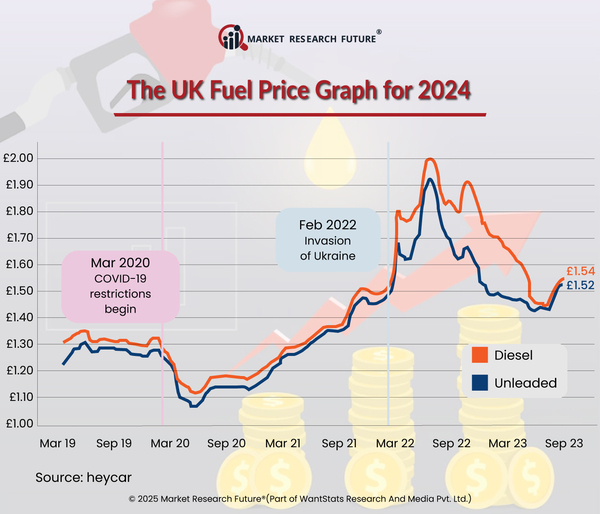

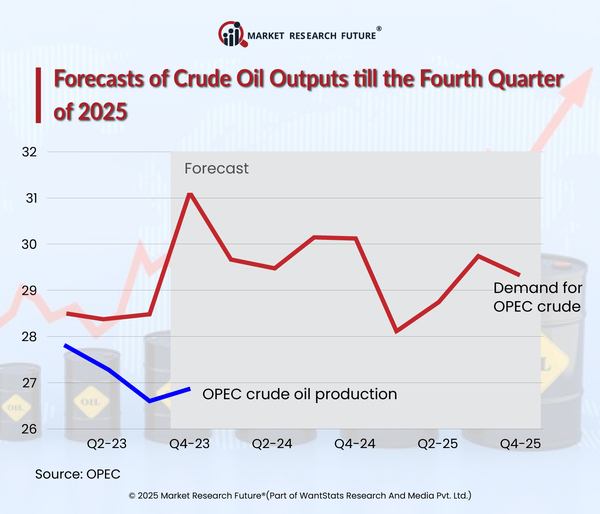

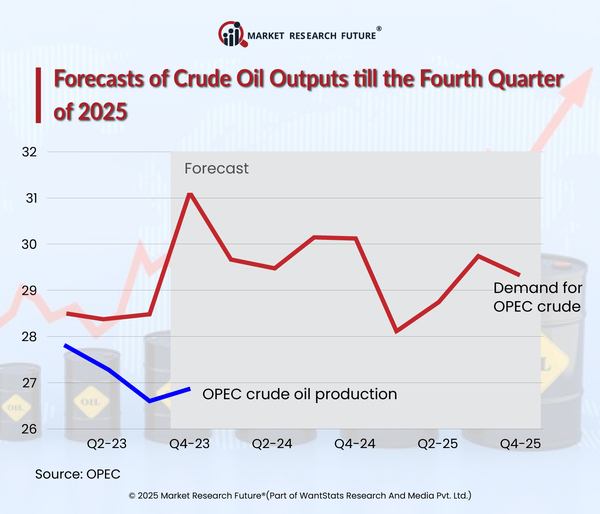

The world's largest oil producer, Saudi Aramco, has released the results from the second quarter and half year of 2023. The gains have dropped by 30 percent in the initial six months of 2023. The prices of crude oil have declined due to geopolitical reasons in 2022.

The company has enabled low-cost production and high supply reliability with solid profitability. Saudi Aramco reported a total income of USD 62 billion for the first quarter of 2023. For the first quarter of 2023, the company's net income was USD 30.1 billion, and the cash flow from the operating activities made up to USD 33.6 billion. The company's CEO views its strong results reflected from its caliber and strength to blend in through the market cycles. The company continues to depict its ability, from long-time experience, to fulfill the customers' needs. He also added that the company maintained its status as a company spending expenditures heavily with a target to enhance its oil and gas productions.

Based on the data released by the company recently, the average realized crude oil per price per barrel is around USD 78.8 million, whereas it was 113.2 million in 2022. The company also maintained spending on the downstream business, such as a petrochemical project, and expenditure of USD 11 billion on the expansion of the SATORP refinery with the total energies for future needs, among others. According to the reports released by Saudi Aramco, the downstream progress plan advances with the construction, engineering, and others for USD 11 billion contract for the Amiral petrochemicals complex. Amid all these circumstances, the CEO of Saudi Aramco announced that to keep the sustainable and progressive dividend for their shareholders to remain stable.

Down but still high

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

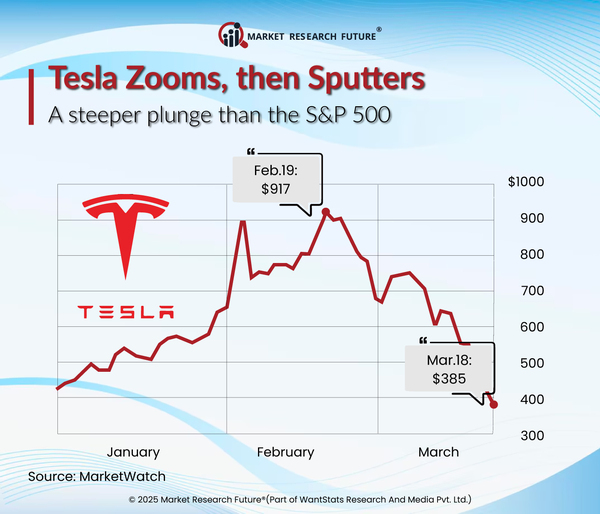

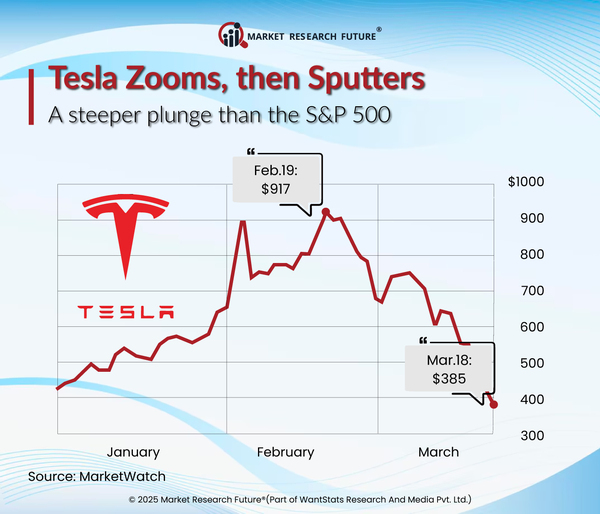

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

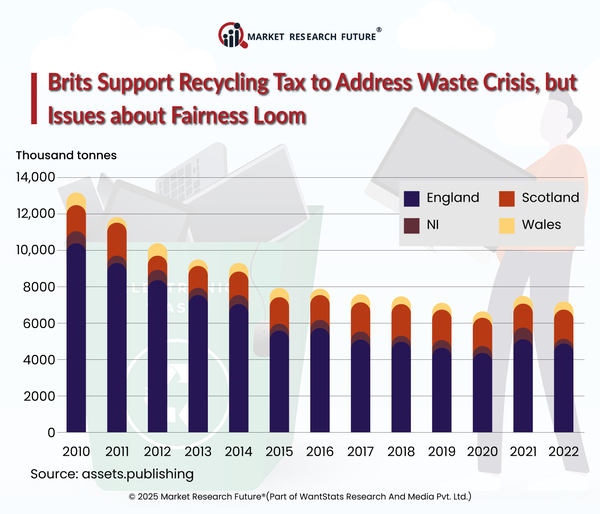

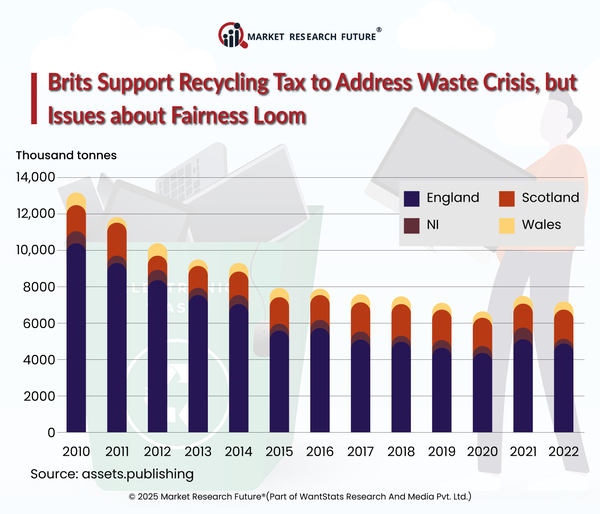

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

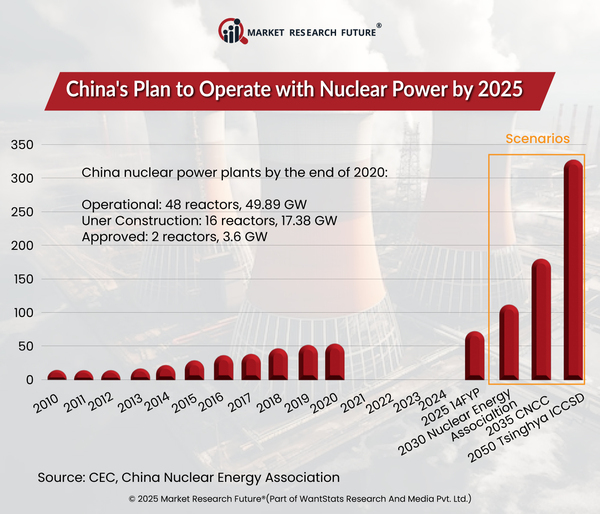

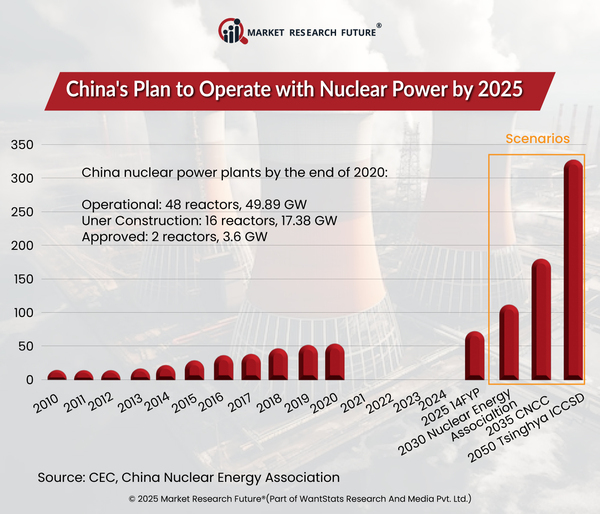

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Head Research

Latest News