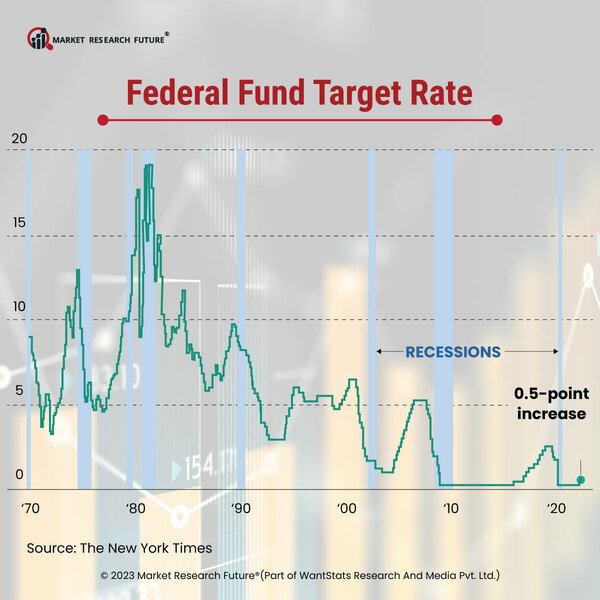

No Pause in Raising Interest Rates from Fed’s Side Amid Banking Turmoil

By Garvit Vyas , 15 May, 2023

U.S Fed decided to stay strong and to keep raising the interest rates to fight against the inflation. Fed chairman, Jerome Powell in a two-day meeting of the Federal Open Market Committee (FOMC), announced a hike of 0.25 percent recently by bringing the target range for the federal funds rate to reach 5 percent to 5.25 percent. It is highest since 2007.

Again, the Fed was also forced to balance the risks of shaky banking sector against the risks of allowing the inflation to flare up. The FOMC also decided to stay firm in its decision regarding the hike in federal funds. The Fed admitted in order to gain confidence, saying the conditions in the sector has improved broadly since March in 2023. It also added that the U.S. banking system was “sound and resilient”.

The previous FOMC statement issued in March said that the committee is expecting some additional policy in depth which may be appropriate for funds rate hike. Despite this, no explicit hint was there at further rate hikes. If Fed wants to get rid of any other rate hike in 2023 which would be in line with the projections released after the FOMC’s March meeting that showed most of the committee members expecting the target range for the federal funds rate to remain stable, till the end of 2023.

Federal Fund Target Rate

Latest News

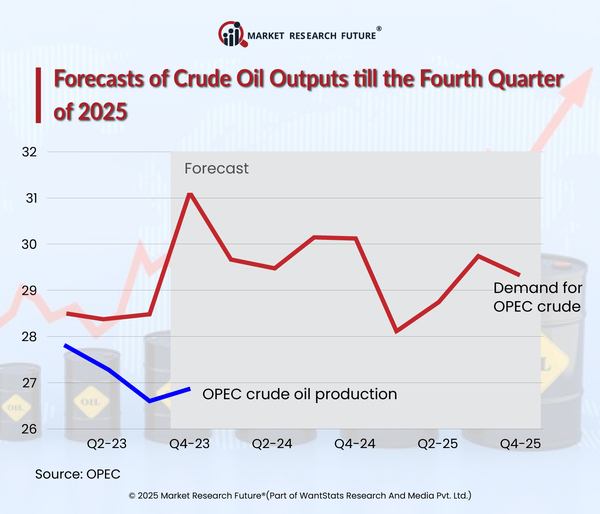

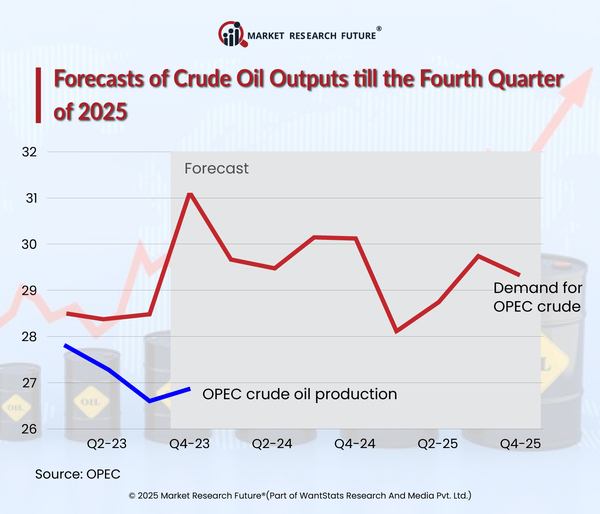

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

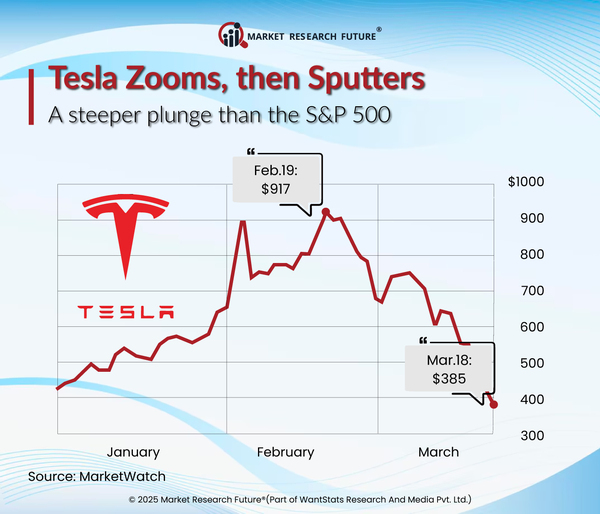

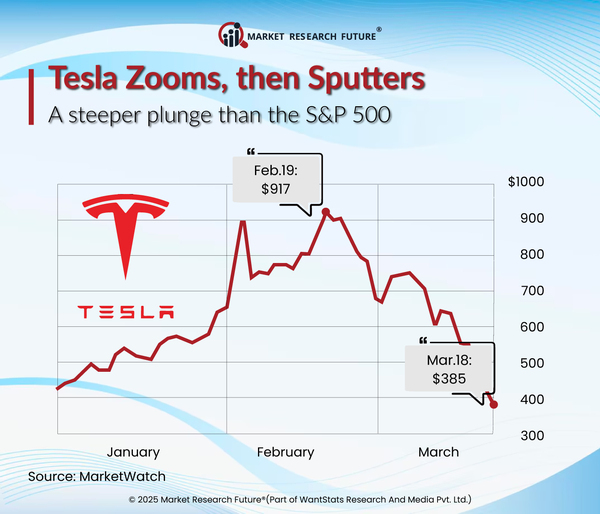

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

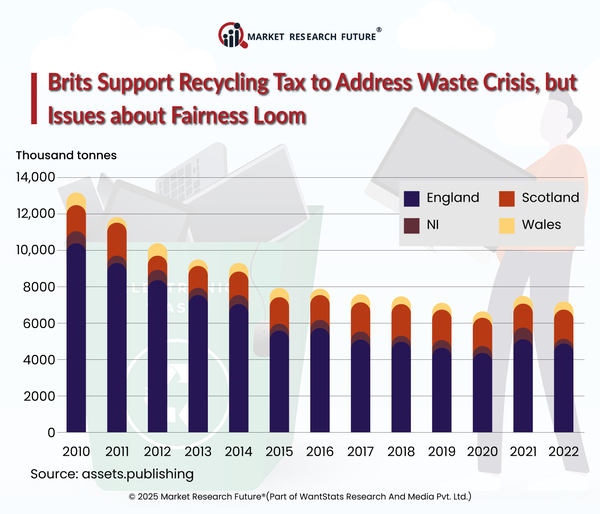

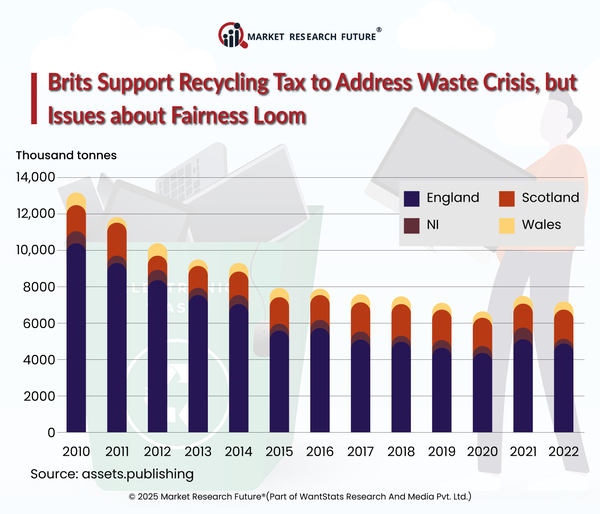

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

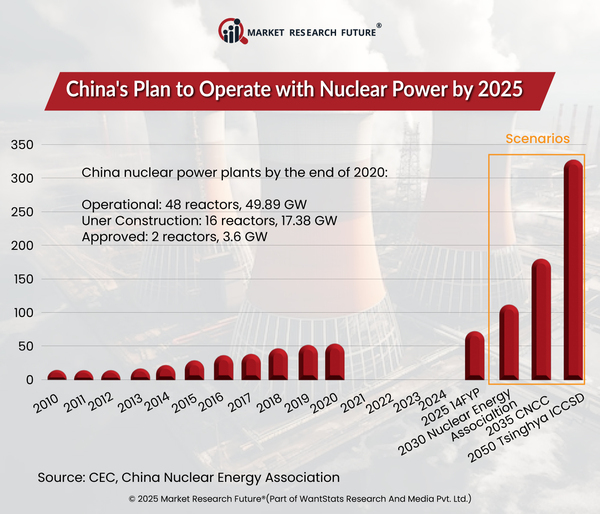

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Analyst

Latest News