Gold Prices Soar Up in the First Quarter of 2023

By Snehal Singh , 17 May, 2023

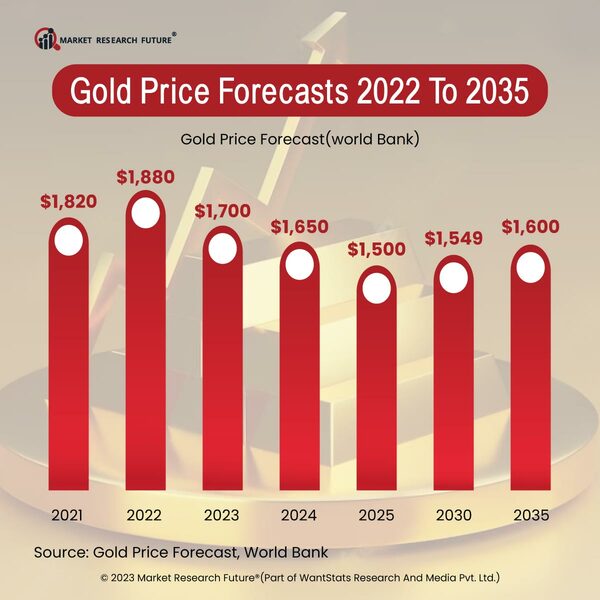

The global banking system is a crisis hit due to many geo-political problems. Gold is the only asset that has given good returns to investors more than their expectations. Due to instability in the global economy, gold prices rose, which is an all-time high till date.

The price of gold reached INR 61,490 per 10 grams on the Multi Commodity Exchange (MCX). In the first quarter of 2023, when the stock market was even more volatile due to global economic conditions, gold as a commodity gave stellar returns among all other asset classes. Even gold's charm was intact among the retail investors irrespective of its high price.

In the financial year 2022-2023, the gold price was INR 52,000 in April 2022, and the price has risen to INR 60,000 by 11 percent since the start of 2023. Conclusively, the price increased by 15 percent in this period.

Many factors are pushing gold prices to rise - like geopolitics and war, the collapse of the banks in Europe and the US, and the monetary tightening because of the steep hikes in the interest rates in the US Federal Reserve. The tumultuous situation in the world economy has led to a rise in demand for gold with high prices in the market. As per the trends for many years, it is known that gold prices go up when the interest rate hiking cycle ends. Also, the federal reserve has hiked the interest rates virtually from 0 to 5 percent in one year from 2022 to 2023, which has already created economic stresses in the US and the rest of the world.

Gold Price Forecasts 2022 To 2035

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

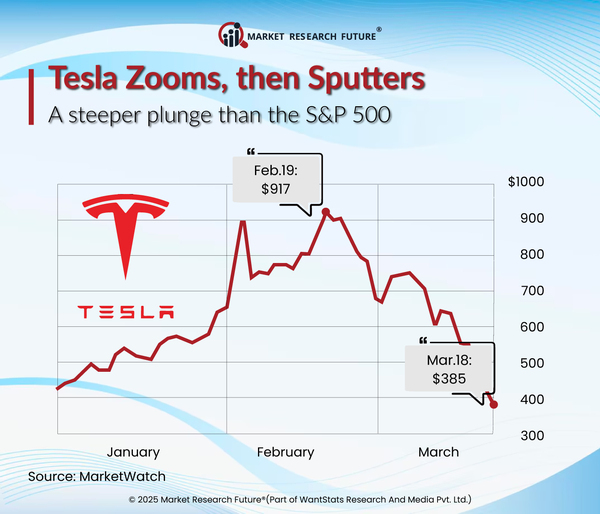

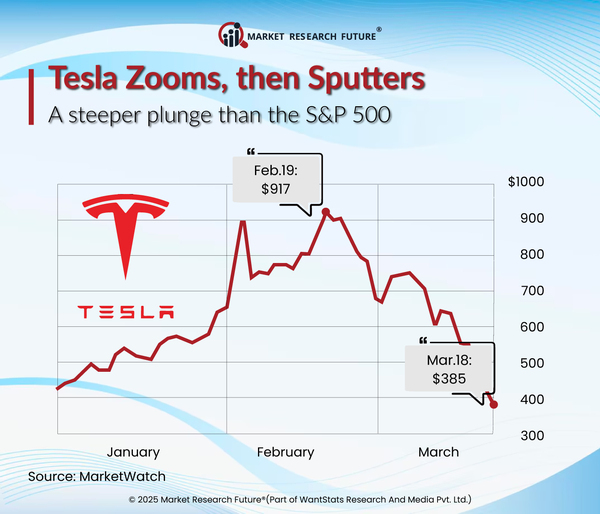

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

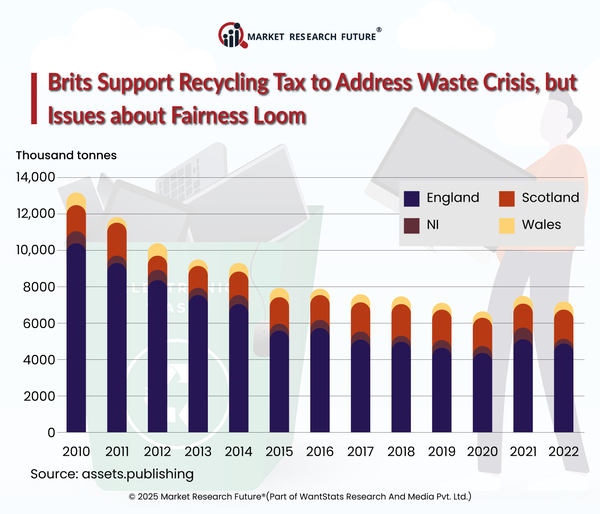

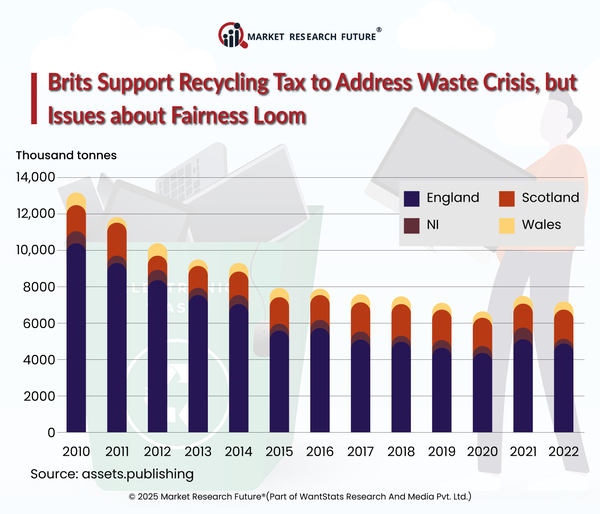

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

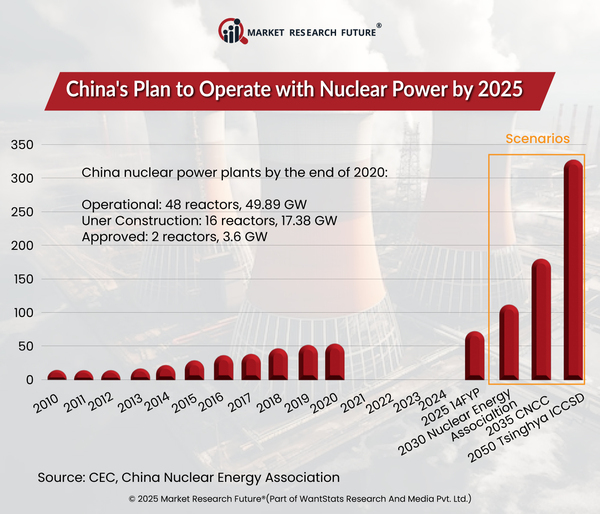

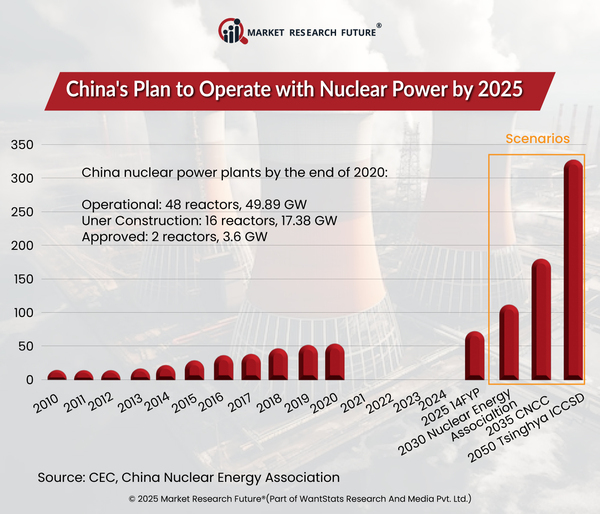

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Assistant Manager - Research

Latest News