Earnings of AT&T Beat Estimates, Stock Slumps in 2023

By Shubhendra Anand , 27 April, 2023

The revenue and earnings of AT&T’s slipped into the first quarter from almost a year earlier. But the real news was a slowdown when it comes to subscriber growth for the post-paid phones, it caused the stocks to slump directly in premarket trading.

AT&T has reported earnings of 60 per share after stripping out certain one-off expenses. It is slightly higher than the 58 cents predicted so far. According to the reports, the revenue of $30.1 billion was slightly lower as per the expectations of $30.2 billion.

As the data says, in 2022, AT&T also reported earnings of 77 cents a share on the revenue of $38.1 billion. AT&T stock also dropped 4.6 percent in the premarket trading in April 2023. The reports reveal, AT&T has a net gain of 424,000 in the post-paid subscriber base for the first quarter of 2023. It is ahead of the 422,800 consensus among the analysts as tracked by the FactSet. AT&T had also added 691,000 post-paid phone subscribers in 2022, followed by 800,000 and 700,000 in the same year.

According to the reports, the company’s post-paid phone business also posted an average revenue per user of $55.20 estimate. It is expected to get benefited from the price increases carried out of older wireless plans in 2022. And also from the migration of users to those plans and increased international roaming activities as well due to the business travels.

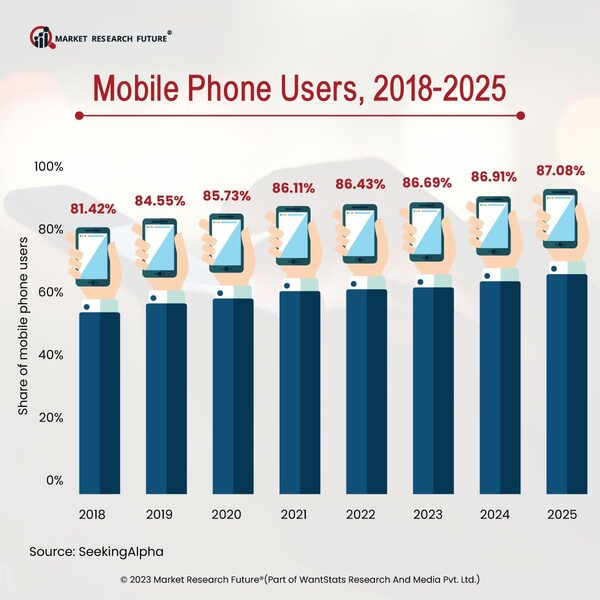

Mobile Phone Users

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

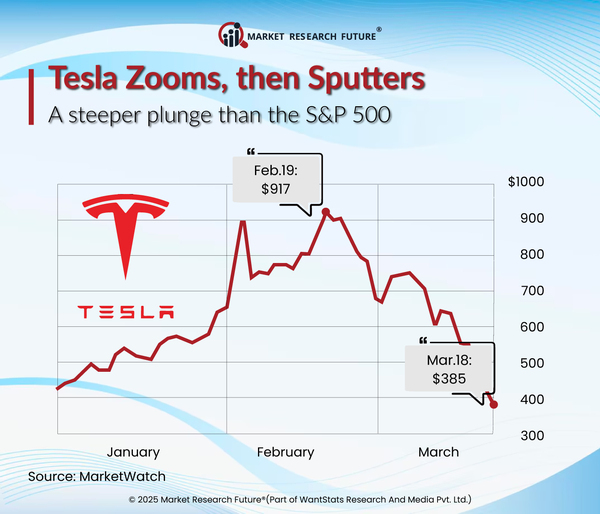

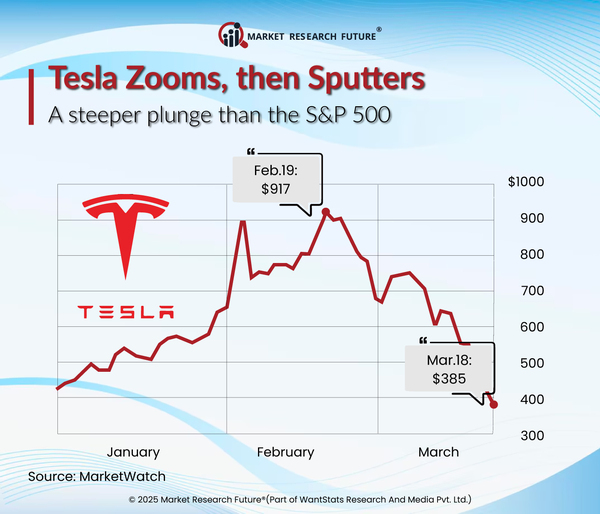

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

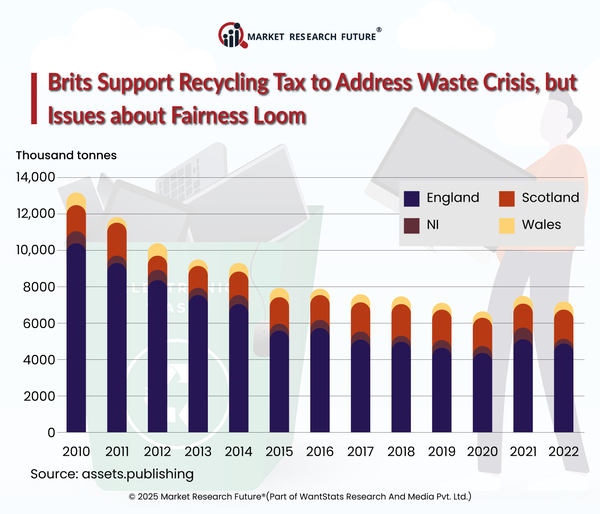

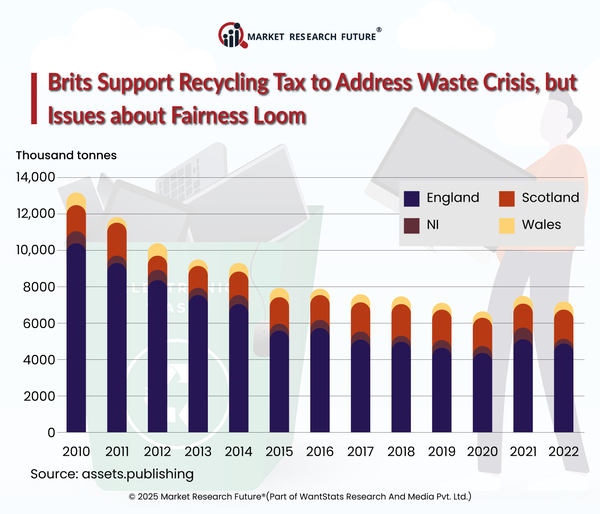

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

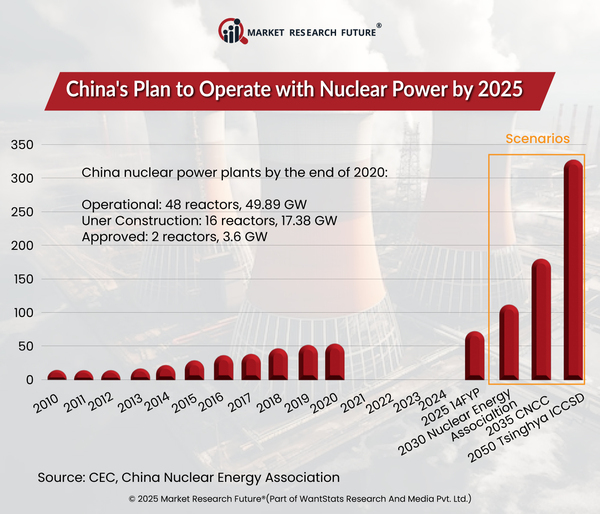

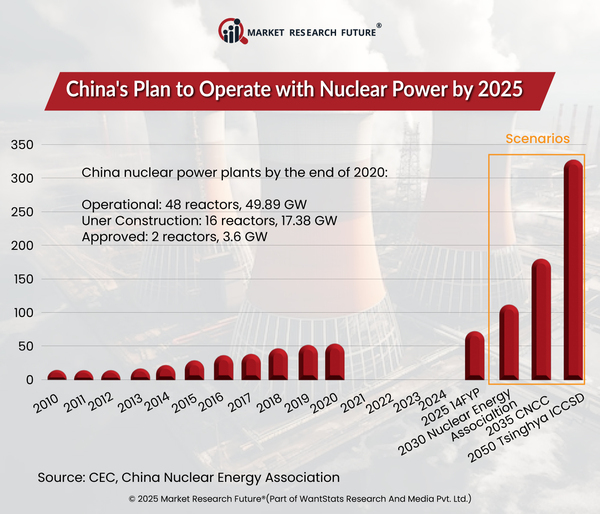

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Head Research

Latest News