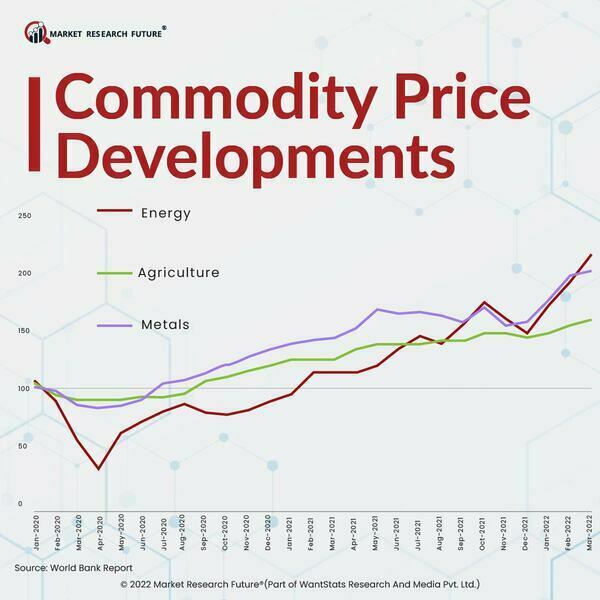

Commodity Price Increases will Adversely Affect the Building Industry

By Garvit Vyas , 26 October, 2022

According to a domestic rating agency, ICRA, a sharp rise in commodity prices and increasing competition will hurt the building industry's profitability. due to the significant increase in the prices of essential commodities, particularly steel, bitumen, and cement, the industry is struggling with pressure on input costs.

ICRA stated that "sharp increases in commodity costs, coupled with increased competition, will have a detrimental impact on industry profitability, with a projected drop in operating profitability of 100-200 basis points in the current year."

If maintained, a high increase in commodity prices seen in FY22 could lower participants' profitability in the current fiscal year by 100 to 200 basis points.

Moreover, the stringent COVID-19 lockdown in Asian countries such as China, Japan, India, and the European Union has induced severe energy crises and disruption in the supply chain. This scenario increases construction materials and equipment prices even if the year-by-year price increases are moderate.

However, improving automation in manufacturing and construction processes and focusing on infrastructure favor industrial growth. The expansion of road development initiatives carried out by various central and state governments has led to a significant increase in the market for road construction machinery in recent years.

For instance, in May 2022, Volvo construction equipment and World RX worked on developing the next generation of rallycross tracks. Volvo CE announced it would expand its commitment by becoming the series' official track-build partner.

Tata Hitachi launched the 5-tonne wheel loader ZW225- touted as the epitome of reliability and productivity that is Made-in-India with Japanese technology.Commodity Price Developments Energy

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

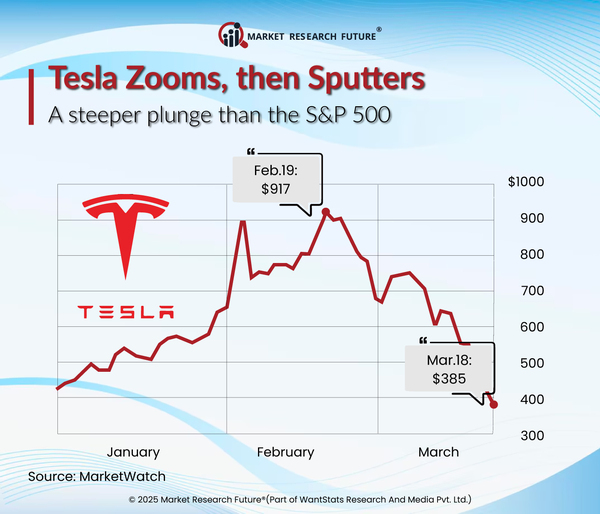

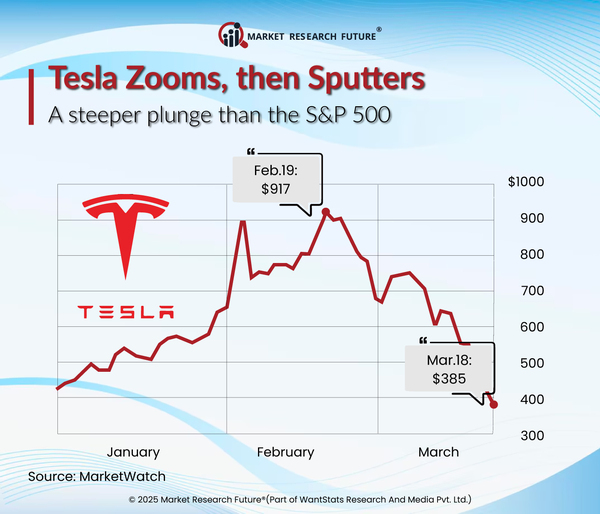

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

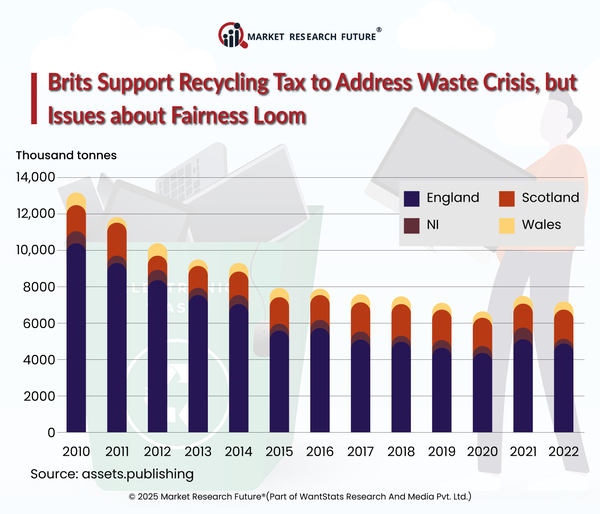

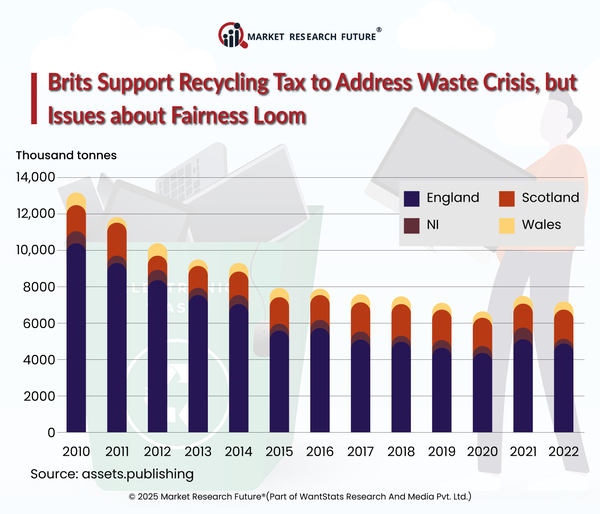

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

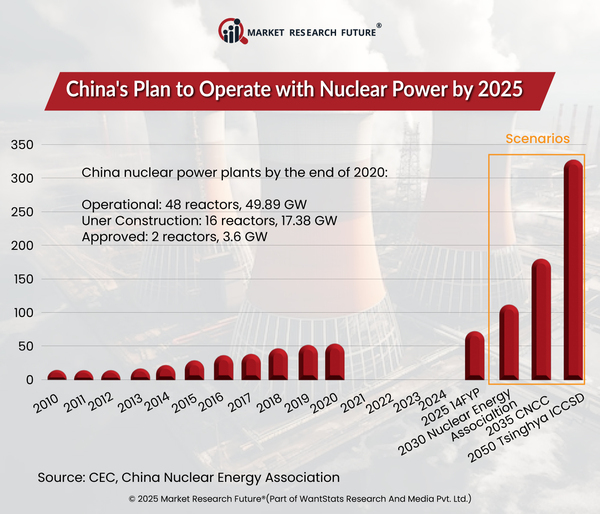

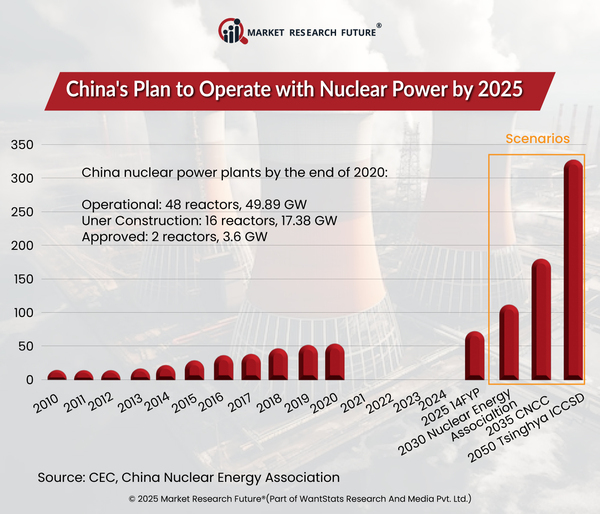

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Analyst

Latest News