China To Boost Economy With New Property Support Package

By Shubhendra Anand , 15 June, 2023

After the policies failed in China's property market, the country is working on new measures to support this sector. In non-core neighborhoods of major cities, regulators are reducing the down payment, lowering agent commissions, and inducing relaxations on restrictions for residential purchases under the guidance of the state council.

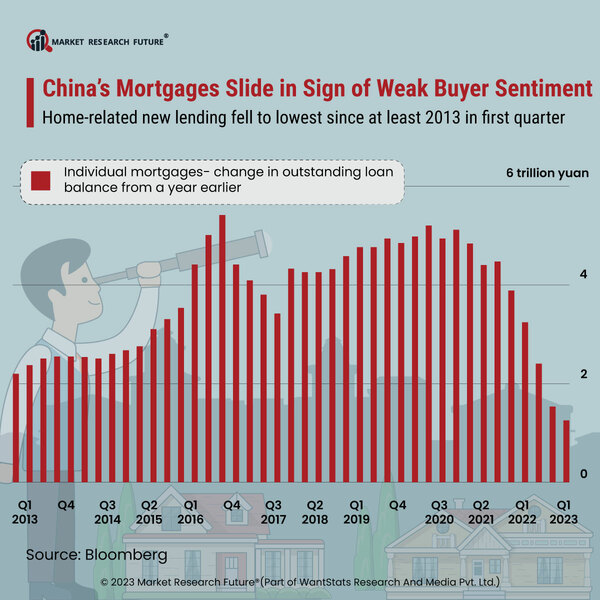

The government of China also looks forward to refining and extending some policies laid out in the sweeping 16-point rescue package it rolled out in 2022. Chinese yuan also jumped on news of the potential measures underpinning more than 0.5 percent against the dollar, the largest advance in two months. Commodities like iron ore and copper also extended gains as dollar bonds rose, which are issued by high-rated Chinese property developers. The country's property sector has neatly avoided a collapse, but it remains a key drag on the world's second-largest economy. In residential markets, a slow progression can be seen with a rebound in home sales in May to just 6.7 percent from more than 29 percent in the previous two months in 2023. According to Bloomberg Economics and Intelligence analysts, the housing sector is still sick. They also surveyed gross domestic product (GDP) to expand from 5.5 percent in 2023 from a year ago compared to the prior estimate of 5.6 percent. In April 2023, home price growth also slowed down

Bloomberg's economists view debt as equal to 12 percent of China's GDP, which is at risk of default and threatens financial stability. It is despite several support measures- lower mortgage rates for the first home buyers if house prices drop for consecutively 3 months in newly constructed houses; the nationwide cap on the real estate commissions to boost demand; and mortgaging 200 billion yuan (USD 28 billion) in particular loans to ensure stalled housing projects are delivered. Thus, China's real estate industry's downturn is a major factor weighing the Chinese market 2023.

China's Mortgages Slide in Sign of Weak Buyer Sentiment

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

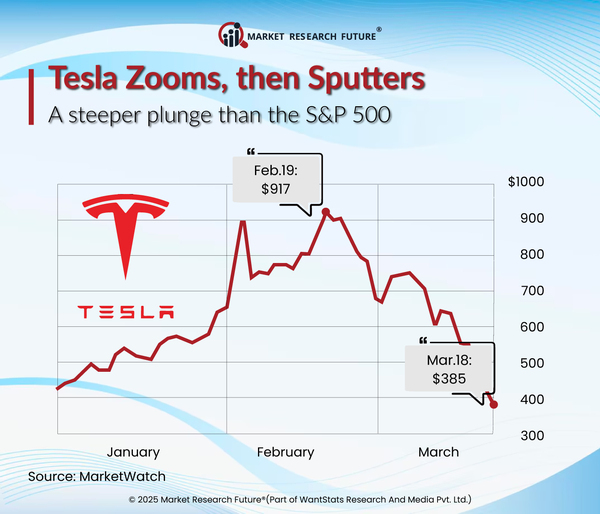

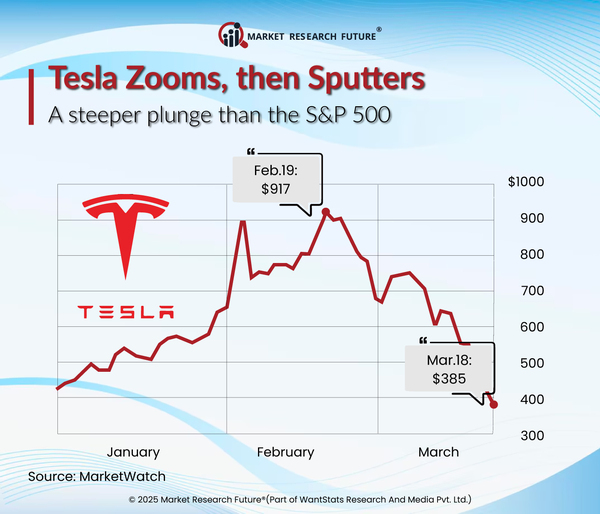

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

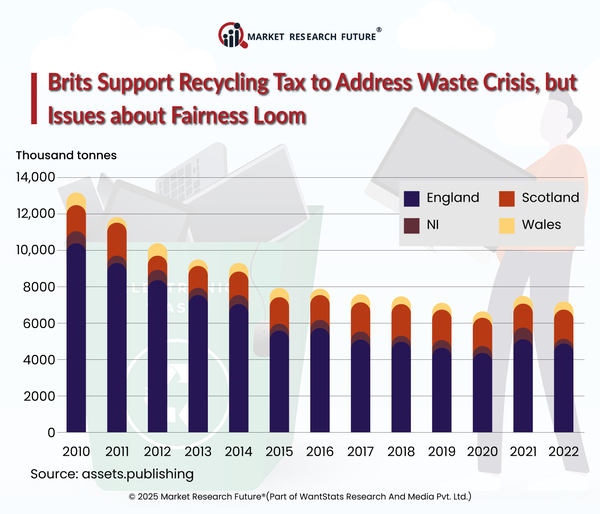

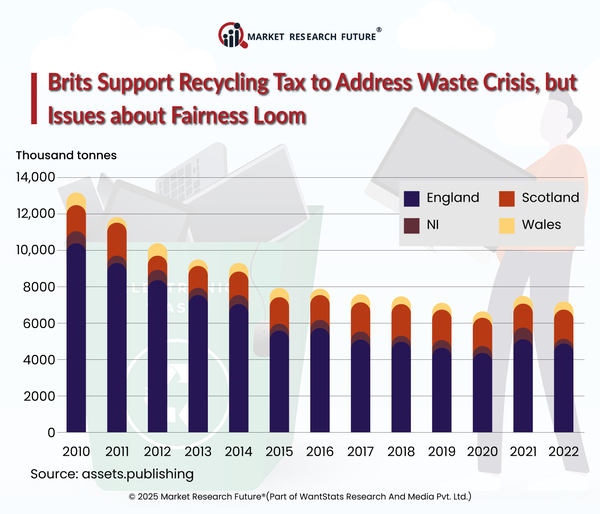

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

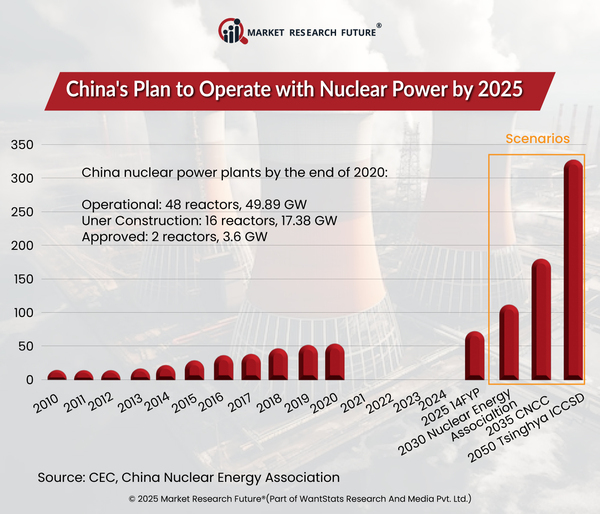

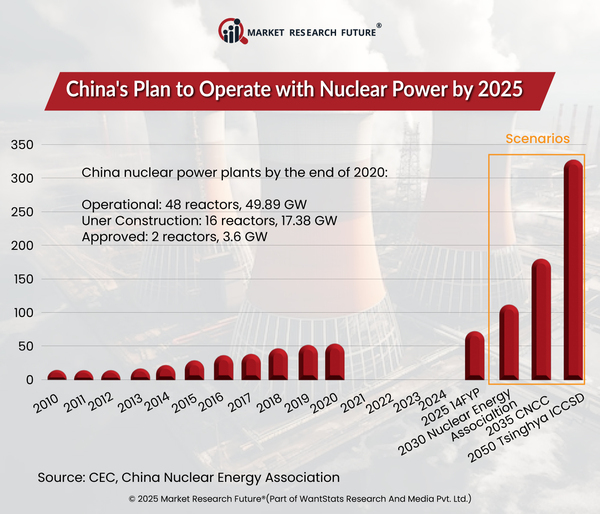

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Head Research

Latest News