Amidst Interest Rates Hike in the US Fed Stays Course

By Shubhendra Anand , 11 April, 2023

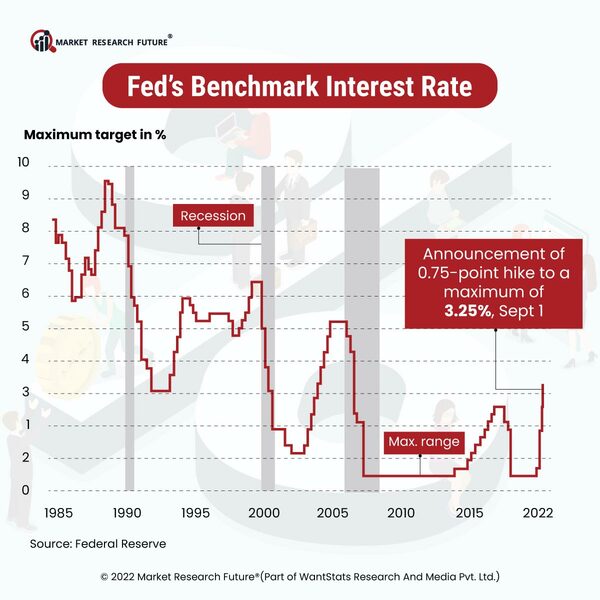

In spite of many turbulences in the banking sector, the Federal Reserve System in the U.S. decided to stay the course and keep raising the interest rates in its fight against inflation. In a two-day meeting of the Federal Open Market Committee (FOMC), Fed chairman Jerome Powell said that a modest 0.25 percent hike is bringing the target range for the federal funds' rates to 4.75 percent to again 5 percent. It is the highest level since 2007.

According to the reports in the latest economic projections, Fed expects economic growth to be slightly slower in 2023, and the inflation slightly higher than they predicted in December 2022. It has been forecasted that raising interest rates to be 5.1 percent by the end of 2023 before coming down to 4.3 percent by the end of 2024.As Mr. Powell says, "there still exists a pathway" in which the Fed might cool the economy without pushing it into recession. He added that the American banking system is "sound and resilient" and that Fed is all prepared to use all of its energy to keep it alright.

The reports reveal that Fed was forced to make a tough decision in March 2023, to balance further the risks of destabilizing the banking sector against the risk of inflation being flared up again. But towards the end, FOMC decided to stay the course even after knowing that stopping the further hikes could send the wrong message. Thus, the Fed attempts to convey confidence concerning the banking crisis with a moderate hike.

Fed acknowledges that the banking crisis may help bring down inflation, as the situation may result in tighter credit conditions for both businesses and households. Also, to weigh on the economic activity, hiring, and inflation.

Fed's Benchmark Interest Rate

Latest News

Asia has retained the position as the top oil importer in 2025, and continues to maintain that critical position in the energy sector that the world relies on. China has retained its top spot as the most prominent crude oil importer since 2013. The…

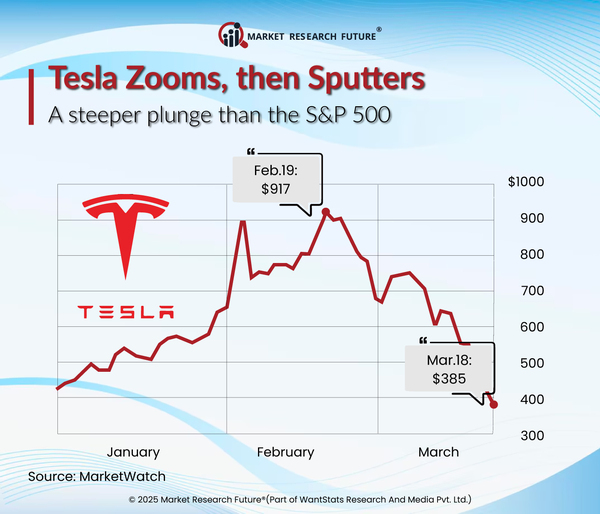

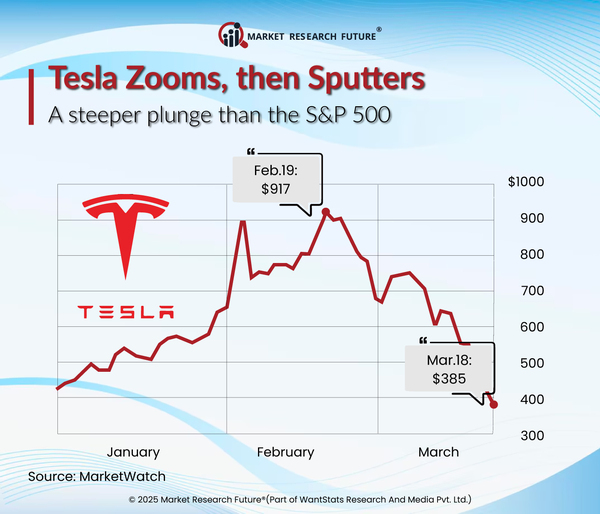

Once the clear leader in the electric vehicle (EV) sector, Tesla's European market is expected to be drastically declining in 2025. Although CEO Elon Musk is still divisive in the United States, recent registration numbers show a bleak image of…

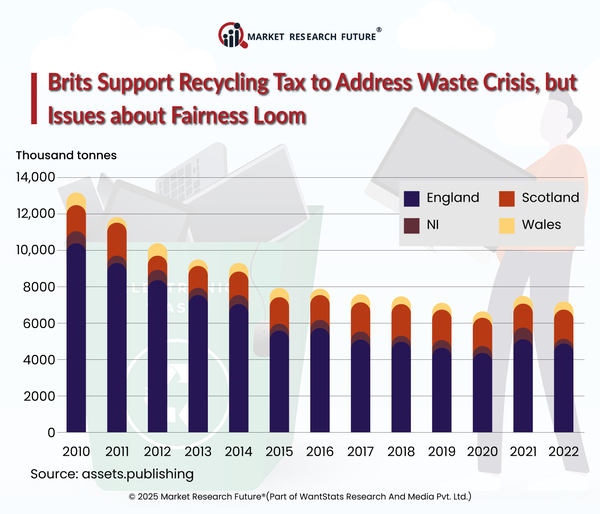

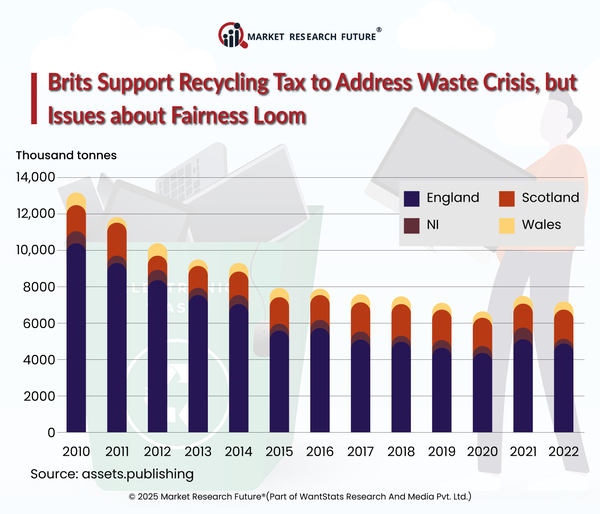

In 2025, the UK government unveiled many essential policies to address the growing trash situation, including a new plastic packaging tax and a landfill fee rise to lessen dependency on landfills. Studies show that over half of Britons support taxes…

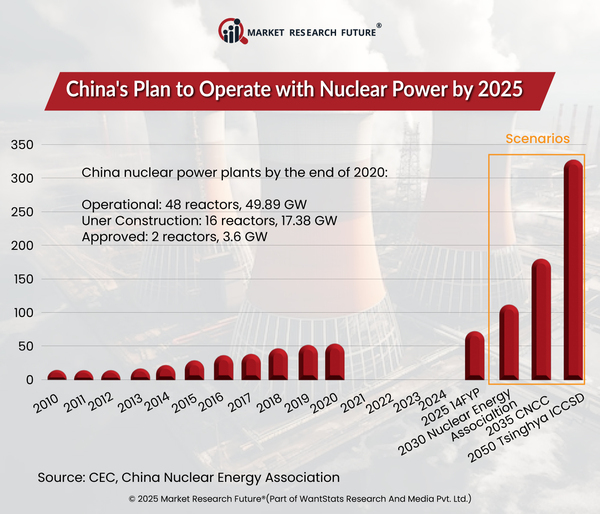

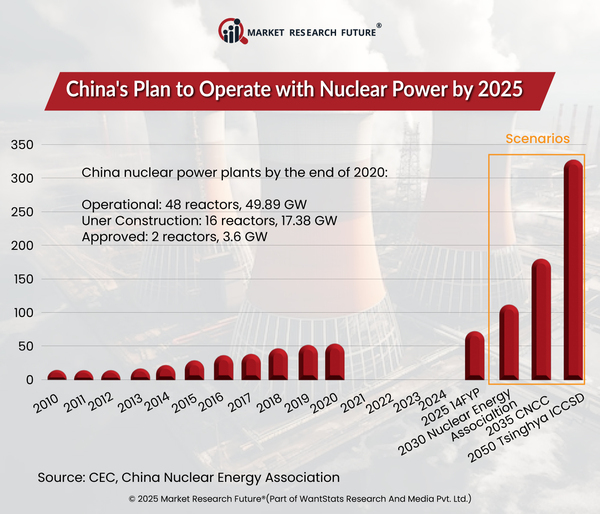

Nuclear energy capacity is growing significantly from the beginning of 2025. It is due to increasing concerns over climate change, and energy security amidst fluctuating fuel prices followed by net-zero targets set up by nations globally. Further…

Head Research

Latest News