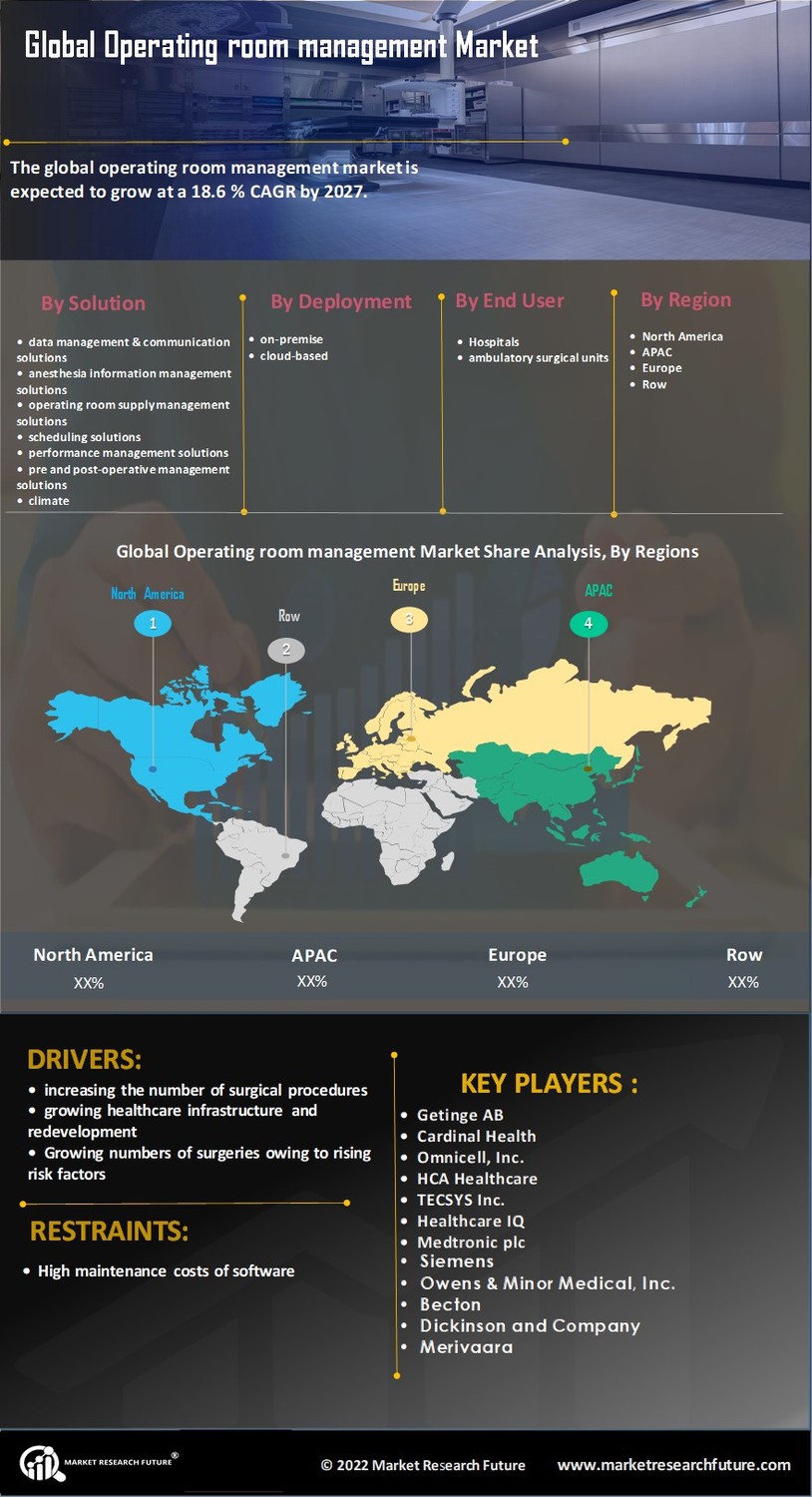

Operating room management Market Summary

As per Market Research Future Analysis, the Global Operating Room Management Market was valued at USD 2.75 billion in 2023 and is projected to reach USD 4.99 billion by 2032, growing at a CAGR of 6.46% from 2024 to 2032. The market growth is driven by hospitals' focus on cost reduction and efficiency, alongside technological advancements such as robotic surgery. The operating rooms account for approximately 70% of hospital revenues and 40% of expenditures, highlighting the importance of effective management solutions.

Key Market Trends & Highlights

Key trends driving the Operating Room Management Market include technological advancements and a focus on cost efficiency.

- Market Size in 2023: USD 2.75 billion; projected to grow to USD 4.99 billion by 2032.

- CAGR during 2024-2032: 6.46%; driven by efficiency enhancements in hospitals.

- Data management & communication solutions held ~65-67% market share in 2022.

- Cloud-based deployment segment projected to be the fastest-growing during 2023-2032.

Market Size & Forecast

2023 Market Size: USD 2.75 billion

2024 Market Size: USD 3.02 billion

2032 Market Size: USD 4.99 billion

CAGR: 6.46%

Largest Regional Market Share in 2022: North America.

Major Players

Getinge AB, Cardinal Health, Omnicell Inc., HCA Healthcare, TECSYS Inc., Healthcare I.Q., Medtronic plc, Siemens, Owens & Minor Medical Inc., Becton.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Operating Room Management Market Trends

Increasing focus on cost reduction and productivity enhancement in hospitals will boost market growth of Operating room management

Throughout the past few decades, there has been a considerable increase in the overall cost of providing healthcare, mostly due to rising health insurance premiums, growing demand for high-quality healthcare services, an aging population, and an increase in the prevalence of chronic diseases. The strong reliance on old and antiquated techniques, such as paper-based patient records, which raises readmission rates, medical mistakes, and administrative expenses, is another significant factor contributing to growing healthcare costs.

With the successful use of various healthcare I.T. solutions, numerous governments and healthcare systems worldwide are increasingly concentrating on managing rising healthcare expenses by reducing patient readmissions, medical mistakes, and administration expenditures. Operating rooms, or O.R.s, comprise around 70% of all hospital revenues while accounting for 40% of all hospital expenditures. Consequently, one of the main areas for cutting healthcare expenses is the efficient administration of operating rooms by combining and arranging all patient data for the surgical staff throughout surgery and simplifying information across numerous platforms.

Consequently, the expansion of this market in the upcoming year will be supported by hospitals' increasing attention to cost reduction and efficiency improvement. Thus, this factor is driving the market CAGR of Operating room management.

Technology advancements, like robotic surgery, are a major driver of Operating room management market revenue development. In the United States, robotic support or assistance was employed in 15% of all surgeries in 2016, while robots will carry out just 3% of surgical procedures in 2020. There have been more financing initiatives, especially in China, to support medical robot development. A Shenzhen, China-based business received series B funding from Edge Medical Robotics Series in January 2021 for USD 92.6 million. With this cash, the startup business plans to hasten the development and commercialization of its robots for minimally invasive surgery.

Further financing for the healthcare sector is also anticipated as research into creating medical robots for prosthetics, rehabilitation, psychological rehabilitation, personal care, and health monitoring advances. Thus, this aspect is anticipated to accelerate market revenue of Operating room management globally.

Operating Room Management Market Segment Insights

Operating Room Management Solution Insights

Based on Solution, the market segments of Operating room management includes Data management & communication solutions, anesthesia information management solutions, operating room supply management solutions, scheduling solutions, performance management solutions, pre-and post-operative management solutions, and climate solutions.

The Data management & communication solutions segment held the majority share in 2022, contributing around ~65-67% concerning the Operating room management market revenue.Due to advantages like easy sharing of patient status during perioperative care phases, monitoring of schedule compliance, and sharing of media and information related to cases within different operating rooms or external hospital departments, data management & communication solutions accounted for the largest share of the operating room management market.

Operating Room Management Deployment Insights

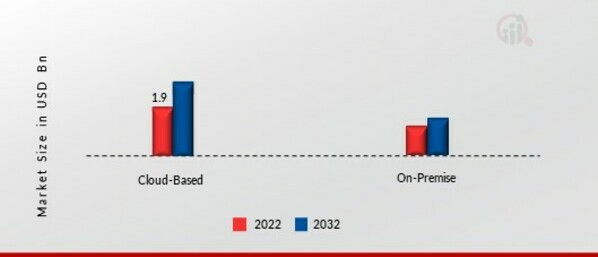

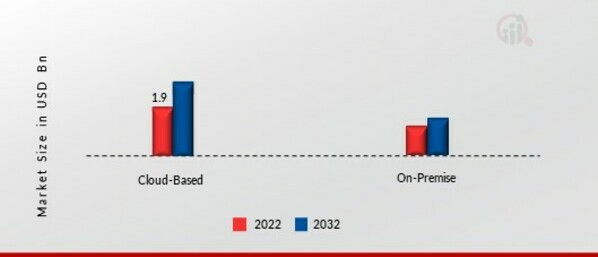

Based on Deployment, the Operating room management market segmentation includes on-premise and cloud-based. The cloud-based segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period, 2023-2032. This is mostly due to its improved efficacy and data accessibility across several platforms. Cloud computing is gradually becoming necessary in the medical sector. More healthcare providers are working with companies that offer cloud computing solutions to store and retrieve their digital information. For large and small service firms, the ability to securely store information off-site is a huge advantage.

Moreover, scalable and robust I.T. computing solutions are paving the way for the rising need for these cutting-edge technologies. Also, the pandemic promoted remote work and dependence on digital simulations, which significantly increased the requirement for the creation of cloud infrastructure. Hence, expanding government programs and incentives and boosting financing for using cloud computing in hospitals positively impacts the Operating room management market growth.

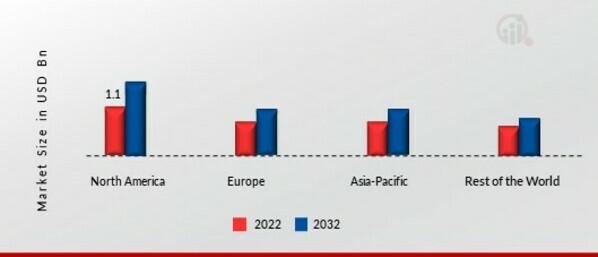

Figure 1: Operating Room Management Market, by Deployment, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Operating Room Management End Users Insights

End Users have bifurcated the Operating room management market data into Hospitals and Ambulatory surgical units. The hospitals segment dominated the market in 2022 and is projected to be the faster-growing segment during the forecast period 2024-2032. Surgical units in hospitals are frequently the most expensive and least utilized. Optimized operating room scheduling is necessary to guarantee higher surgical unit utilization rates. Moreover, inaccurate or inefficient operating room scheduling results in costly surgical cancellations or delays for both the patient and the institution. In nations of all financial levels, surgery treats most cancers in curative and comforting ways.

The American Cancer Society estimates there will be 608,570 cancer-related deaths and 1.9 million new cancer cases in the United States in 2021. Prostate, lung, and colorectal cancers are anticipated to account for 43% of all male malignancies identified in 2020.

Operating room management Regional Insights

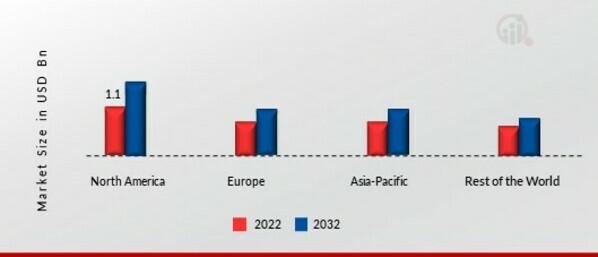

By Region, the study provides market insights into North America, Europe, Asia-Pacific and the Rest of the World. The North America, Operating room management market accounted for USD 1.145 billion in 2022 and is expected to exhibit a significant CAGR growth during the study period. The fast use of robotic surgery in this area is also propelling market revenue expansion of Operating room management. Healthcare firms' successful adoption of EHR records substantially impacts this Region's market revenue growth. Due to the rising frequency of chronic diseases, the United States market accounted for the biggest revenue share.

The major market players in this nation are launching new products and spending a lot of money to improve their market positions, causing the market to increase in revenue.

Further, the major countries studied in the market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: OPERATING ROOM MANAGEMENT MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

The second-largest revenue share in 2021 was attributed to the Europe Operating room management market. Quick technical developments in operating room management systems and breakthroughs in A.I. technology are driving significant market revenue growth Operating room management market in this area. The European Commission's proposed A.I. Act aims to safeguard A.I. security and promote the Deployment of trustworthy A.I. in E.U. economies. Due to its sophisticated healthcare system, the U.K. market accounted for the biggest revenue share. Also, increasing market participant investments will lead to the launch of innovative products, which will drive market expansion.

Further, the Germany Operating room management market held the largest market share, and the U.K. Operating room management market was the fastest-growing market in the European Region.

Due to a growing need for advanced medical equipment, the Asia Pacific Operating room management market had the third-largest sales share in 2021. Furthermore, a sizable patient base with chronic illnesses is propelling revenue development in this area. Due to major market participants in Japan, the country's market contributed the highest income. For instance, the Japanese government granted regulatory clearance to Medicaroid's Hinotori, the first robotic surgical system made in Japan, on August 7, 2020. On December 4, 2020, Japanese medical institutions will have access to the H.F.

Series Instrument, a reusable active end therapy device, and the Hinotori Surgical Robot System, a surgical robot unit. Moreover, the China market of Operating room management held the largest market share, and the India market of Operating room management was the fastest-growing market in the Asia-Pacific region.

Operating room management Key Market Players & Competitive Insights

Leading market players are investing a lot of money in R&D to expand their product portfolios, which will spur further market growth for Operating room management. With significant industry changes including new product releases, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations, market developments are also undertaking various strategic activities to expand their presence. In order to grow and remain in a market that is becoming more and more competitive, Operating room management industry competitors must provide affordable products.

Manufacturing locally to cut operational costs is one of the main business tactics used by the Operating room management industry to serve customers and increase the market sector. The Operating room management industry has recently given medicine some of the most important advantages. The market major player of Operating room management such as Getinge AB, Cardinal Health, Omnicell Inc., HCA Healthcare, TECSYS Inc., Healthcare I.Q., Medtronic plc, Siemens, Owens & Minor Medical Inc., Becton, and others are working to expand the market demand by investing in research and development activities.

Medical Information Technologies, Inc., sometimes known as Meditec, is a privately held software and service provider with headquarters in Massachusetts that creates and markets information solutions for healthcare institutions. MEDITECH (U.S.) and Steward Health Care System will collaborate in 2020. (U.S.). The partnership's main goal will be to put MEDITECH's EHR into use at 18 locations in the U.S. states of Arizona, Texas, Utah, Arkansas, and Louisiana. Steward's "One Platform" approach, which involves unifying all 35 hospitals under a single EHR, is reflected in this choice.

An Illinois-based medical corporation named Hill-Rom Services, Inc. stated on July 20, 2021, that it would introduce the Helion Integrated Surgical System to the American market. The Helion System offers operating room surgical teams the connection, adaptability, and efficient staff communications they require to optimize patient outcomes. Hillrom's vendor-neutral Helion System conveniently manages connections to Operation Room (OR) equipment and other hospital systems by balancing patient safety with operational efficiency and throughput. Helion makes vital patient information available within the OR and provides a zero-latency connection to 4K capable live video and image streams during treatments.

Key Companies in the market of Operating room management include

- Getinge AB

- Cardinal Health

- Omnicell Inc.

- HCA Healthcare

- TECSYS Inc.

- Healthcare I.Q.

- Medtronic plc

- Siemens

- Owens & Minor Medical Inc.

- Becton

Operating room management Market Developments

-

Q2 2024: Oracle launches new AI-powered operating room management platform Oracle announced the launch of its latest AI-driven operating room management solution, designed to optimize surgical scheduling and resource allocation for hospitals. The platform aims to improve efficiency and reduce costs in operating room workflows.

-

Q2 2024: Epic Systems partners with GE Healthcare to integrate operating room analytics Epic Systems and GE Healthcare entered a strategic partnership to integrate real-time analytics into operating room management software, enabling hospitals to enhance surgical throughput and patient safety.

-

Q3 2024: Medtronic receives FDA clearance for new operating room workflow automation device Medtronic announced FDA clearance for its latest device that automates key operating room workflows, including instrument tracking and post-operative reporting, aiming to reduce errors and improve surgical outcomes.

-

Q2 2024: Stryker acquires OR management software startup SurgiTech for $150M Stryker completed the acquisition of SurgiTech, a startup specializing in cloud-based operating room management software, to expand its digital health portfolio and strengthen its position in surgical workflow optimization.

-

Q1 2024: Philips launches cloud-based operating room scheduling platform Philips introduced a new cloud-based platform for operating room scheduling, targeting hospitals seeking to improve resource utilization and reduce patient wait times through advanced data analytics.

-

Q2 2024: Siemens Healthineers opens new R&D facility for operating room management solutions in Germany Siemens Healthineers inaugurated a dedicated research and development center focused on advancing operating room management technologies, including AI and interoperability solutions.

-

Q3 2024: Operating room management startup OpFlow raises $40M Series B funding OpFlow, a healthcare IT startup specializing in operating room management software, secured $40 million in Series B funding to accelerate product development and expand its market reach.

-

Q2 2024: Cerner Corporation appoints new Chief Operating Officer to lead operating room management division Cerner Corporation named a new COO to oversee its operating room management business, signaling a renewed focus on innovation and growth in surgical workflow solutions.

-

Q1 2025: Intuitive Surgical wins major contract to supply operating room management systems to UK NHS hospitals Intuitive Surgical secured a multi-year contract with the UK National Health Service to deploy its operating room management systems across several hospitals, aiming to standardize surgical workflows and improve patient outcomes.

-

Q2 2025: Johnson & Johnson launches next-generation operating room management suite Johnson & Johnson unveiled its latest suite of operating room management tools, featuring enhanced interoperability and AI-powered analytics to support complex surgical procedures.

-

Q1 2025: Philips partners with Mayo Clinic to pilot advanced operating room scheduling software Philips and Mayo Clinic announced a pilot program to test new operating room scheduling software, aiming to improve efficiency and reduce cancellations in high-volume surgical centers.

-

Q3 2025: GE Healthcare opens new manufacturing facility for operating room management devices in India GE Healthcare opened a new manufacturing plant in India dedicated to producing operating room management devices, supporting increased demand in Asia and expanding its global supply chain.

Operating room management Market Segmentation

Operating room management Solution Outlook

- Data Management & Communication

- Anesthesia Information Management

- Operating Room Supply Management

- Scheduling

- Performance Management

- Pre- And Post-Operative Management

- Climate

Operating room management Deployment Outlook

Operating room management End-User Outlook

- Hospitals

- Ambulatory surgical units

Operating room management Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

USD 2.75 billion |

| Market Size 2024 |

USD 3.02 billion |

| Market Size 2032 |

USD 4.99 billion |

| Compound Annual Growth Rate (CAGR) |

6.46% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2019 - 2021 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Product Type, Operating Platforms, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Getinge AB, Cardinal Health, Omnicell Inc., HCA Healthcare, TECSYS Inc., Healthcare I.Q., Medtronic plc, Siemens, Owens & Minor Medical Inc., Becton |

| Key Market Opportunities |

Healthcare Infrastructure Imperative as well as strategic for hospitals to manage operating rooms efficiently |

| Key Market Dynamics |

Chronic sick population Diseases are the demographic |

Operating room management Market Highlights:

Frequently Asked Questions (FAQ):

The Operating room management market size was valued at USD 2.75 Billion in 2023.

The Operating room management market is projected to grow at a CAGR of 6.43% during the forecast period, 2024-2032.

North America had the largest share in the Operating room management market.

The key players in the Operating room management market are Getinge AB, Cardinal Health, Omnicell Inc., HCA Healthcare, TECSYS Inc., Healthcare I.Q., Medtronic plc, Siemens, Owens & Minor Medical Inc., and Becton.

The Cloud-based Operating room management category dominated the market in 2023.

The Hospitals had the largest share in the Operating room management market.