Growth in Livestock Production

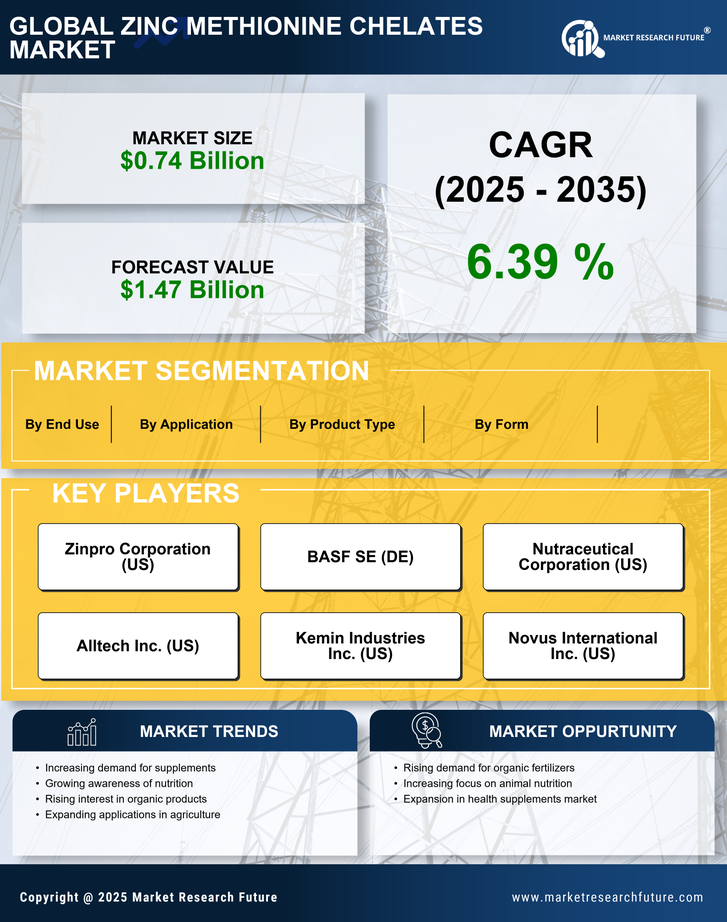

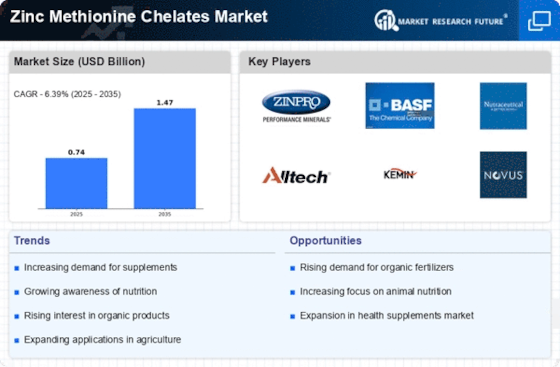

The Zinc Methionine Chelates Market is poised for growth due to the rising demand for livestock products. As the global population continues to expand, the need for meat, dairy, and eggs is increasing, driving livestock production to new heights. This growth necessitates the use of effective nutritional supplements, such as zinc methionine chelates, to ensure optimal animal health and productivity. Reports suggest that the livestock sector is expected to grow at a compound annual growth rate of approximately 3% over the next few years. This trend underscores the importance of zinc methionine chelates in supporting the health of livestock, thereby propelling the market forward.

Regulatory Support for Feed Additives

The Zinc Methionine Chelates Market benefits from favorable regulatory frameworks that support the use of feed additives. Governments and regulatory bodies are increasingly recognizing the importance of nutritional supplements in enhancing animal health and productivity. This regulatory support is crucial for the acceptance and integration of zinc methionine chelates into animal feed formulations. As regulations evolve to promote the use of safe and effective feed additives, the market for zinc methionine chelates is likely to expand. This trend indicates a growing acknowledgment of the role that such supplements play in sustainable livestock production within the Zinc Methionine Chelates Market.

Shift Towards Sustainable Farming Practices

The Zinc Methionine Chelates Market is influenced by a notable shift towards sustainable farming practices. Farmers are increasingly adopting methods that prioritize animal welfare and environmental sustainability. Zinc methionine chelates align with these practices by providing essential nutrients while minimizing waste and environmental impact. The emphasis on sustainability is driving demand for high-quality feed additives that support both animal health and ecological balance. As consumers become more conscious of the origins of their food, the market for zinc methionine chelates is expected to grow, reflecting a broader commitment to sustainable agriculture within the Zinc Methionine Chelates Market.

Increasing Awareness of Nutritional Benefits

The Zinc Methionine Chelates Market is experiencing a surge in awareness regarding the nutritional benefits of zinc in animal diets. Zinc is essential for various biological functions, including immune response and growth. As livestock producers become more informed about the advantages of zinc methionine chelates, they are increasingly incorporating these supplements into their feeding regimens. This trend is supported by research indicating that zinc methionine chelates enhance zinc bioavailability, leading to improved animal health and productivity. Consequently, the demand for these chelates is projected to rise, reflecting a broader shift towards optimizing animal nutrition in the Zinc Methionine Chelates Market.

Technological Advancements in Feed Formulation

The Zinc Methionine Chelates Market is witnessing technological advancements that enhance feed formulation processes. Innovations in feed technology are enabling the development of more effective and efficient nutritional supplements, including zinc methionine chelates. These advancements facilitate better nutrient absorption and utilization in animals, leading to improved health outcomes. As feed manufacturers adopt these technologies, the demand for zinc methionine chelates is likely to increase. This trend highlights the importance of continuous innovation in the feed industry, which is essential for meeting the evolving needs of livestock producers and ensuring the growth of the Zinc Methionine Chelates Market.