Market Analysis

In-depth Analysis of Wound Closure Devices Market Industry Landscape

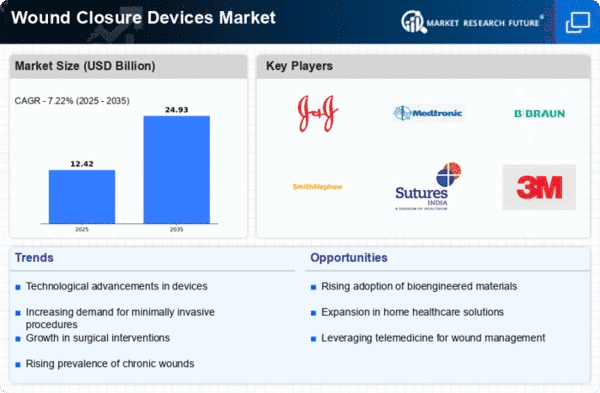

Wound closure devices market is characterized by dynamic trends fueled by rising incidence of wounds, advancement in technology and growing attention towards efficient and aesthetic wound closure solutions. Technological innovation is one primary driver shaping dynamics within wound closure devices market. The emergence of novel sutures, hemostats alongside other advanced skin-closure techniques has changed the face of wound care practices. These innovations aim at speeding up healing process through reducing marks left on patients’ body after treatment also satisfying different practitioners’ preferences.

Increasing prevalence of wounds due to surgical procedures, traumatic injuries or chronic conditions forms one major driving factor behind growth & dynamics exhibited by this medical device’s market segment relating to its classification as such when being defined either in general terms. There is increasing demand for effective and quick wound-closure solutions as the global population ages and chronic diseases become more prevalent. In a wide range of healthcare settings, advanced wound closure devices are used to ensure minimal complications, shorten healing time and aesthetically pleasing results.

Regulatory factors play an important role in shaping dynamics related to Wound Closure Devices Market. Stricter regulations and guidelines apply when it comes to approval, manufacturing and marketing of these products so that they maintain their safety, efficacy as well as quality standards. It is not possible to enter the market without complying with regulatory requirements or expect healthcare providers and patients’ trust. The development timelines, post-market surveillance systems, market entry strategies etc., for wound closure devices are influenced by this regulatory landscape.

Economic aspects and healthcare reimbursement policies also influence market dynamics. The economic burden of wound care, cost-effectiveness different closure techniques and reimbursement policies affect hospital’s choice of using wound closure devices. Critical issues such as affordability or accessibility of advanced technologies necessary in closing wounds make them be widely spread particularly within resource-constrained healthcare institutions.

Leave a Comment