Market Trends

Key Emerging Trends in the Wood Chipper Market

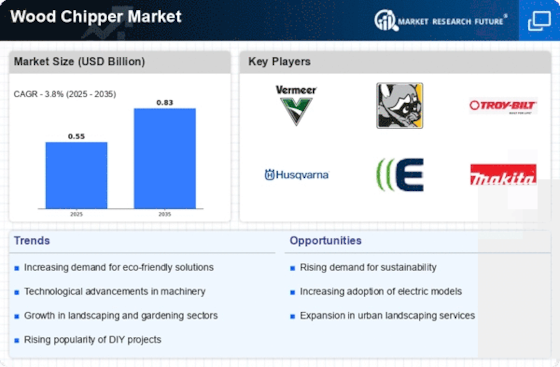

The wood chipper market is experiencing significant trends driven by several factors influencing both demand and supply dynamics. One noticeable trend is the increasing emphasis on sustainability and environmental conservation, prompting a shift towards more eco-friendly and efficient wood chipping solutions. This trend is fueled by growing awareness among consumers and regulatory bodies regarding the importance of reducing carbon footprints and preserving forests. As a result, manufacturers are innovating to develop wood chippers that are more energy-efficient, produce fewer emissions, and utilize sustainable materials in their construction.

Another prominent trend in the wood chipper market is the rise of compact and portable models. With the expansion of landscaping and gardening activities in both residential and commercial sectors, there is a growing demand for smaller, maneuverable wood chippers that can easily access tight spaces and handle smaller volumes of wood waste. These compact models are favored by homeowners, landscaping professionals, and small-scale businesses for their convenience and versatility.

Furthermore, technological advancements are playing a crucial role in shaping market trends. Manufacturers are integrating cutting-edge features such as advanced safety mechanisms, remote monitoring capabilities, and automation to enhance the efficiency and user experience of wood chippers. These technological innovations not only improve productivity but also contribute to the overall safety of operators and bystanders, thereby driving adoption among a wider range of users.

The wood chipper market is also witnessing a trend towards customization and specialization. As the requirements of end-users become more diverse and specific, there is a growing demand for tailor-made wood chipping solutions that can meet unique needs and applications. Manufacturers are offering a range of customization options, including different power sources, chipping capacities, and cutting mechanisms, to cater to various industries such as forestry, agriculture, construction, and landscaping.

Moreover, the market is experiencing increased competition, leading to price competitiveness and product differentiation. With the entry of new players and the expansion of existing manufacturers into new geographical regions, there is a greater emphasis on product innovation and value-added services to gain a competitive edge. This competitive landscape is driving manufacturers to continuously improve their offerings in terms of performance, durability, and cost-effectiveness to attract and retain customers in a crowded market.

On the supply side, the wood chipper market is influenced by factors such as raw material availability, manufacturing processes, and distribution networks. Fluctuations in wood supply, driven by factors such as weather conditions, forest management policies, and logging activities, can impact the production and pricing of wood chippers. Additionally, advancements in manufacturing technologies, such as CNC machining and 3D printing, are enabling manufacturers to produce wood chippers more efficiently and cost-effectively, leading to greater economies of scale and lower prices for consumers.

Leave a Comment