Wireless Iot Sensors Size

Wireless IoT Sensors Market Growth Projections and Opportunities

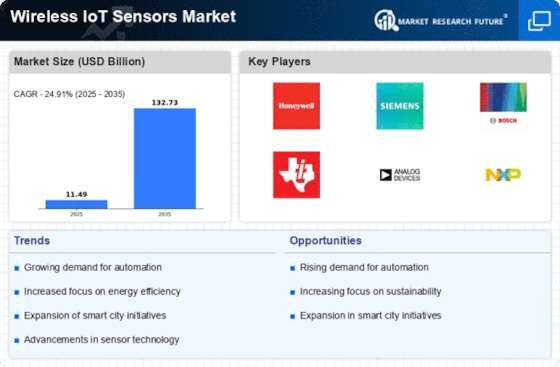

The expansion of the global wireless IoT sensors market is propelled by several factors, including the increasing adoption of connected wearable devices and the continual rise in internet penetration. However, potential obstacles to market growth lie in concerns related to data security and the inherent risk of operational failures.

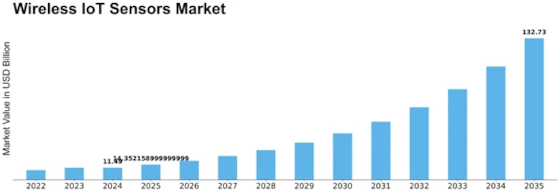

Projections for the global wireless IoT sensors market indicate a robust Compound Annual Growth Rate (CAGR) of approximately 32.87% during the forecast period, aiming to reach a substantial valuation of USD 40,728.6 million by 2025. In the landscape of 2018, North America emerged as the dominant force, commanding a market share of 36.20%, closely followed by Europe and Asia-Pacific, with shares of 26.61% and 23.45%, respectively.

The market's comprehensive segmentation is based on type, component, technology, vertical, and region. Among these, the image sensor segment seized the forefront in 2018, securing a share of 14.25%, equivalent to USD 850.6 million. Forecasts anticipate the image sensor segment to sustain its dominance, projecting the highest CAGR of 31.71% from 2019 to 2025. In terms of components, the hardware segment took the lead with a commanding market share of 56.15% in 2018, translating to a value of USD 3,352.7 million. Expectations point to the hardware segment maintaining its prominence, with the highest projected CAGR of 32.66% from 2019 to 2025. In the realm of technology, the Wi-Fi segment led the market in 2018, holding a share of 27.40% and accounting for USD 1,635.8 million. Foreseen as the frontrunner, the Wi-Fi segment is anticipated to achieve the highest CAGR of 32.95% from 2019 to 2025. Moving on to verticals, the Industrial IoT segment dominated in 2018, claiming a share of 40.87% and contributing USD 2,440.5 million. This segment is poised to sustain its dominance, with the highest projected CAGR of 33.23% from 2019 to 2025.

While the growth prospects of the global wireless IoT sensors market appear promising, potential impediments loom, specifically related to concerns regarding data security and the risk of operational failures. As technological advancements drive the evolution of IoT sensors, stakeholders must navigate these challenges to harness the market's full potential. In summary, the market's trajectory is marked by significant growth, propelled by key drivers, yet tempered by challenges that necessitate strategic considerations for sustained success in this dynamic landscape.

Leave a Comment