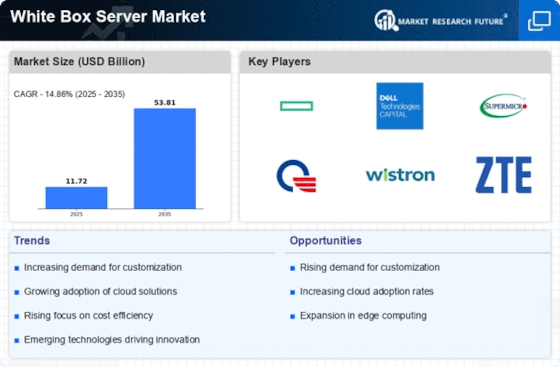

Top Industry Leaders in the White Box Server Market

Competitive Landscape of White Box Server Market:

The competitive landscape of the White Box Server market is characterized by dynamic shifts and strategic maneuvers, as key players vie for dominance in this rapidly evolving sector. Several factors contribute to the complex ecosystem, ranging from technological advancements to market trends and emerging players. Understanding the competitive dynamics is crucial for businesses seeking to navigate this space effectively.

Key Players:

- Silicon Mechanics

- Quanta Computer Inc.

- ZT Systems

- Penguin Computing

- Inventec Corporation

- Celestica Inc.

- Servers Direct

- MiTAC Holdings Corp.

- Wistron Corporation

- Stack Velocity Group

- Compal Electronics

- Hon Hai Precision Industry Company Ltd.

- Hyve Solutions

- Super Micro Computer Inc.

Strategies Adopted:

- Customization Focus: Key players are increasingly emphasizing customization to meet specific client needs, allowing businesses to optimize their IT infrastructure.

- Partnerships and Collaborations: Strategic alliances with software vendors and technology partners enable white box server providers to enhance their offerings and provide comprehensive solutions.

- Cost Competitiveness: With a focus on cost-effective solutions, companies are adopting strategies to streamline manufacturing processes and reduce overall production costs.

Factors for Market Share Analysis:

- Technological Innovation: The ability to incorporate cutting-edge technologies, such as advanced processors and storage solutions, plays a pivotal role in gaining market share.

- Global Presence: Companies with a robust global presence can tap into diverse markets, catering to the evolving needs of clients across different regions.

- Service Offerings: The range of services offered, including maintenance, support, and upgrade options, contributes significantly to market share, as businesses seek comprehensive solutions.

New and Emerging Companies:

- ZT Systems: As an emerging player, ZT Systems has gained traction by focusing on energy-efficient white box server solutions, attracting environmentally conscious clients.

- Wiwynn Corporation: Wiwynn Corporation has carved a niche by specializing in hyperscale data center solutions, addressing the growing demand for high-performance computing.

- Hyve Solutions: With a focus on open standards and modular designs, Hyve Solutions is an emerging player offering scalable white box server solutions.

Current Company Investment Trends:

- Research and Development: Key players are allocating substantial resources to research and development, aiming to stay at the forefront of technological advancements and meet evolving market demands.

- Global Expansion: Investments in expanding global footprints are evident, with companies establishing a presence in emerging markets to tap into new opportunities.

- Sustainability Initiatives: Many companies are investing in sustainable practices, aligning with the growing trend of environmentally conscious business operations.

Latest Company Updates:

October 2023: Dell Technologies announces a new line of white box servers aimed at challenging traditional market leaders like Hewlett Packard Enterprise (HPE).

November 2023: Open Compute Project (OCP) releases new specifications for liquid cooling technology in servers, potentially improving performance and efficiency of white box systems.

December 2023: Chinese tech giant Huawei unveils its own line of white box servers, targeting the growing domestic cloud computing market.

January 10, 2024: Intel releases its next-generation Xeon Scalable processors, which are expected to be widely adopted in white box servers due to their performance and price competitiveness.