Market Trends

Key Emerging Trends in the Welding Materials Market

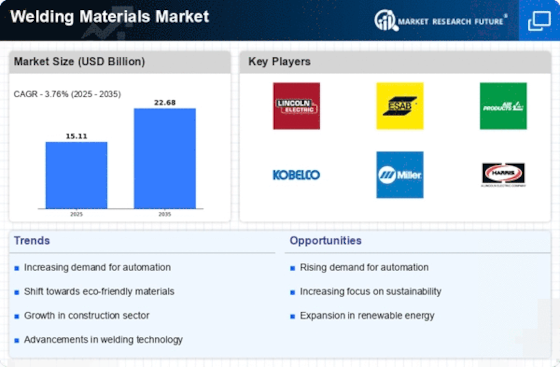

The welding materials market has seen positive market shifts of late, which are created by the influence of current market trends in changing the industry scene. However, an important upshot is the concomitant growth of innovative welding technologies and materials. As new trends arise in the industries where efficiency and precision are at the heart of metalworking, the demand for cutting-edge material such as those that have appropriate strength, wear resistance and flexibility endures to rise. Additionally, although in almost every industry requirement for high performance welding technology attracts additional attention.

Besides, the ESG (environmental, social and governance) principle which involves the emphasis on the sustainability and environmental issues is another key driver of the welding materials market. As manufacturers and the end-users familiar with new tendencies favour eco-friendly products, processes, and materials, they are pointing to the need of welding materials that, while meeting all performance and quality requirements, are compliant with strict environmental standards. The material changes show that in the recent time, there has been a shift towards using materials produced from sustainable processes with a low environmental impact. This trend is not evolved only due to the regulators but it also characterizes a broader industry determination in being responsible and ethical.

With the increase in the number of industries and going global, demanding factors and more varied operating environments have become imminent. Such improvement has created welding materials with more utmost versatility, enabling them to suit different jobs that are in different sectors and in different places. The necessity for a compatibility and dependable performance materials that can operate in the global scope is among all the factors that contribute to the growth of the demand for welders.

Also, technological improvements cannot be denied to have any impact on what the trends are in this field of market. The moved towards the use of weld automation and robotics is creating a more urgent need for materials which are are able to withstand the hazards of more sophisticated welding techniques.

Price instability in basic materials is an aspect that should be taken into consideration while dealing with a topic of a fashion market trends in a welding materials sector. Shifts in the value of the requisite raw materials that are given the name as metals and alloys, in fact, significantly affect the whole welding materials selling price. Both the manufacturers and the consumers/end users alike carry out their price monitoring in a serious manner and make efforts to avoid the blow on their margins by the changing prices. Thus, it is relevant that that the supply chain cost and efficient supply chain management become a huge area of interest in welding markets.

Leave a Comment