Water Soluble Polymer Size

Market Size Snapshot

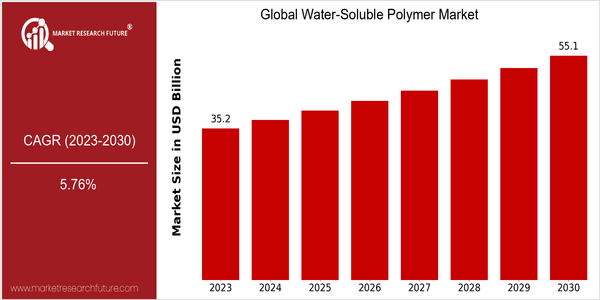

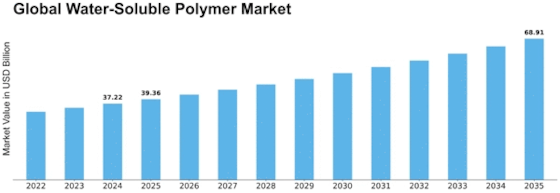

| Year | Value |

|---|---|

| 2023 | USD 35.19 Billion |

| 2030 | USD 55.1 Billion |

| CAGR (2023-2030) | 5.76 % |

Note – Market size depicts the revenue generated over the financial year

The water-soluble polymers market is expected to reach $36.9 billion by 2023 and $57.4 billion by 2030, at a CAGR of 5.76% during the forecast period. The high growth rate of this market is mainly due to the wide application of water-soluble polymers in various industries, such as pharmaceuticals, food and beverages, personal care, and agriculture. In addition, the growing demand for sustainable and eco-friendly materials is driving the development of water-soluble polymers, which are biodegradable alternatives to traditional plastics. Also, a number of innovations and technological developments have contributed to the expansion of the market. For instance, the development of high-performance water-soluble polymers that enhance product efficacy in applications such as drug delivery systems and agricultural coatings is gaining momentum. The leading companies, such as BASF SE, The Dow Chemical Company, and Ashland Inc., are investing heavily in research and development activities to launch new products and improve existing formulations. Strategic initiatives, such as acquisitions, mergers, and collaborations, are also gaining momentum, which will help the companies to meet the growing demand for water-soluble polymers in the coming years.

Regional Market Size

Regional Deep Dive

The market for water-soluble polymers is characterised by its many applications in food, pharmaceuticals, and personal care. Each region is shaped by its own dynamics, influenced by local demand, regulations, and technological developments. The market is set to grow as industries increasingly turn to water-soluble polymers for their eco-friendly properties and versatility, and as product development is driven by a strong emphasis on both sustainability and innovation.

Europe

- In Europe the development of the market for water-soluble polymers is at its most active, and a considerable amount of research and development is directed towards the production of new materials for various applications. The European Union's Green Deal initiative encourages the transition to a sustainable economy, which also affects the market in a positive way.

- Key players like Evonik Industries and Solvay are actively involved in developing new formulations that cater to the growing demand for eco-friendly products, particularly in the personal care and agricultural sectors.

Asia Pacific

- A region of the world undergoing rapid industrialization and urbanization, such as the Asia-Pacific region, is in need of water-soluble polymers, especially in the textile and building industries. Such countries as China and India are the main drivers of this market, and local companies such as Shandong Yulong and Zhejiang Jianye are expanding their production capacity.

- Innovations in manufacturing processes, such as the use of advanced polymerization techniques, are enhancing the quality and performance of water-soluble polymers, making them more appealing to various industries in the region.

Latin America

- In Latin America, water-soluble polymers are gradually becoming more and more used, particularly in the agricultural sector, where they are used to increase the yield and the water-saving capacity of crops. Local companies are beginning to see the value of these polymers in sustainable farming.

- Regulatory frameworks in countries like Brazil are evolving to support the use of biodegradable materials, which is expected to drive the growth of the water-soluble polymer market as manufacturers align their products with these regulations.

North America

- The American market is seeing a sharp rise in demand for biodegradable polymers, with the demand being driven by a combination of increasing environmental regulations and consumers’ growing preference for sustainable products. The companies like BASF and Ashland are investing heavily in R&D in order to develop new products that meet these demands.

- Recent regulatory changes, such as the U.S. Environmental Protection Agency's initiatives to promote sustainable materials, are encouraging manufacturers to shift towards water-soluble polymers, enhancing their market presence and competitiveness.

Middle East And Africa

- The water-soluble polymers market in the Middle East and Africa is driven by the growing oil and gas industry, where these polymers are used in the process of improving oil recovery. The demand for water-soluble polymers is growing rapidly in this region, and companies such as SNF Floerger are establishing production facilities in the Middle East and Africa.

- The region's unique climatic conditions and water scarcity issues are prompting investments in water management solutions, including the use of water-soluble polymers in agriculture to improve water retention and soil quality.

Did You Know?

“Water-soluble polymers can absorb up to 300 times their weight in water, making them highly effective in applications such as agriculture and personal care products.” — Journal of Applied Polymer Science

Segmental Market Size

The water-soluble polymer market is expected to grow at a CAGR of 4.3 percent over the forecast period, led by the increasing demand from the pharmaceutical, food and beverage, and personal care industries. This market is crucial for manufacturers looking to enhance their product formulations and improve performance characteristics. The demand for water-soluble polymers is expected to increase due to the growing need for biodegradable materials and the strict regulations imposed by the government on the use of sustainable materials. In addition, technological advancements in polymer chemistry are enabling the development of new and advanced water-soluble polymers to suit different applications. The water-soluble polymer market is currently at a mature stage, with leading companies such as BASF and Ashland deploying these products across their product lines. The key applications of these polymers are as thickeners in the personal care and pharmaceutical industries. The increasing demand for water-soluble polymers is attributed to the growing focus on sustainable materials and the growing health issues. The development of biopolymer technology, such as the use of natural sources for polymer production, is also expected to have a positive impact on the growth of this market.

Future Outlook

OVERVIEW OF WATER-SOLUBLE POLYMER MARKET : The global water-soluble polymer market is expected to expand significantly from 2023 to 2030, at a CAGR of 5.76%. The growth in this market is due to the rising demand for water-soluble polymers from various industries such as pharmaceuticals, food & beverage, and personal care. In addition, water-soluble polymers are increasingly being used in the food industry because of their biodegradable properties. Further, government support and technological advancements are expected to drive the market. These advancements in chemistry have led to the development of new formulations that have enhanced properties such as solubility and viscosity, thereby expanding their scope of application. The government’s focus on reducing plastic waste is also expected to boost the market. Further, the increasing usage of these polymers in drug delivery systems and agricultural applications is expected to drive their demand. In short, the global water-soluble polymer market is expected to grow significantly, owing to the growing demand from various industries, technological advancements, and changing customer preferences.

Leave a Comment