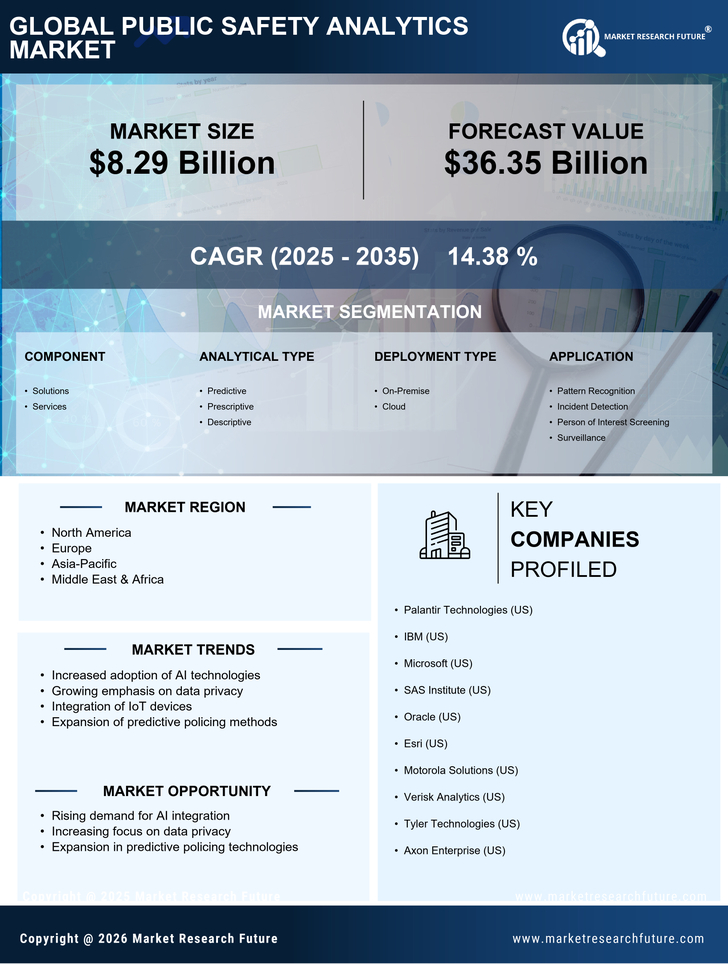

Public Safety Analytics Market Summary

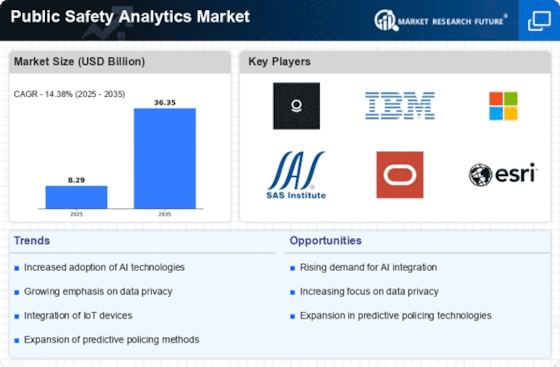

As per Market Research Future analysis, the Public Safety Analytics Market Size was estimated at 8.29 USD Billion in 2024. The Public Safety Analytics industry is projected to grow from 9.482 USD Billion in 2025 to 36.35 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 14.38% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Public Safety Analytics Market is experiencing robust growth driven by technological advancements and increasing demand for real-time data solutions.

- The integration of Artificial Intelligence is transforming public safety analytics, enhancing predictive capabilities.

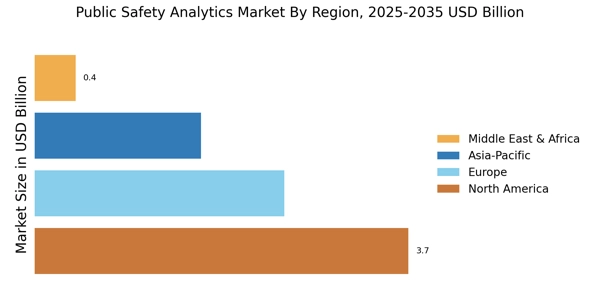

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for public safety solutions.

- Solutions dominate the market, yet services are rapidly gaining traction as organizations seek comprehensive support.

- Rising crime rates and government initiatives are key drivers propelling the demand for advanced public safety analytics.

Market Size & Forecast

| 2024 Market Size | 8.29 (USD Billion) |

| 2035 Market Size | 36.35 (USD Billion) |

| CAGR (2025 - 2035) | 14.38% |

Major Players

Palantir Technologies (US), IBM (US), Microsoft (US), SAS Institute (US), Oracle (US), Esri (US), Motorola Solutions (US), Verisk Analytics (US), Tyler Technologies (US), Axon Enterprise (US)