Market Growth Projections

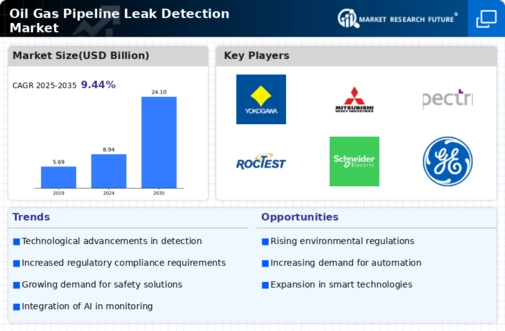

The Global Oil Gas Pipeline Leak Detection Market Industry is poised for substantial growth, with projections indicating a market size of 24.1 USD Billion by 2035. This growth is underpinned by a compound annual growth rate (CAGR) of 9.44% from 2025 to 2035. The increasing emphasis on safety, regulatory compliance, and technological advancements are key factors contributing to this upward trajectory. As the industry evolves, stakeholders are likely to explore innovative solutions to enhance leak detection capabilities, ensuring the integrity of pipeline operations in a rapidly changing energy landscape.

Increasing Regulatory Compliance

The Global Oil Gas Pipeline Leak Detection Market Industry is experiencing a surge in demand due to stringent regulatory frameworks aimed at environmental protection. Governments worldwide are enforcing regulations that mandate the implementation of advanced leak detection systems to minimize environmental risks. For instance, the U.S. Pipeline and Hazardous Materials Safety Administration has set forth regulations that require operators to adopt technologies that can detect leaks promptly. This regulatory pressure is expected to drive the market's growth, as companies seek to comply with these standards and avoid hefty fines. As a result, the market is projected to reach 8.94 USD Billion in 2024.

Focus on Environmental Sustainability

The Global Oil Gas Pipeline Leak Detection Market Industry is increasingly shaped by a growing focus on environmental sustainability. As public awareness of environmental issues rises, companies are under pressure to adopt practices that minimize their ecological footprint. Effective leak detection systems are crucial in preventing spills that can lead to environmental disasters. This trend is prompting investments in advanced technologies that not only comply with regulations but also demonstrate corporate responsibility. The commitment to sustainability is expected to drive market growth, as companies recognize the long-term benefits of investing in leak detection solutions.

Investment in Infrastructure Development

The Global Oil Gas Pipeline Leak Detection Market Industry is benefiting from substantial investments in infrastructure development. Governments and private entities are allocating significant resources to upgrade and expand pipeline networks, particularly in emerging economies. This investment is often accompanied by the implementation of modern leak detection technologies to ensure safety and reliability. As these infrastructure projects progress, the demand for effective leak detection systems is likely to increase, contributing to the market's expansion. By 2035, the market is anticipated to reach 24.1 USD Billion, reflecting the critical role of infrastructure in driving technological adoption.

Rising Demand for Energy and Oil Products

The Global Oil Gas Pipeline Leak Detection Market Industry is also driven by the increasing demand for energy and oil products. As global populations grow and economies expand, the need for reliable energy sources intensifies. This demand necessitates the expansion of pipeline networks, which in turn raises the stakes for effective leak detection systems. The market is projected to grow at a CAGR of 9.44% from 2025 to 2035, reflecting the urgency for enhanced safety measures in pipeline operations. Companies are investing in leak detection technologies to ensure the integrity of their pipelines and to meet the rising energy demands.

Technological Advancements in Detection Systems

The Global Oil Gas Pipeline Leak Detection Market Industry is significantly influenced by rapid technological advancements. Innovations such as fiber optic sensors, acoustic monitoring, and drone surveillance are enhancing the accuracy and efficiency of leak detection systems. These technologies allow for real-time monitoring and data analysis, which can lead to quicker response times in the event of a leak. For example, the integration of artificial intelligence in monitoring systems is proving to be a game-changer. As these technologies continue to evolve, they are likely to attract investments, further propelling the market's growth trajectory.