Market Share

Veterinary Laboratory Testing Market Share Analysis

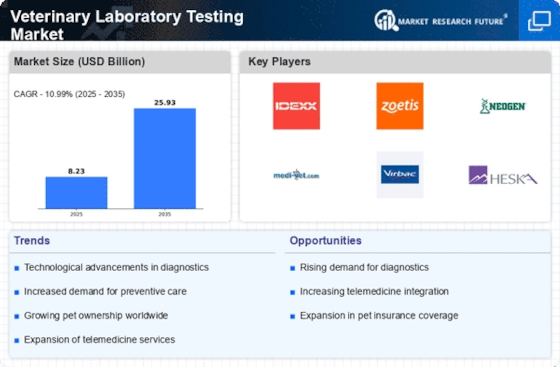

The veterinary laboratory testing market performs a crucial role in ensuring the fitness and well-being of animals. As the demand for advanced diagnostic offerings in veterinary care grows, organizations inside this sector implement various market proportion positioning strategies to establish themselves as leaders within the competitive landscape of Veterinary Laboratory Testing. Market leaders' cognizance of increasing their variety of veterinary laboratory exams to cover a large spectrum of diseases and situations. By offering specialized checks for diverse animal species, companies cater to the numerous needs of veterinary practitioners. This approach positions them as comprehensive providers of diagnostic solutions, attracting a bigger customer base and securing a large marketplace share. To stay beforehand within the marketplace, agencies prioritize investments in modern-day diagnostic technologies. Embracing innovations such as molecular diagnostics, genetic testing, and superior imaging strategies complements the accuracy and pace of veterinary diagnoses. This commitment to technological advancement positions businesses as leaders in the field, attracting veterinary specialists searching for brand-new diagnostic skills. Building sturdy partnerships with veterinary clinics and hospitals is a key marketplace positioning strategy. Collaborations permit agencies to set up a network of distribution and provider points. By aligning with set-up veterinary establishments, organizations have the advantage of credibility and agreement within the veterinary community, which contributes to a bigger marketplace share. Companies aiming for marketplace dominance frequently adopt a worldwide growth approach. Expanding offerings to distinctive regions calls for compliance with numerous regulatory requirements. Companies that correctly navigate worldwide regulatory landscapes position themselves as dependable and sincere carriers of Veterinary Laboratory Testing services, taking pictures of a broader marketplace share. Tailoring checking out packages to deal with the unique wishes of various animal categories is a strategic method. Companies increase specialized testing solutions for companion animals, cattle, and exotic species. This customization no longer only caters to the unique requirements of different veterinary practices but also positions the corporation as a versatile and complete company of laboratory checking-out offerings. Embracing telemedicine and virtual structures is a developing trend in veterinary diagnostics. Companies offer online structures for taking a look at requests, effects delivery, and consultation services. By integrating digital answers, businesses decorate accessibility and comfort for veterinary experts, positioning themselves as current and adaptive vendors in the evolving panorama of veterinary care.

Leave a Comment