Investment in Research and Development

The Vector Control Market is witnessing a significant increase in investment in research and development (R&D) aimed at discovering novel vector control solutions. As the threat of vector-borne diseases continues to evolve, there is a pressing need for innovative approaches that can effectively address emerging challenges. Funding from both public and private sectors is being directed towards the development of new insecticides, biological control agents, and integrated pest management strategies. This focus on R&D is expected to yield breakthroughs that enhance the effectiveness and sustainability of vector control measures. Moreover, collaborations between academic institutions, research organizations, and industry players are likely to foster innovation within the Vector Control Market, ultimately leading to improved health outcomes and reduced disease transmission.

Regulatory Support and Policy Frameworks

The Vector Control Market is significantly influenced by regulatory support and the establishment of robust policy frameworks aimed at vector-borne disease management. Governments and health organizations are increasingly recognizing the importance of vector control in public health, leading to the implementation of policies that promote research, funding, and the adoption of innovative control measures. For example, initiatives such as the WHO's Global Vector Control Market Response emphasize the need for coordinated efforts in vector management. This regulatory backing not only fosters investment in the Vector Control Market but also encourages collaboration among stakeholders, including public health agencies, private sector players, and non-governmental organizations. As a result, the market is expected to expand, with an increasing number of countries adopting comprehensive vector control strategies.

Rising Incidence of Vector-Borne Diseases

The Vector Control Market is propelled by the rising incidence of vector-borne diseases, which poses a significant public health challenge. Diseases such as malaria, dengue fever, and Zika virus continue to affect millions worldwide, necessitating effective vector control measures. According to recent estimates, vector-borne diseases account for over 700,000 deaths annually, underscoring the urgent need for enhanced control strategies. This alarming trend is likely to drive investments in the Vector Control Market, as governments and health organizations seek to mitigate the impact of these diseases. The increasing burden of vector-borne diseases is expected to stimulate demand for innovative solutions, including insecticides, repellents, and biological control methods, thereby contributing to the market's growth trajectory.

Public Awareness and Education Initiatives

The Vector Control Market is benefiting from heightened public awareness and education initiatives aimed at combating vector-borne diseases. As communities become more informed about the risks associated with vectors, there is a growing demand for effective control measures. Educational campaigns, often spearheaded by health organizations and NGOs, are crucial in promoting preventive practices, such as the use of insect repellents and the elimination of standing water. This increased awareness not only empowers individuals to take action but also encourages governments to allocate resources towards vector control programs. Consequently, the Vector Control Market is likely to see a rise in the adoption of various control methods, as informed communities actively participate in vector management efforts.

Technological Innovations in Vector Control

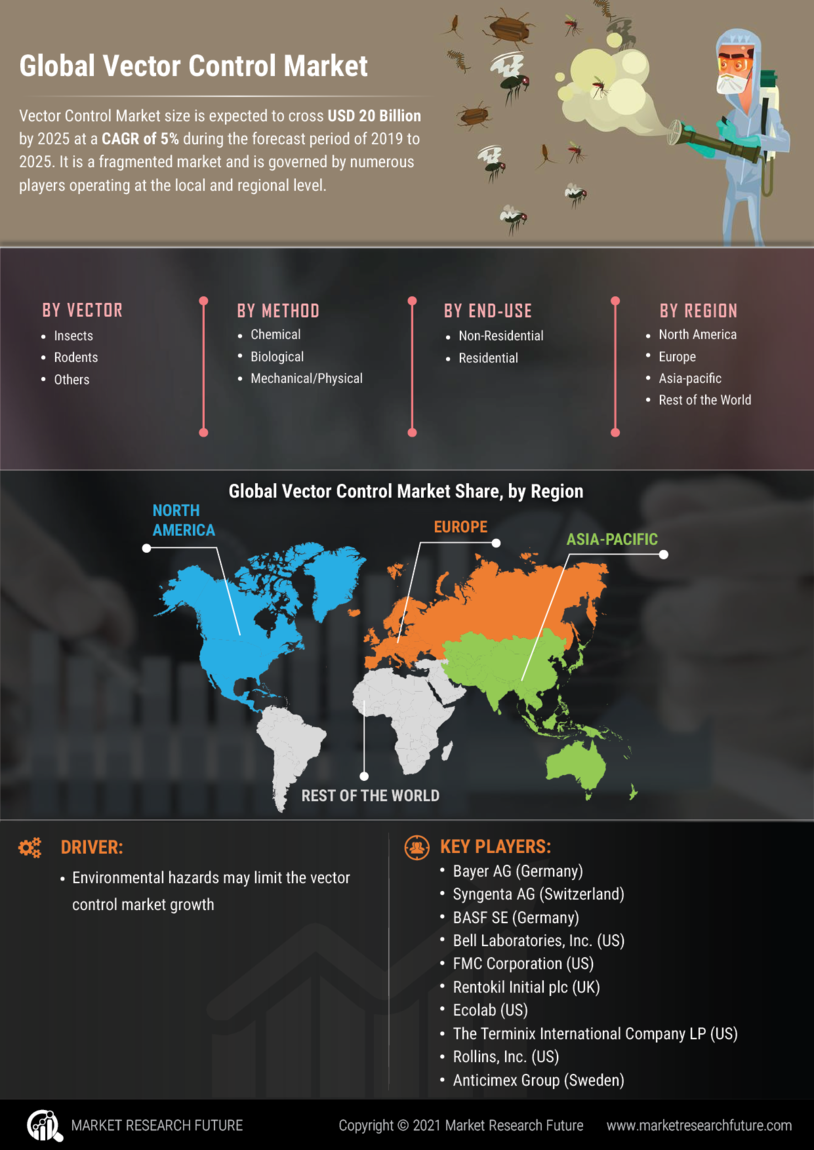

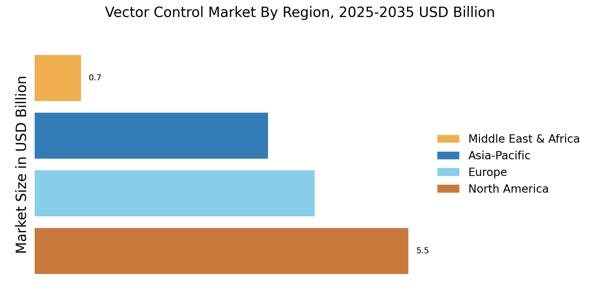

The Vector Control Market is experiencing a surge in technological innovations that enhance the efficacy of vector management strategies. Advanced tools such as drones, remote sensing, and GIS technology are being integrated into vector control programs, allowing for precise targeting and monitoring of vector populations. For instance, the use of genetically modified organisms (GMOs) and biocontrol agents is gaining traction, potentially reducing reliance on chemical pesticides. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% from 2025 to 2030, driven by these technological advancements. Furthermore, the development of smart traps and automated systems for surveillance is likely to improve operational efficiency, thereby contributing to the overall growth of the Vector Control Market.